- DXY corrects lower from new 2021 highs around 91.60.

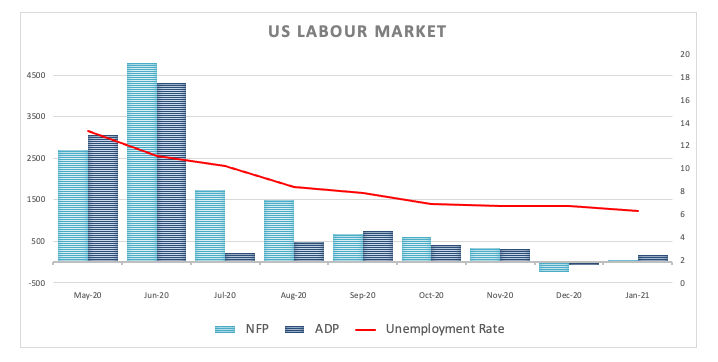

- US Nonfarm Payrolls came in at 49K in January.

- The US jobless rate surprised to the upside at 6.3%.

Following earlier new yearly peaks around 91.60, the US Dollar Index (DXY) lost some upside momentum and now tests daily lows in the 91.20/15 band.

US Dollar Index weaker despite higher yields

The index fades Thursday’s advance and came under pressure soon after hitting new yearly highs around 91.60.

The daily correction in the dollar comes despite decent gains in yields of the US 10-year benchmark, which now navigate the 1.15% region after climbing to as high as the 1.19% vicinity.

In the US data space, the January’s Nonfarm Payrolls showed the US economy created just 49K jobs, a tad below expectations. The Unemployment rate surprised to the upside and dropped to 6.3% during the same period.

Further data saw Average Hourly Earnings expanding 0.2% inter-month and 5.4% from a year earlier.

What to look for around USD

The dollar’s upside remains well and sound and pushed DXY to new YTD highs around 91.60 earlier on Friday, always on the back of the renewed offered bias in the risk-associated universe and higher yields in the US bond market. The continuation of the uptrend in the dollar, however, is forecast to remain somewhat contained amidst the fragile outlook for the currency in the medium/longer-term, and always against the backdrop of the current massive monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Fed and prospects of a strong recovery in the global economy.

US Dollar Index relevant levels

At the moment, the index is losing 0.36% at 91.19 and faces initial support at 90.63 (55-day SMA) followed by 89.20 (2021 low Jan.6) and finally 88.94 (monthly low March 2018). On the other hand, a breakout of 91.60 (2021 high Feb.5) would open the door to 91.84 (100-day SMA) and finally 92.46 (23.6% Fibo of the 2020-2021 drop).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.