The electoral heatmap, 12 months ahead – Standard Chartered

The global election calendar looks lighter ahead, after a record H1 that delivered multiple surprises. The November US election is now center stage given its global geopolitical and economic importance. We also look at the implications of various other elections around the world in the coming year, Senior Economist and Global Geopolitical Strategist at Standard Chartered Philippe Dauba-Pantanacce notes.

2024 is one of the biggest election years in history

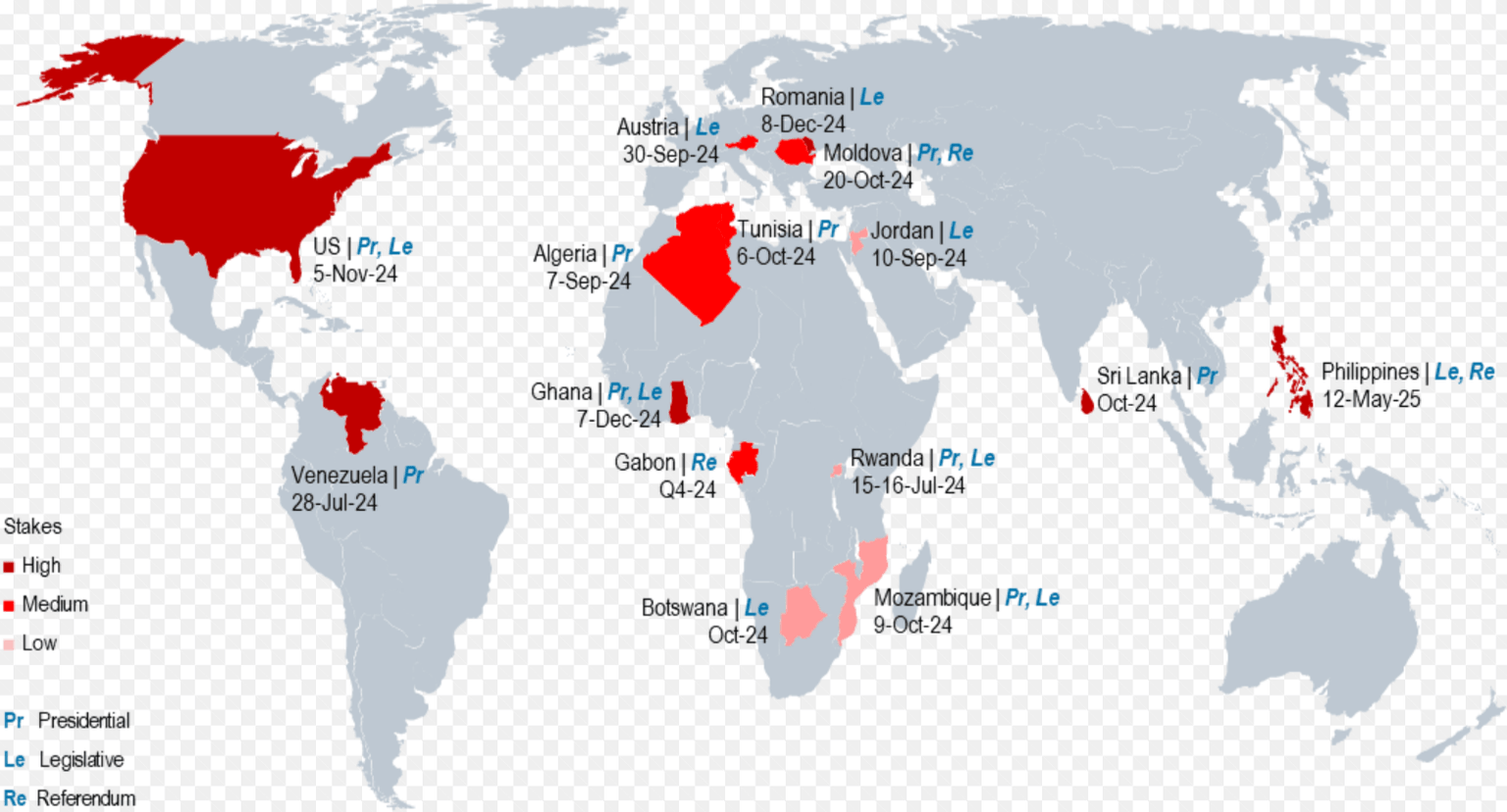

“2024 is the biggest election year in history. It has already brought multiple surprises and market shocks, including unexpected election outcomes in Mexico and India and snap elections in France. The electoral calendar will be less busy in the 12 months ahead. The November US election is dominating attention given its high global stakes; we also focus on 14 other upcoming elections, mostly in emerging markets.”

“’High-stakes’ elections – which we define as having an uncertain outcome, significant political (and in some cases geopolitical) implications, and/or the potential to move markets – will take place in Venezuela, Moldova, Sri Lanka, Ghana and the Philippines, as well as the US. In many cases, a confluence of populist movements and economic and political tensions is raising the election stakes.”

“Other elections will be watched for their importance to wider geopolitical developments (Algeria, Tunisia), the implications for debt restructuring and foreign investment in their debt markets (Sri Lanka, Ghana), or, in the case of Austria and Romania, their implications for the broader EU. Elections are also scheduled in Rwanda, Jordan, Mozambique and Botswana over the next 12 months.”

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.