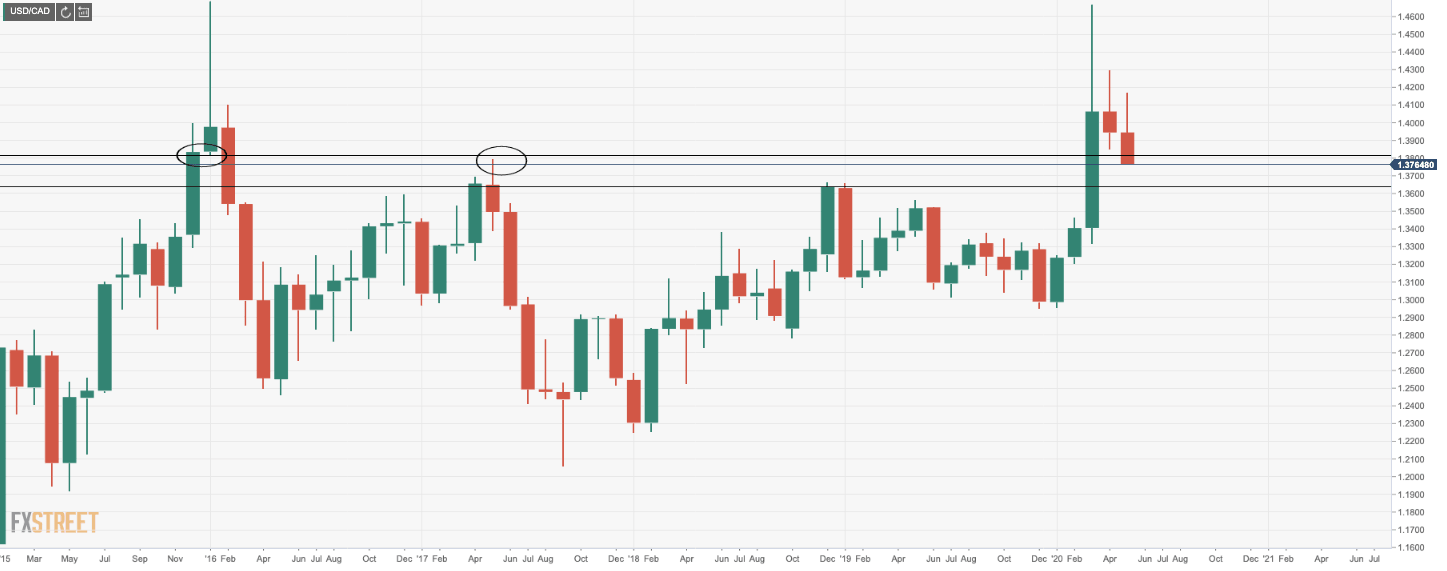

USD/CAD breaks critical monthly support, eyes on geopolitics

- USD/CAD falling to fresh daily lows below key support as USD loses grip of the top spot.

- Risk-on sentiment fuelling a bid in the commodity complex.

- However, plenty of geopolitical risks to rock the oil market, keenly watched by CAD traders.

Following a risk on start in Asia, with the Nikkei 225 closing higher by 2.55% at 21,271.17, US futures were 2% higher and the US transpired into a positive day for risk sentiment. The S&P index opened above 3000 and above its 200-day moving average.

There are glimmers of hope on a new vaccine trial for COVID-19, positive Brexit developments and a general theme of nations emerging from their COVID-19 lockdown cocoons giving a new lease of life to the global economy.

For those reasons, we are seeing the US dollar losing around 0.8% on the day which in turn is lifting all boats in the FX space, including the commodity complex. Copper is up 0.6% at the time of writing and the CRB index has climbed 1.2%. WTI is also positive for the day. All of which is supportive of the CAD.

Overall, specifically for CAD, WTI is now at a more sustainable level and has already provided some support. This is all well and good, for now. The geopolitics between the world and China isn't favourable for the commodity complex.

Nor would be any further delays n a vaccine or a spike in new COVID-19 cases as a consequence of governments trying to get their nations back to work and their economies stabilised. Still, there could be some further upside potential, so long as March Gross Domestic Product data coming out at the end of this week doesn't disappoint too much.

What matters the most for CAD, is whether any of will would set-off a material correction in oil prices.

"The global oil market is on the cusp of rebalancing. Indeed, our modelling argues that a gradual recovery in demand, combined with OPEC+ and market-driven cuts will lead to deficits as early as June," analysts at TD Securities explained, adding:

In this context, reports that China's teapots have strengthened their appetite for imported crude lend strength to our view that commodity demand continues to firm amid a global reopening, which is a key contribution to the expected Great Rebalancing.

On the whole, the CAD seems to be in a less precarious piston than the antipodeans given their closer proximity to China. USD net longs edged higher last week for a ninth consecutive week following the mid-March dip.

The geopolitical tensions have spurred up the demand for US dollars which should be noted, especially in the face of the Federal Reserve and a coordinated effort during the crisis by other central banks measures aimed at helping USD liquidity.

The fact that the dollar has remained strong and how gold was able to climb to monthly highs at the same time is telling. A flare-up in global trade wars or stronger rhetoric in the war of words between the US and China would be enough to set up another flight to safety and commodity-FX would be the first to unwind.

USD longs are still well below their late February highs, so there is plenty of upside in the USD at this juncture should war themes hit the fan.

Critical themes in play

- The Hong Kong scenario is a definite risk to pay close attention to. More on that here: The Hong Kong Dollar, the next black swan?

- After a meeting between Xi and military delegates at the NPC session, China president Xi Jinping has said he will step up preparedness for military combat. Xi said China will improve its ability to carry out military tasks as the coronavirus pandemic is having a profound impact on national security, state television reported. Xi, who chairs China’s Central Military Commission, made the comments when attending a plenary meeting of the delegation of the People’s Liberation Army and People’s Armed Police Force on the sidelines of the annual session of parliament.

- Meanwhile, on the central bank side, the market will keep an eye on two speeches by Governor Stephen Poloz this week, one of which will be later on today.

USD/CAD levels

CAD breaks a key long term support below the 1.38 handle.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.