USD/CAD Price Analysis: Bears taking on critical support

- USD/CAD is trading at the mercy of the US dollar post-Fed.

- The Fed had something for both the bulls and bears and markets are largely unchanged.

USD/CAD is suffering a slight weakness in the US dollar after the Federal Reserve's hawkish hold. However, the US dollar suffered the consequence of a more dovish tone in the Federal Reserve's chair, Jerome Powell's comments to the press.

Powell indicated that only much higher inflation would be a concern and as such, markets got the green light for risk-on.

DXY analysis, 15-min & 4-hour chart

The markets are taking Powell's presser as dovish in contrast to what was seen as a hawkish hold as per the statement.

hence we have seen a turnaround in the greenback as follows:

15-min chart

This has sunk the dollar to below the 4-hour trendline support as follows:

This is giving the commodity complex a lift and has supported commodity-linked currencies, such as the Canadian dollar.

The following is a top-down analysis of USD/CAD:

Weekly chart

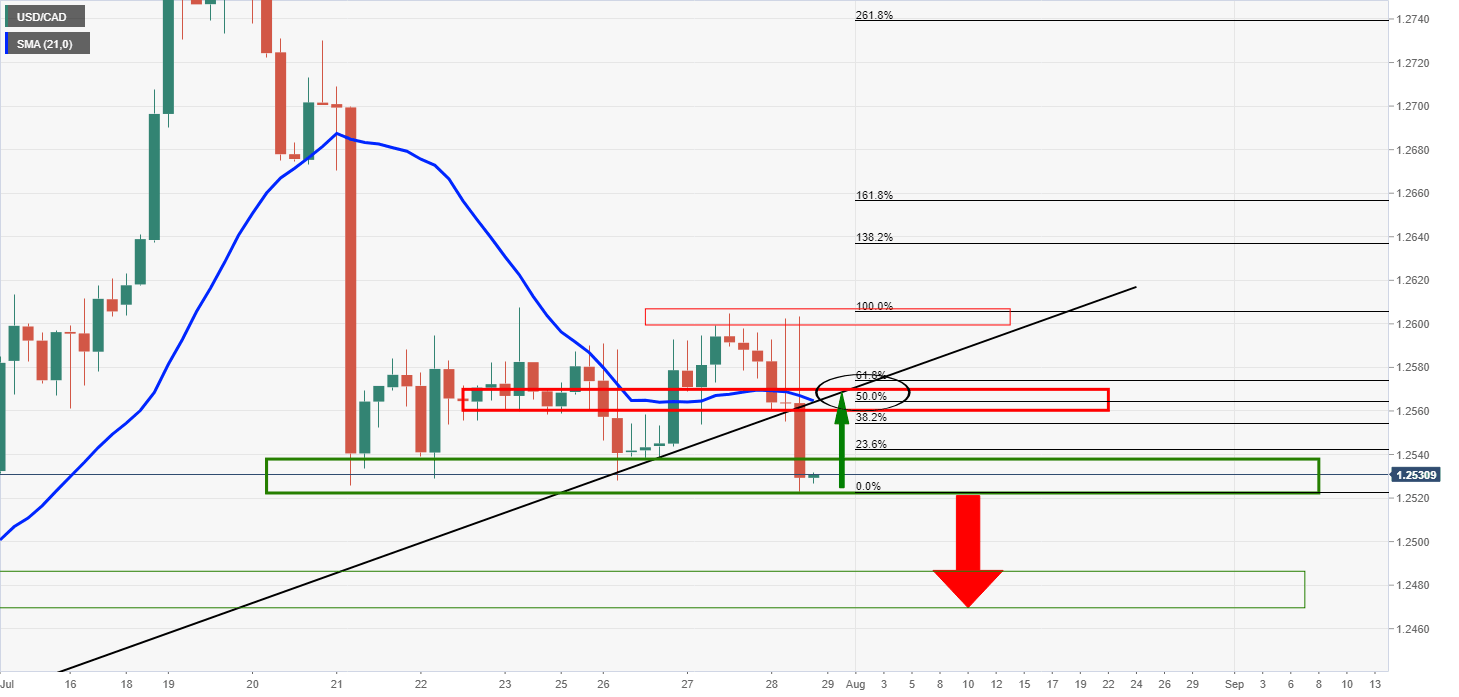

At this rate, the weekly chart is headed for a bearish closing candle this week setting a bearish tone for the start of August.

Bears will eye the confluence of old resistance and the 61.8% Fibo near 1.2460.

Daily chart

The price is testing daily support near 1.2520. A break of here would set the stage for lower lows towards the weekly target near 1.2460.

4-hour chart

The price is already below trendline support and the 100-EMA which is a new bearish development.

However, the price is yet to convincingly break the support and there is every chance that the price will move back into the range as follows:

On failures to break support, the price will be expected to move in on the counter trendline, the 21-EMA and the confluence of a 50% mean reversion.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.