US Yields: The US 10-year bond yields stay above 4.20% as US equity futures rise

- The US 10-year Treasury bond yield extends its gains ahead of the US Consumer Price Index (CPI) for October.

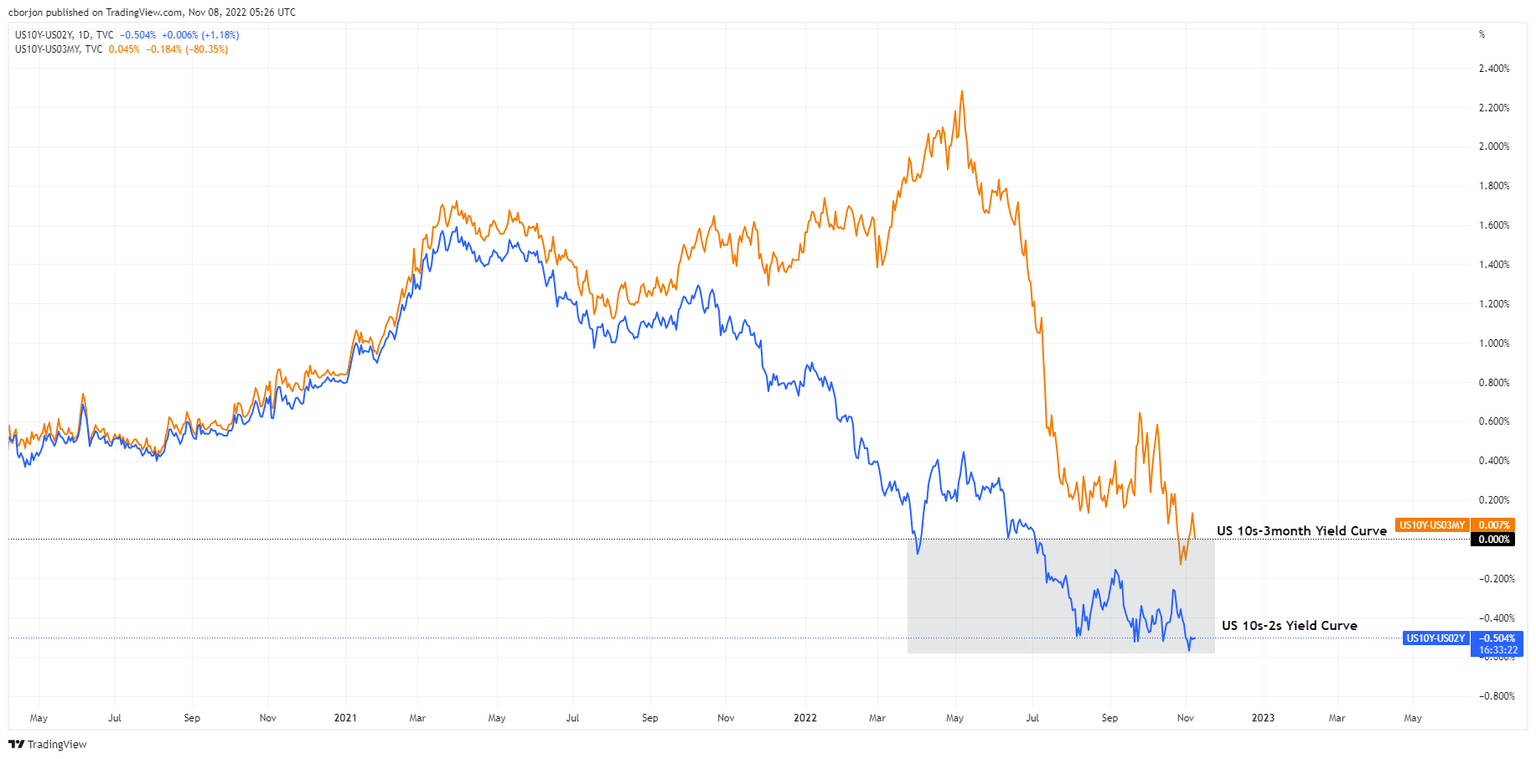

- The US 10s-2s yield curve inverted the most since the Paul Volcker era, and the spread widened the most, more than 60 bps.

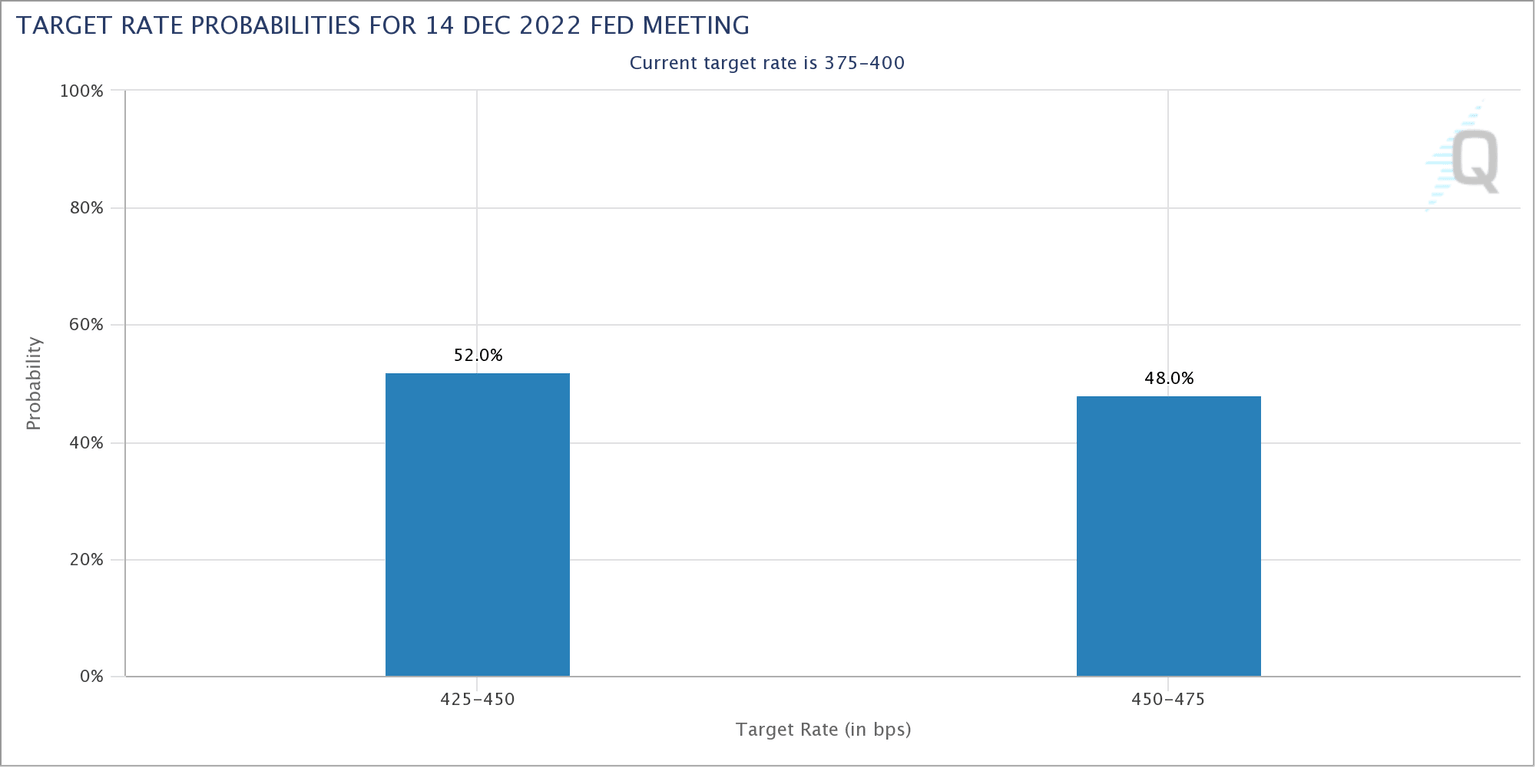

- Money market futures have priced in a 50 bps rate hike, as shown by the CME FedWatch Tool.

As the Asian Pacific session gets to an end, the US Treasury bond yields continued to advance, courtesy of the last week’s rate hike by the US Federal Reserve, lifting 75 bps to the Federal Funds rate (FFR) to 4%, while Fed officials laid the ground for additional increases though seen as a dovish rate hike. However, Federal Reserve Chair Jerome Powell commented that even though the pace of increases would be “less aggressive,” the peak would be higher. Therefore, the US 10-year benchmark note rate sits at a 4.229% gain of one bps.

The US 10-year Treasury bond yield retreated on US jobs data

US and European equity futures edge higher. Last week’s US employment data, which reflected that ha labor market is still tight, showed signs that it could be easing as the Unemployment Rate increased from 3.5% to 3.7%. Nevertheless, the Average Hourly Earnings, although lower than the previous month’s reading, they’re adding to inflationary pressures. The United States bond market reacted negatively to date, with the 10-year benchmark rate sliding from 4.209% to 4.163%.

Fed officials reiterated Jerome Powell’s message for higher rates, while the US 10s-2s yield curve further inverted

Regarding inflationary pressures, the Boston and Richmond Fed Presidents Susan Collins and Thomas Barkin said that the United States economy needs more interest rate increases, but not at an aggressive pace. Collins said that the Federal Reserve might slow down the pace to balance growth and inflation risks as the Fed struggles to achieve a “soft landing.” Echoing her comments was Thomas Barkin, who added that the peak of rates would surpass the September projections.

That said, the US 2-year Treasury bond yield, the most sensitive to the Federal Funds rate (FFR) adjustments, tumbled to 4.663%, following the jobs report after hitting a YTD high at 5.134%. It should be noted that the 2-year yield exceeded the 10-year benchmark note rate by 60 bps during the last week, as the 10s-2s yield curve inverted the deepest since the 1980s, which is usually seen as a leading indicator that precedes recessions by 12 to 18 months.

Meanwhile, some sources cited by Bloomberg said that “Now it’s about the ultimate destination” of the policy rate, according to analysts at Bank of America Corp., whose forecast for the terminal level ranges from 5%-5.25%.

Traders focus on October’s CPI, and expectations for a Federal Reserve 50 bps increase are at 52%

In the meantime, investors are bracing for the October Consumer Price Index (CPI) report. Asides from this, money market futures expect that the US Federal Reserve would hike 50 bps, as shown by the CME FedWatch Tool, with odds of lifting 50 bps at 52%, while for 75 bps, chances lie at 48%.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.