TSLA Stock Price and Forecast: Tesla to accept Dogecoin for some payments

- TSLA stock has been under pressure, finally breaking $1,000.

- Tesla CEO Elon Musk says Tesla will accept Dogecoin for some payments.

- Tesla shares slump but Dogecoin jumps as Elon still favours it over Bitcoin.

Elon Musk took to Twitter, as he so often does, to announce that Tesla (TSLA) will accept Dogecoin for certain merchandise transactions.

Tesla to accept Dogecoin

Dogecoin holders have been persistent in their asking of Tesla CEO Elon Musk to accept Dogecoin. They were rewarded on Tuesday when CEO Musk tweeted that some Tesla merchandise will accept payment in Dogecoin and "see how that goes".

It obviously goes well for Dogecoin holders as the coin is currently up 21% in early US trading. The signs are not so good for TSLA stock, however, as a technical close below $1,000 on Monday has led to a further round of selling. Elon Musk certainly has a large following with over 66 million followers, but in an interview with Time Magazine, he said, "Markets move themselves all the time based on nothing as far as I can tell. So the statements that I make, are they materially different from random movements of the stock that might happen anyway? I don’t think so...I’m not really trying to do brand optimization. So sometimes, I obviously shoot myself in the foot. As is obvious from my tweets, they’re humor that I find funny, but not many other people find funny."

Tesla stock news

Dogecoin acceptance aside, Elon musk has sold another chunk of Tesla shares. Filings show Elon Musk sold another 934,091 shares on Monday, raising over $906 million. The sale was to satisfy tax obligations. Mr. Musk has been selling blocks of stock repeatedly, taking advantage of record-high prices. Cathie Wood, another noted Tesla bull, has also been profit-taking some of her fund's positions in TSLA.

TSLA stock forecast

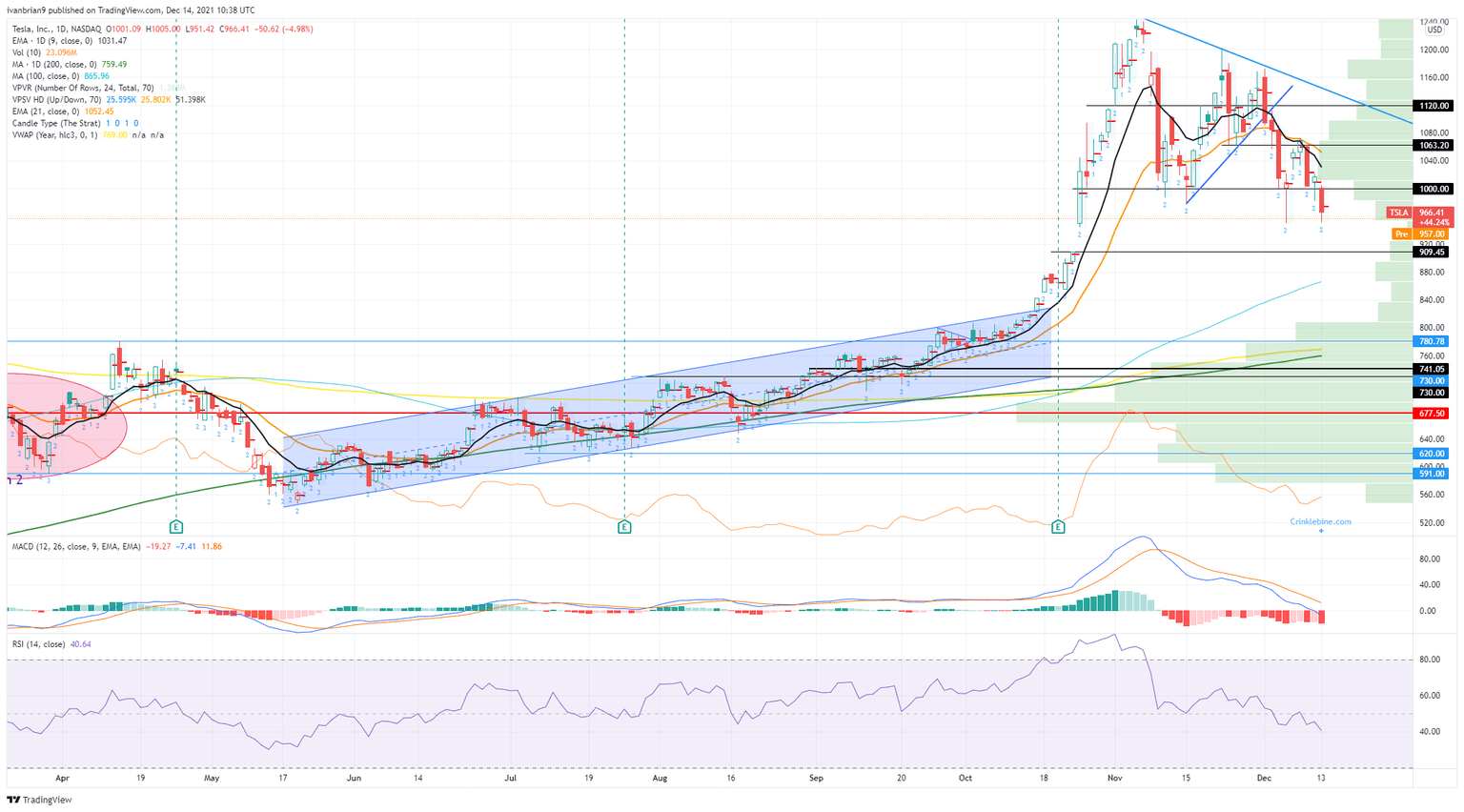

Closing below a key level is much more significant than an intraday breach. The next support, therefore, is the gap open from October 22 at $910. Already Tesla is indicating lower in Tuesday's premarket despite stock index futures and European markets looking positive. Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are trending lower and signaling a likely continuation of the bearish trend in the short term. Currently, Tesla is trading over 3% lower in Tuesday's premarket at $937.

TSLA 1-day chart

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.