The path to recovery: Does Robinhood’s promising end to march point to a long-awaited stock revival?

It’s been a long and winding road, but Robinhood’s stock ended March some 14.7% up on the beginning of the month - the highest rate of monthly growth from NASDAQ: HOOD since the weeks following its floatation. Could this positive movement point to a revival for the embattled stock? Or is HOOD’s bullish recent performance just another flash in the pan?

Despite playing a key role in the retail investor boom of 2020 and 2021, and having infamously hosted much of the trading activity that paved the way for the short squeeze on GameStop and AMC Entertainment stocks in early and mid-2021 that sparked a meme stock frenzy, Robinhood’s NASDAQ floatation hasn’t gone quite to plan.

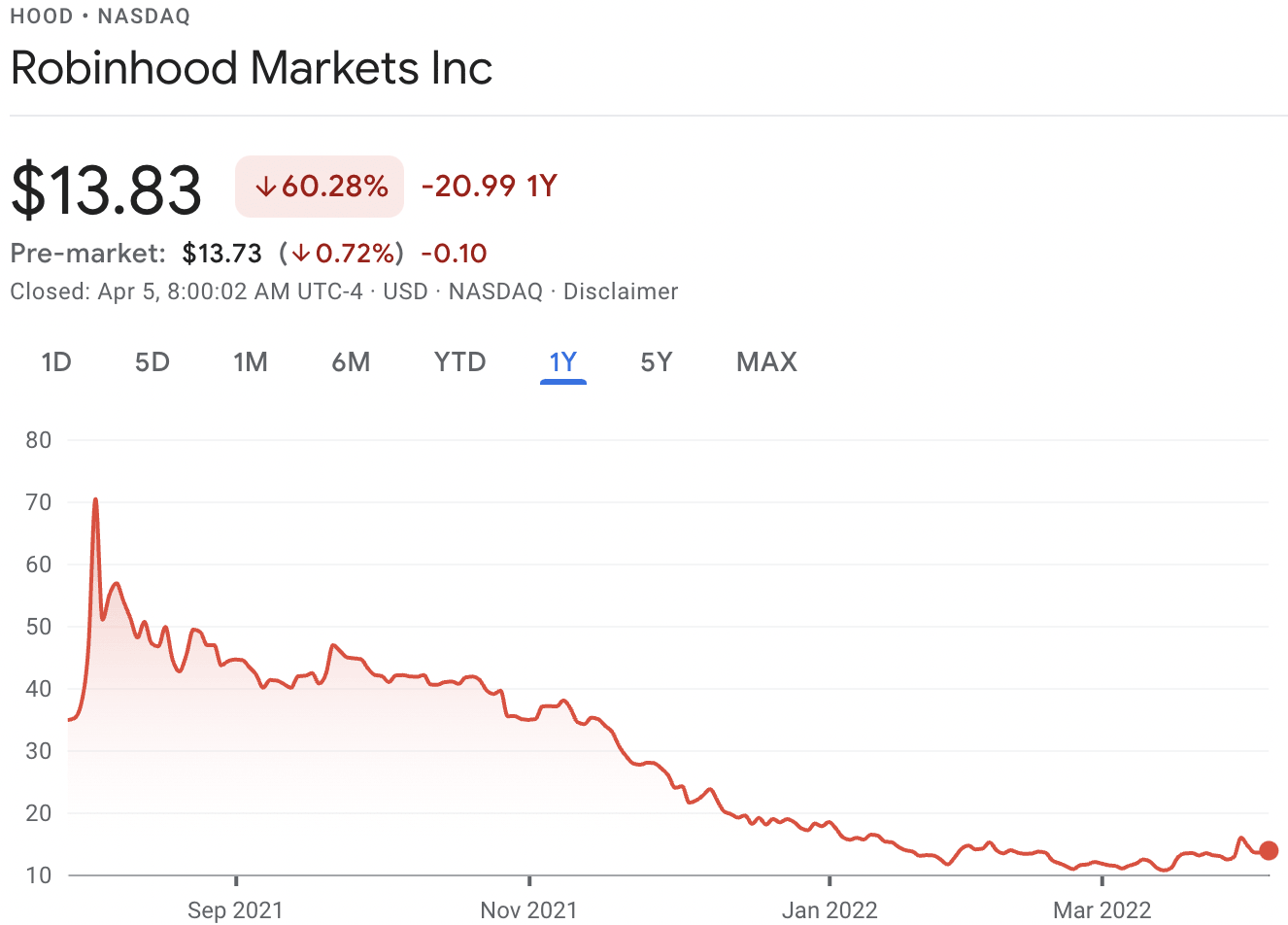

Following an initial pop in the week following its stock market debut, HOOD’s value has tumbled consistently. From its launch price, the stock remains more than 60% adrift today, whilst the stock is trailing its early all-time high price by over 80% at the time of writing. As a result, Robinhood’s market cap has fallen to $12 billion - a $10 billion decline on its IPO capitalization.

Battling controversies

Despite an early rally, Robinhood’s struggled to gather momentum on the stock market amidst a long list of controversies and spats with the SEC and Wall Street stalwarts like Charlie Munger and Warren Buffett - with the latter likening the online trading platform to a casino.

Despite HOOD flying out of the traps to a 100% gain off the back of sentiment-based trading and the launch of options trading on the platform, the stock collapsed by 27.59% soon after following the news that existing shareholders were set to sell up to 97.9 million shares in the company.

Over the past year alone, Robinhood has endured a number of controversies. In January 2021, the platform’s user base became furious at Robinhood’s move to suspend trading on the GameStop short squeeze. The move led to scores of investors being unable to sell their falling shares in the company and led to around 50 lawsuits.

Robinhood has also faced much SEC scrutiny over its controversial payment for order flow operating model, which promises to deliver commission-free trading to investors - albeit at prices set by the chosen marketmaker.

When discussing whether other brokerages should look to Robinhood’s performance as a cautionary tale, Maxim Manturov, head of investment advice at Freedom Finance Europe believed that Robinhood’s risks are largely exceptional in the industry.

“It all depends on the company's performance and its potential risks, which Robinhood had, for example, where the SEC wanted to ban ‘pay per order flow’. Robinhood has also faced a decline in cryptocurrency revenues,” Manturov explained.

In January 2022, Robinhood gave a troubled forecast for the first quarter, which showed a sustained decline in monthly active users.

With these well documented troubles, how has Robinhood’s stock shown signs of turning a corner in March? It appears that the platform is hell-bent on innovating its way out of difficulties.

Answers in innovation

On the 29th March, Robinhood’s stock experienced a 25% boost upon the news that the platform was preparing to extend its trading hours in the morning and evening as it aimed to push closer towards its goal of 24-hour trading. Where the app had previously offered trading between 9am and 6pm ET, its new operations will extend between 7am to 8pm ET.

Just one week earlier, Robinhood had announced the launch of a new debit card, called the Robinhood Cash Card. The card will be linked up to a new spending account that’s separate to customers’ investing accounts, and they’re set to work for both brick and mortar and online payments, as well as ATM withdrawals. The new card will replace Robinhood’s initial Cash Management credit card, which was first announced in 2019.

The new card’s headline feature is the option for investors to automatically buy into stocks and cryptocurrencies when spending their money in everyday situations. Much like round up accounts, Robinhood will invest the spare change of transactions made on the card to the nearest dollar to subsequently invest in assets chosen by the account holder. This means a morning coffee at $4.50 can pave the way for a 50 cent investment in, say Tesla, or Bitcoin, with the total cost leaving the card amounting to $5.

Throughout its market downturn, we haven’t seen any change in Robinhood’s flurry of new announcements and innovations.

One of the hottest anticipated developments within the platform is likely to be the rollout of Robinhood’s own cryptocurrency wallet, which will allow users to hold and spend their crypo much more easily. The move is likely to cement Robinhood’s place as a strong option for cryptocurrency investors, with many within the company hopeful that the move will help to recapture some of the platform’s lost cryptocurrency investors over recent months.

Although Robinhood has endured a difficult start to life, the platform’s continuous hunt to innovate its way to recovery has seen a number of useful tools arrive for users. Should markets recapture some of their early 2021 momentum, it’s hard to imagine Robinhood remaining in the doldrums for much longer.

Author

Dmytro Spilka

Solvid

Dmytro is a tech, blockchain and crypto writer based in London. Founder and CEO at Solvid. Founder of Pridicto, an AI-powered web analytics SaaS.