Tesla Stock News and Forecast: TSLA suffers from Bitcoin investment, but relief rally sends shares higher

- Tesla stock closed just short of $700 on Wednesday.

- Fed's robust 75 basis point hike sees equities rally, go figure!

- Tesla holds over 43,000 BTC and is losing money on its so-called investment.

Tesla recovered ground on Wednesday as the market liked the Fed raising rates by 75 basis points. This was the first time in over 30 years that the Fed has raised rates so much in one meeting, and there was actually some talk of a possible 100 basis point hike circulating ahead of the event. Despite the rarity of such a hike, equity markets reacted positively to the news and rallied sharply. So why the apparent contradiction of that move?

Mostly it was some relief that the Fed is waking up to the threat of inflation. This means a recession now looks more likely, but it may be short. The market is hopeful that the Fed can get things under control. Given their track record of pumping markets and then saying all inflation is transitory, we do not buy this "all hail the Fed" mantra. Regardless, the short-term reaction was a relief, and Tesla just barely failed to get above $700. Already this morning long-term investors are repositioning and selling. We expect more selling pressure before a possible month and quarter end bounce led by positive inflows.

Tesla Stock News: Bitcoin woes and market share headwinds

What has been overlooked by investors is the impact that the current Bitcoin (BTC) meltdown is having on Tesla's balance sheet. Tesla used $1.5 billion to buy 43,200 BTC in early 2021. Now this $1.5 billion is worth more in the region of $900 million, resulting in a loss of $600 million. This is small in the overall Tesla scheme but is another headwind we feel will impact next quarter's earnings. Tesla may or may not of course choose to write down its holdings. It may hold off until a later quarter. Elon Musk has already spoken of the challenges of this quarter, and we do expect earnings to miss estimates.

Shanghai was locked down, hitting both Chinese demand and supply. While this situation is resolved, Beijing is already under more covid restrictions, and the situation is constantly evolving. We also feel the current high valuation assigned to Tesla is likely to come under yet more pressure from investors, who continue to shun high-growth tech stocks and switch to value and defensive names. With yields again on the rise globally, this portfolio rebalance is likely to accelerate as 2022 progresses.

We recently issued a long-form stock report on Tesla: Tesla Stock Deep Dive: Price target at $400 on China headwinds, margin compression, lower deliveries

The title gives it away, but we have run a discounted cash flow and comparative valuation model. The research has informed the author's current short position, which is a long-term view for the remainder of 2022 unless something fundamentally changes. We think recent research notes have all assumed Tesla will continue to remain the number one EV manufacturer and that Tesla will then become the number one overall auto manufacturer once EV adoption is complete. We think this is highly unlikely, but even if true the assumption of a 15% + market share of the global auto market, which is the current average analyst assumption, is too high. This is five percentage points higher than the current largest auto manufacturer in the world by market share – Toyota. The Japanese giant has just over 10% market share globally. This week Bloomberg Intelligence published a report highlighting its opinion that Volkwagen would overtake Tesla in the EV market by 2024.

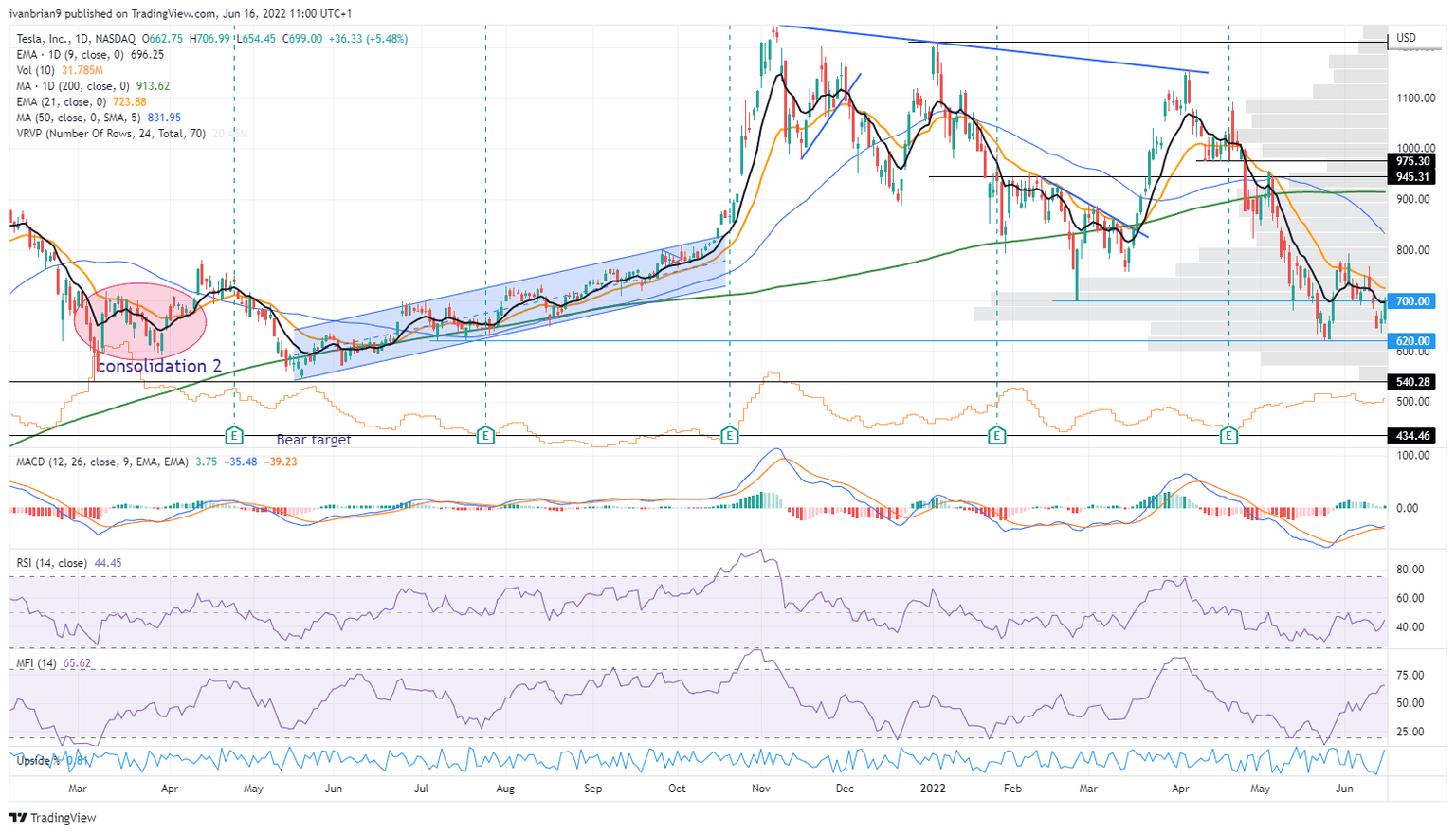

Tesla Stock Forecast: $620 is key support

$620 remains the key support but looks likely to be retested this week. The bounce is already short-lived, and equities again look to be under renewed selling pressure on Thursday. A washout to $540 would be swift if $620 breaks. This could then see a short-term rally based on the likelihood of Tesla being oversold and month-end and quarter-end positive inflows.

Tesla (TSLA) chart, daily

The author is short Tesla.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.