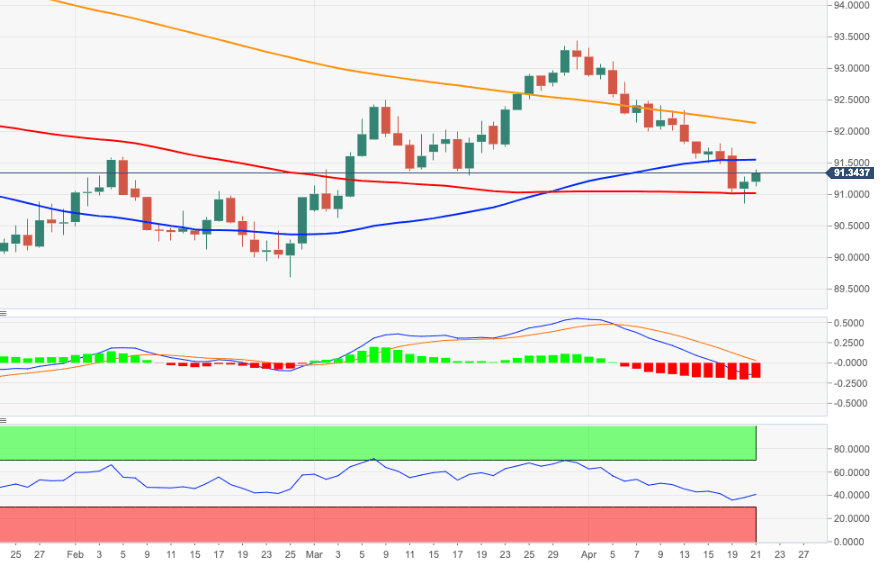

US Dollar Index Price Analysis: Interim hurdle is located at 91.63

- DXY extends the bounce off lows in sub-91.00 levels.

- There is a minor hurdle at the 50-day SMA (91.63).

DXY adds to the recovery from multi-week lows in the 90.90/85 band, retaking the 91.00 barrier and beyond on Wednesday.

Extra recovery is forecast to meet immediate hurdle at the minor resistance in the 50-day SMA, today at 91.63 ahead of the more relevant 200-day SMA at 92.13.

Above the latter, the index is expected to reclaim a more constructive outlook and allow for extra gains to, initially, the Fibo level (of the 2020-2021 drop) at 92.46.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.