US dollar in focus ahead of the FOMC

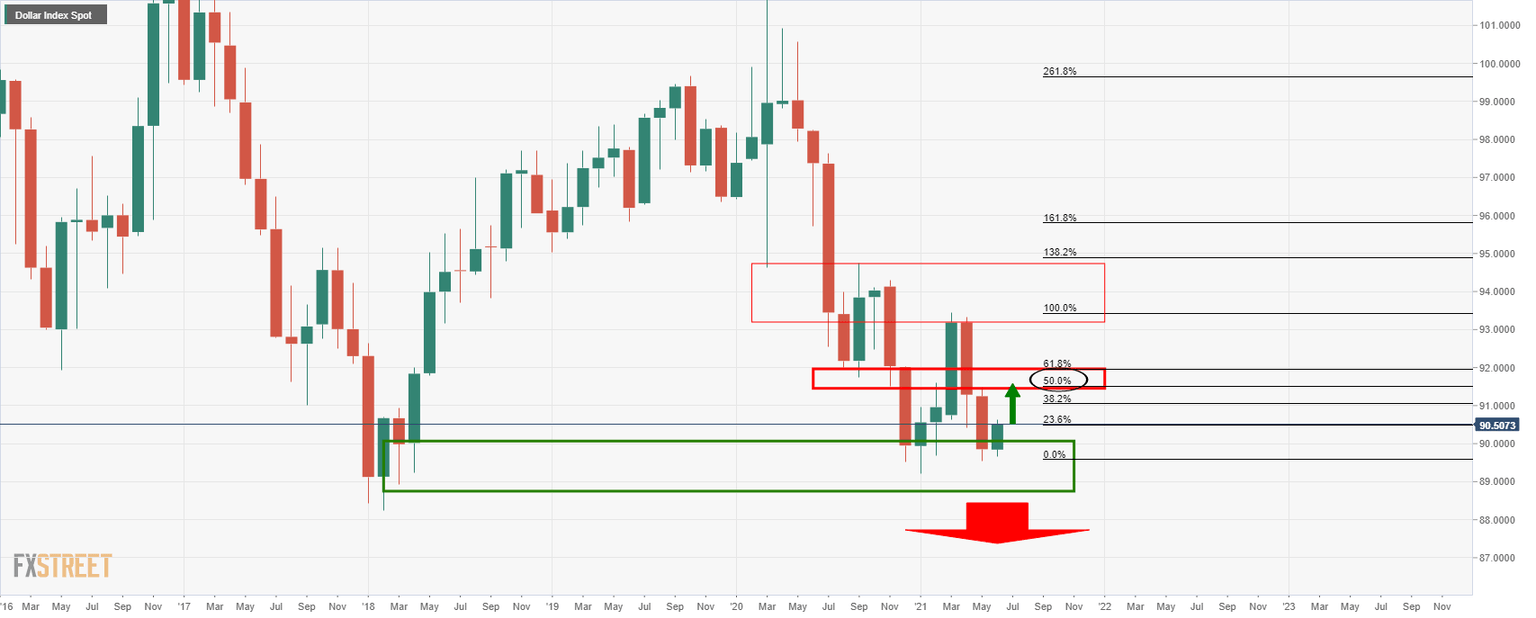

- The US dollar is in a phase of accumulation at the monthly demand area.

- Markets are looking to the Fed for a catalyst, one that might not come.

The greenback is going to be in focus this week as traders get set for the last big event before the summer period in the Federal Open Market Committee meeting mid-week.

The meeting will likely set the market tone for the coming weeks but it may not be the volatility game-changer that traders are hoping for.

Forex is at the lowest level in volatility that has been experienced in over a year:

Financial and commodity markets, in general, are in a period of consolidation and low volatility.

The VIX is trading at the bottom of its monthly decline as well, printing a fresh low of 15.15 on Friday.

The markets are priced for a steady climb in economic activity and for a lower for longer Fed which has taken a chink of uncertainty out of markets and likely sending investors on the reach for carry and yield.

The Fed this week is expected to be sounding off a cautionary tone which may ultimately sap some of the support from the greenback with plenty of Fed liquidity in place for the summer.

The Fed may be a little nearer to discussing tapering, but it is unlikely that the Fed will mention as such in the statement.

There are likely no new projections so Jerome Powell’s press conference could be the only part of the event that might kick up some dust for traders to move on.

Markets are of the mind that Fed tapering could start in December this year, with the first-rate hike in early 2023.

However, core inflation hit a 30 year high in last week's Consumer Price Index which Powell is bound to be scrutinised over with respect to the transitory mantra coming from around the board members.

If there is not a sense of focus on tapering from Powell's presser then the search for carry could well send the greenback back on its southernly trajectory as volatility takes another leg lower.

In other US data next week, be it Retail Sales and Industrial Production will fall second to the Fed.

DXY technical analysis

As per, Chart of the Week: US dollar in focus at demand area, forex hoping for a spike in vol, there are bullish probabilities towards 91.50 on the following chart analysis.

Monthly chart

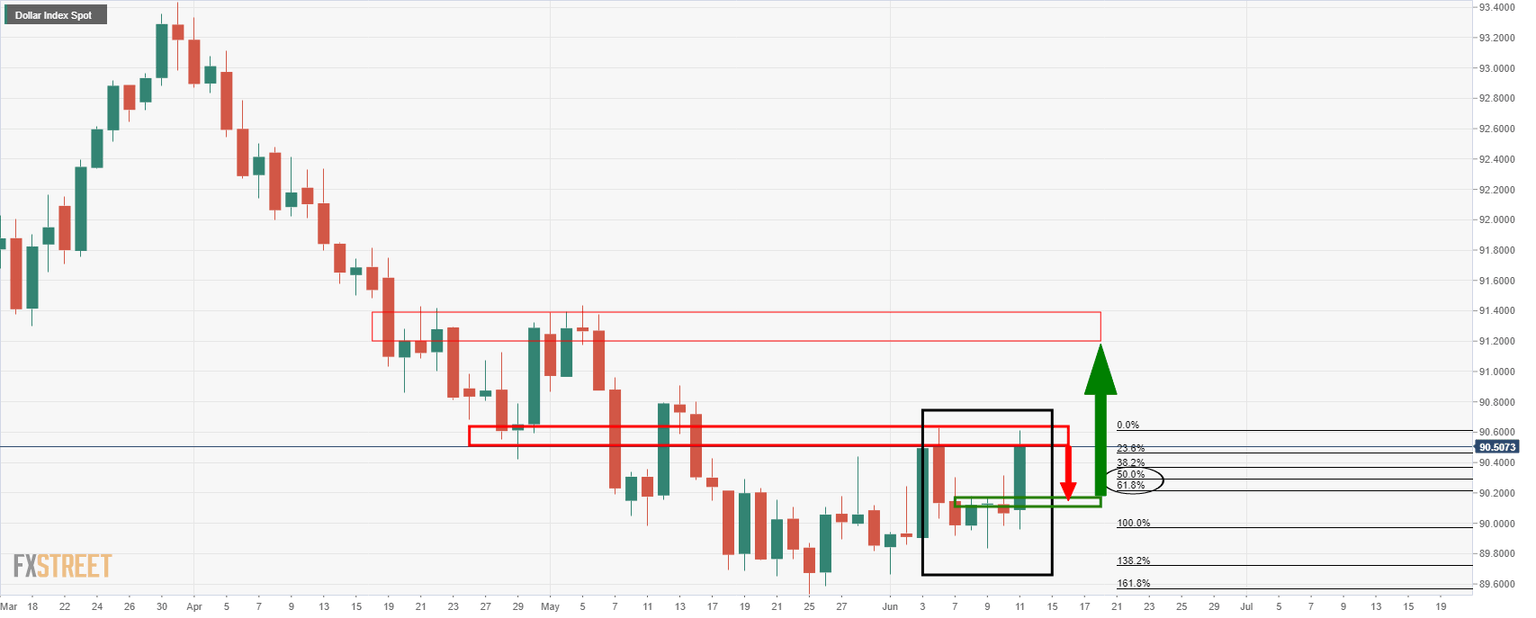

Daily chart

''The W-formation is a bearish pattern within this phase of accumulation.

The neckline of the formation would be expected to act as support prior to the next leg higher.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637592265197840603.jpeg&w=1536&q=95)