USD/CAD Price Analysis: Clings to recovery gains around 1.3550 ahead of US PCE Price Index

- USD/CAD stages a goodish rebound from a multi-week low amid a pickup in the USD demand.

- Bullish Crude Oil prices underpin the Loonie and act as a headwind amid a positive risk tone.

- Traders also seem reluctant to place bets ahead of the Canadian GDP and the US PCE inflation.

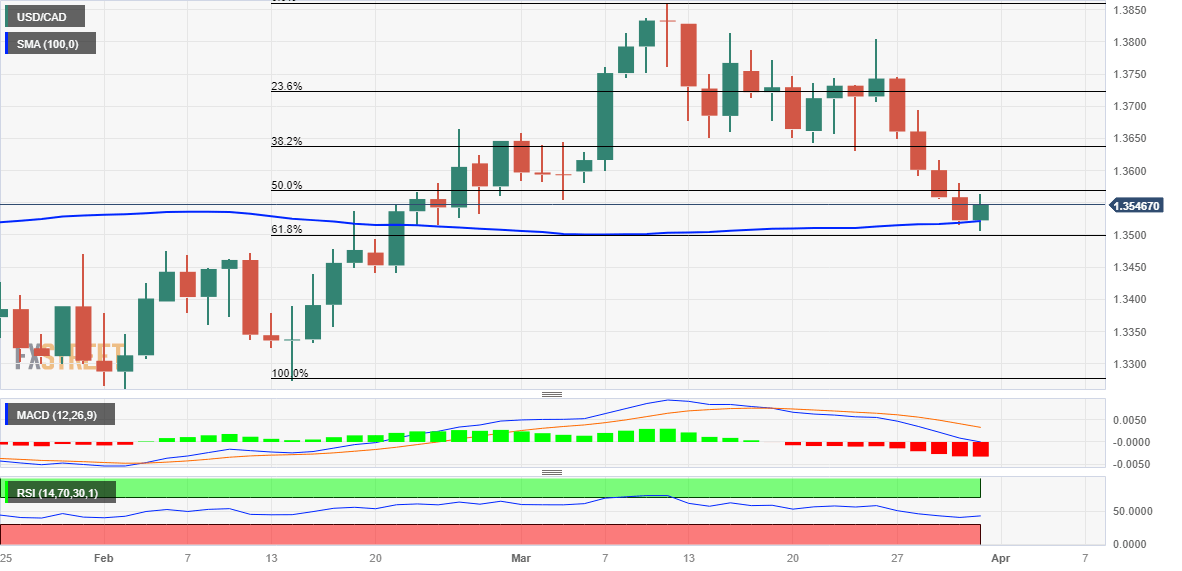

The USD/CAD pair shows resilience below the 100-day Simple Moving Average (SMA) and attracts some buying in the vicinity of the 1.3500 psychological mark, or a five-and-half-week low touched earlier Friday. The pair maintains its bid tone heading into the North American session and is currently placed around the 1.3550 area, just a few pips below the daily high.

The US Dollar (USD) regains some positive traction on the last day of the week and is seen as a key factor acting as a tailwind for the USD/CAD pair. That said, the prevalent risk-on mood keeps a lid on any meaningful upside for the safe-haven Greenback. Apart from this, the recent uptrend in Crude Oil prices, to a nearly three-week high, lends some support to the commodity-linked Loonie and contributes to capping gains for the major.

Traders also seem reluctant to place aggressive bets ahead of the release of the monthly Canadian GDP and the US Core PCE Price Index, the Fed's preferred inflation gauge. The USD/CAD pair, for now, seems to have stalled its intraday positive move near the 50% Fibonacci retracement level of the February-March rally. A sustained move beyond could lift spot prices beyond the 1.3600 mark, towards the 1.3640 region, or the 61.8% Fibo. level.

Some follow-through buying beyond mid-1.3600s will negate any near-term bearish bias and pave the way for a move towards the 1.3700 round figure en route to the 1.3720 zone, or the 23.6% Fibo. level.

On the flip side, the 1.3500 mark represents 61.8% Fibo. level and should now act as a pivotal point, which if broken will be seen as a fresh trigger for bearish traders. The USD/CAD pair might then turn vulnerable to accelerate the fall towards intermediate support near the 1.3455-1.3450 horizontal zone. Spot prices could eventually drop to the 1.3400 round figure en route to the next relevant support near the 1.3330-1.3325 region.

USD/CAD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.