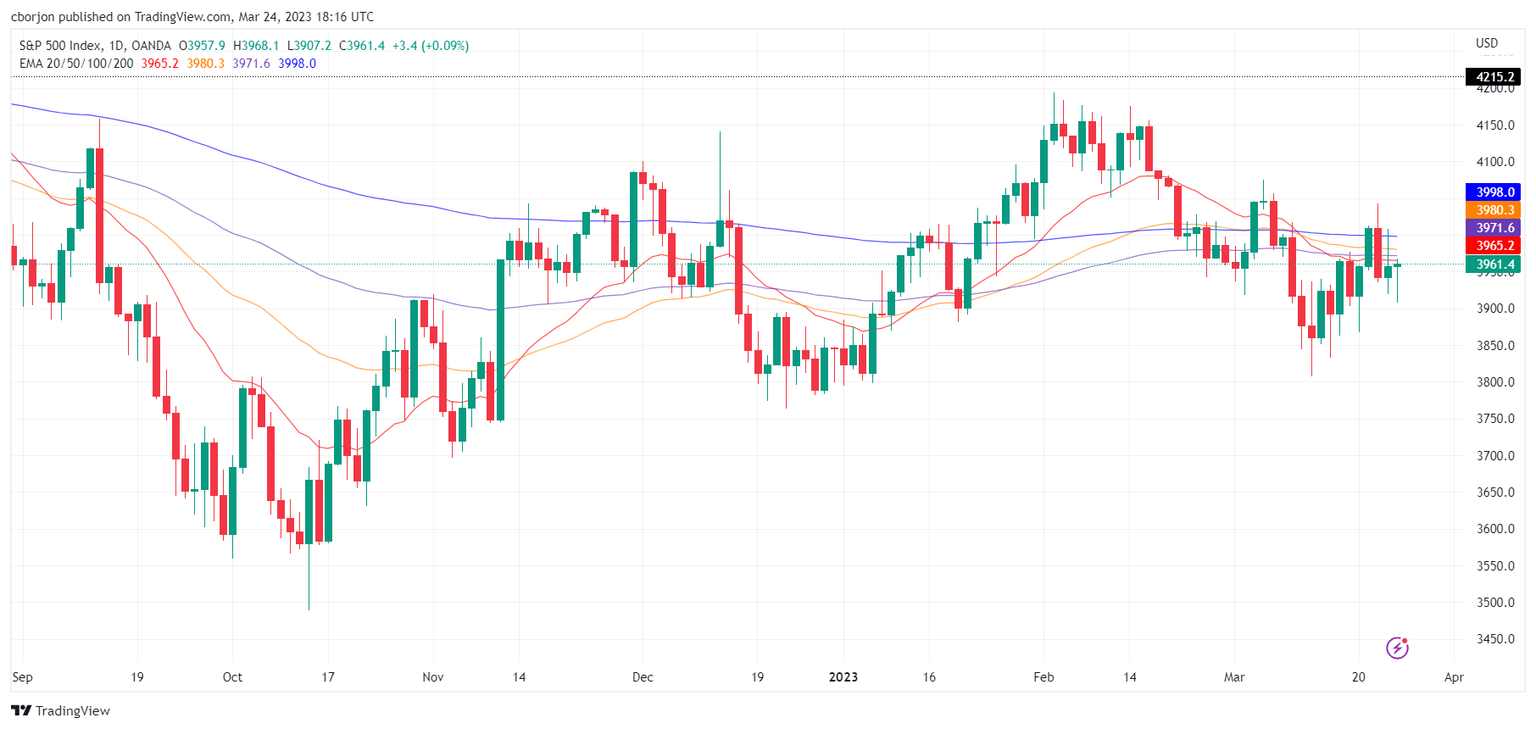

S&P 500 advances moderately amidst the Deutsche Bank crisis, mixed US data

- The S&P 500 and the Dow Jones edge higher while the Nasdaq 100 remains downward pressured.

- US Treasury bond yields collapsed after the Fed’s decision, as investors expect a rate cut.

- US economic data was mixed, spurred by cumulative tightening by the Fed.

US equities are trading mixed across the board due to a dampened market mood caused by a crisis with Deutsche Bank (DB) being in the spotlight. The shares of the German bank dropped 14%, while its CDS, a form of insurance against its default, skyrocketed 200 bps.

In the mid-North American session, the S&P 500 and the Dow Jones are climbing 0.10% and 0.06%, each at3951.28 and 32119.30, respectively. Contrarily the heavy-tech Nasdaq Composite is down 0.23%, at 11757.02.

S&P Global revealed that business activity in the United States (US) during March improved, above estimates and the prior month’s readings. Nonetheless, the S&P Global Manufacturing PMI was shy of expansion territory, at 49.3, but smashed estimates and February’s data.

Meanwhile, US Durable Good Orders plummeted 1%, beneath forecasts of 0.6% but exceeded the previous month’s 5% decline, reported the US Department of Commerce. Excluding transportation equipment, it remained unchanged. Albeit the report was better than January’s data, the cumulative tightening by the Federal Reserve (Fed) could begin to weigh on businesses, as traders are expecting a hard landing by the Fed.

Sector-wise, the three main drivers of Wall Street are Utilities, Consumer Staples, and Real Estate, each gaining 2.08%, 1.37%, and 1.18%. The laggards are Consumer Discretionary, Technology, and Financials, down 0.79%, 0.45%, and 0.34%.

In the FX space, the US Dollar Index (DXY) found a bid, gains 0.53%, at 103.135, despite falling US Treasury bond yields. The US 10-year Treasury bond yield falls six basis points, down at 3.372%, putting a lid on the greenback gains

Federal Reserve officials were one of the reasons that underpinned the greenback, with Bostic and Bullard saying that the US central bank needs to get inflation under control. Bullard foresees the Federal Funds Rate (FFR) to peak at around 5.50% - 5.75%, meaning policymakers are short three-quarters of percentage points. Atlanta’s Fed President Bostic said there was a “debate” in the latest FOMC meeting about raising rates. HE confirmed that signs that the banking system is solid were the main reason to pull the trigger.

S&P 500 Daily chart

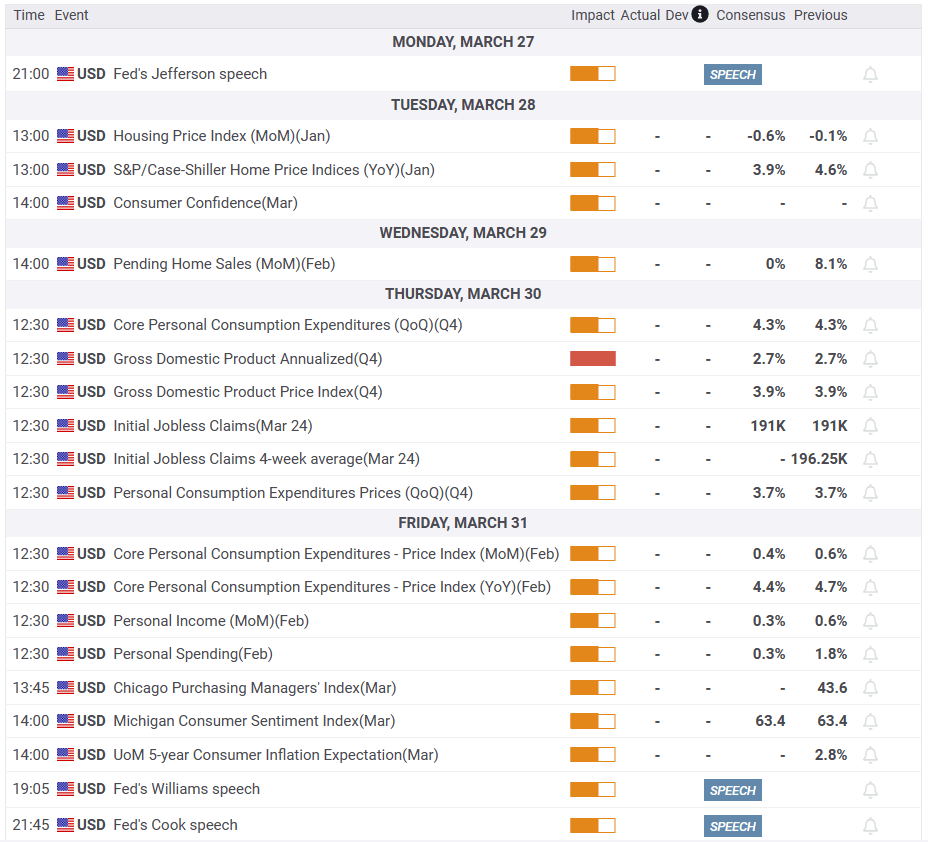

What to watch

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.