US ISM Non-Manufacturing PMI adds another miss, USD slide continues

- US services sector business survey released at 53.9, below 54.5 expectations.

- Employment sub-component improves to 55.5 in November.

- NFP leading-indicator table is looking more red than green.

- US dollar sell-off is prolonged across the board.

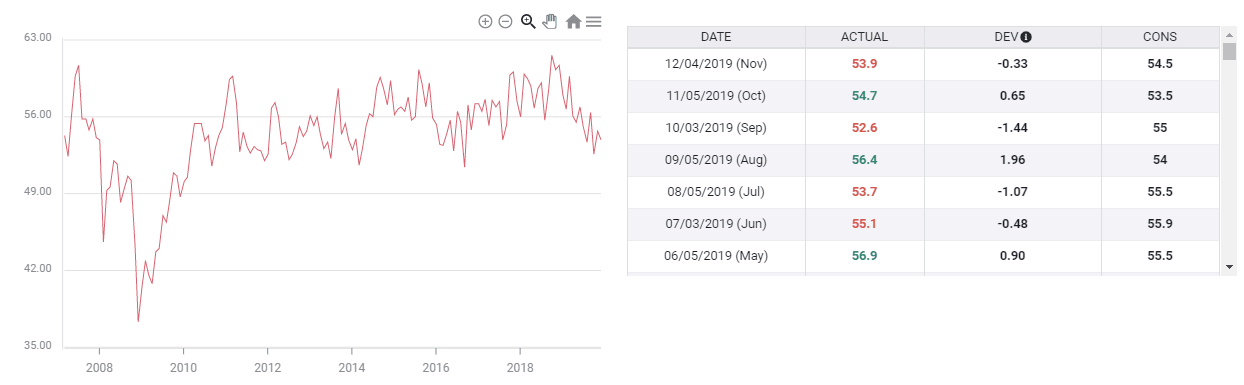

The US ISM Non-Manufacturing PMI for the month of November printed a 53.9 reading, half a point below the consensus expectation. The service sector business survey adds to the bunch of negative releases coming from the United States this week, after disappointments from the ISM Manufacturing PMI and the ADP Employment Report.

Despite being sustained by historically good employment figures, the US service sector is slowly surrendering to the deceleration already seen in the manufacturing one. The disappointment seen in November's survey makes it the seventh month this year where ISM Non-Manufacturing PMI figures have disappointed expectations and the eighth time it has shown a decrease from the previous release.

ISM Non-Manufacturing PMI historical data

The US dollar extended its losses after the release, with EUR/USD touching 1.1110 before retracing back just below 1.11 and GBP/USD making new multi-month highs at 1.3115 at press time.

Upbeat employment sub-component helps shaky NFP leading-indicator table

Despite the negative generic reading, there were some green lights in the report, as the employment sub-index came out improved in November, printing a 55.5 reading, growing 1.8% from the 53.7 seen in October.

All in all, these dismal releases are providing negative signals for Friday's US jobs report, an important one before next week's Federal Reserve monetary policy meeting. The NFP leading indicator table looks more reddish than greenish.

US jobs report pre-release checklist – Dec 6th, 2019

Author

Jordi Martínez

FXStreet

Jordi Martínez is the Editor in Chief at FXStreet, leading editorial operations at the company, before being promoted to the role in 2023, he worked in several editorial positions at FXStreet, including roles as Senior