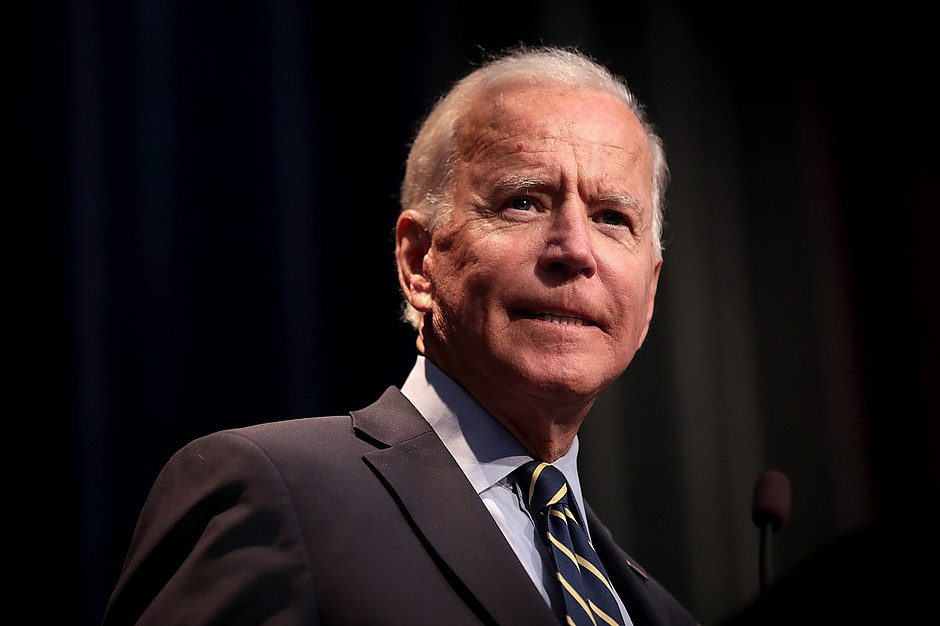

US President Biden: Iran will never get nuclear weapon on my watch

US President Joe Biden hosted the outgoing Israel President Reuven Rivlin at the White House on Monday. During the meet, Biden assured Rivlin, “What I can say to you, Iran will never get a nuclear weapon on my watch, as they say.”

The Democratic Party representative also said that the US commitment to Israel is ‘Ironclad’.

In a reaction, Israel's Rivlin said, "Very satisfied that Biden pledged to ensure iran does not get nuclear weapons."

Biden also signaled that the Democrats haven’t stepped back on their stimulus promised while saying, “Bottom line on infrastructure is exactly what we negotiated.”

It’s worth noting that Reuters also came out with the news suggesting the US Senate Republican leader Mitch McConnell exerting pressure on Biden and Democrats to abandon a plan to link a $1.2 trillion bipartisan infrastructure deal to a larger reconciliation package.

FX implications

A lack of major data/events ahead of Friday’s US NFP, coupled with the quarter-end positioning, restricts market reaction to the news. Even so, AUD/USD remains pressured and the S&P 500 Futures also print mild gains by the press time. Additionally, WTI also extends pullback from a fresh high since October 2018 to 72.40, down 0.12% intraday.

Read: AUD/USD: Bulls and bears jostle around 200-DMA amid subdued markets

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.