US Dollar Index regains the smile around 92.30

- DXY bounces off sub-92.00 levels on Monday.

- US markets will be closed due to Labor Day holiday.

- Investors continue to digest Friday’s Payrolls disappointment.

The greenback, when tracked by the US Dollar Index (DXY), seems to have net some dip-buyers in the 92.00 neighbourhood and manages to reverse part of the recent sharp selloff.

US Dollar Index looks to risk trends

After four consecutive daily pullbacks, the index begins the week on a better mood and advances to the 92.30 region soon after the opening bell in the old continent. DXY sunk to fresh lows in the sub-92.00 area at the end of last week, as tapering prospects now seem to have been postponed to later in the year, likely in November or December.

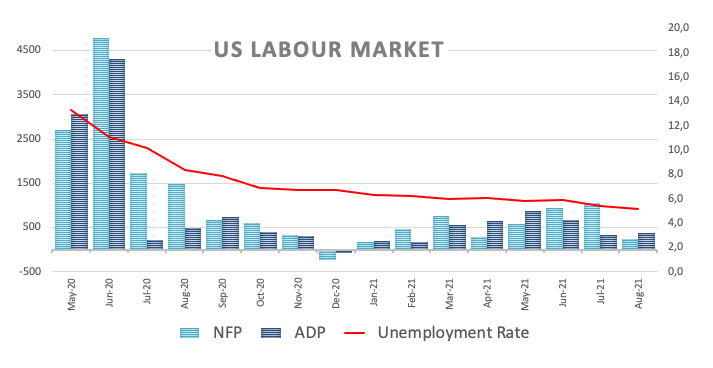

In the meantime, market participants continue to adjust to Friday’s Payrolls fiasco, after the US economy added 235K jobs vs. more than 700K jobs expected. The positive news, though, came from the jobless rate, which ticked lower to 5.2%, as previously estimated.

No activity in the US markets on Monday due to the Labor Day holiday should leave trading conditions reduced and favour the broader risk appetite trends to rule the price action in the global markets.

Further out, the US calendar looks nearly empty this week, leaving all the attention to the ECB monetary policy meeting due on Thursday.

What to look for around USD

The index has been under increasing selling pressure during most of last week and dropped to new 4-week lows in levels just below the 92.00 yardstick on Friday. Powell’s speech at Jackson Hole was the initial trigger of the intense selloff in the dollar, which found extra oxygen later in the week from the persistent improvement in the risk complex. In the meantime, and looking at the broader picture, support for the buck is expected to emerge in the form of delta concerns, high inflation, tapering prospects and the performance of the US economic recovery vs. its peers overseas.

Key events in the US this week: Initial Claims (Thursday) – Producer Prices (Friday).

Eminent issues on the back boiler: Biden’s multi-billion plan to support infrastructure and families. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Debt ceiling debate. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is advancing 0.15% at 92.25 and a break above 92.52 (55-day SMA) would open the door to 93.18 (high Aug.27) and then 93.72 (2021 high Aug.20). On the flip side, the next down barrier emerges at 91.94 (monthly low Sep.3) followed by 91.78 (monthly low Jul.30) and finally 91.63 (100-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.