Silver Price Forecast: XAG/USD rallies on soft USD ahead of FOMC minute's release

- Silver prices climb for the fourth consecutive day, spurred by a weak USD and expectations of the upcoming Fed meeting minutes.

- Amid disappointing US economic data, China-US trade tensions may further drive XAG’s appeal as a haven asset.

- Market anticipation builds ahead of key US labor market data and Nonfarm Payrolls report, which could shape future Fed actions.

Silver price climbs for the fourth consecutive trading day as the US Dollar (USD) weakened ahead of the release of June’s Federal Reserve (Fed) last meeting minutes, which would give some cues about the US central bank’s forward path on monetary policy. The XAG/USD trades above the $23.00 figure after hitting a daily low of $22.77.

Slowdown in the US economy and geopolitical tensions bolster Silver prices

Wall Street is back though operating with losses ahead of the release of the Fed’s minutes. Data from the US Census Bureau revealed that Factory Orders for May came at 0.3%, unchanged compared to April’s data, but missed estimates of a 0.8% increase. Excluding transports, orders plunged -0.5%, less than the prior’s month downward revised metric of -0.6% and below the 0.5% expansion projected by the consensus.

XAG/USD reacted upwards to the data, as it shows the US economy is slowing down, as data revealed on Monday showed June’s ISM Manufacturing PMI plummeting into the recessionary territory at 46.0, below April’s 46.9. US Treasury bond yields are almost unchanged, while US real yields, calculated with the nominal yield minus inflation, stay at 1.630%, capping XAG/USD’s rally.

Regarding monetary policy, futures traders see the Fed raising rates just once, contrary to what Fed Chair Powell said on his last two public appearances, as shown by the CME FedWatcth Tool odds for a 25 bps rate hike in July, at 88.7%. The minutes could cement the Fed’s dot-plot case for two rate increases, which market participants do not project.

Meanwhile, China-US tussles could augment appetite for precious metals as tension around IT, technology, and raw materials exports from China to the US to produce chips could shift sentiment sour and bolster precious metals. In that regard, US Treasury Secretary Janet Yellen travels to China Thursday for meetings with Chinese officials.

Upcoming events

The US agenda will deliver labor market data on Thursday and the ISM Services PMI. On Friday, the US Nonfarm Payrolls report could dictate what the Fed could do at the next monetary policy meeting.

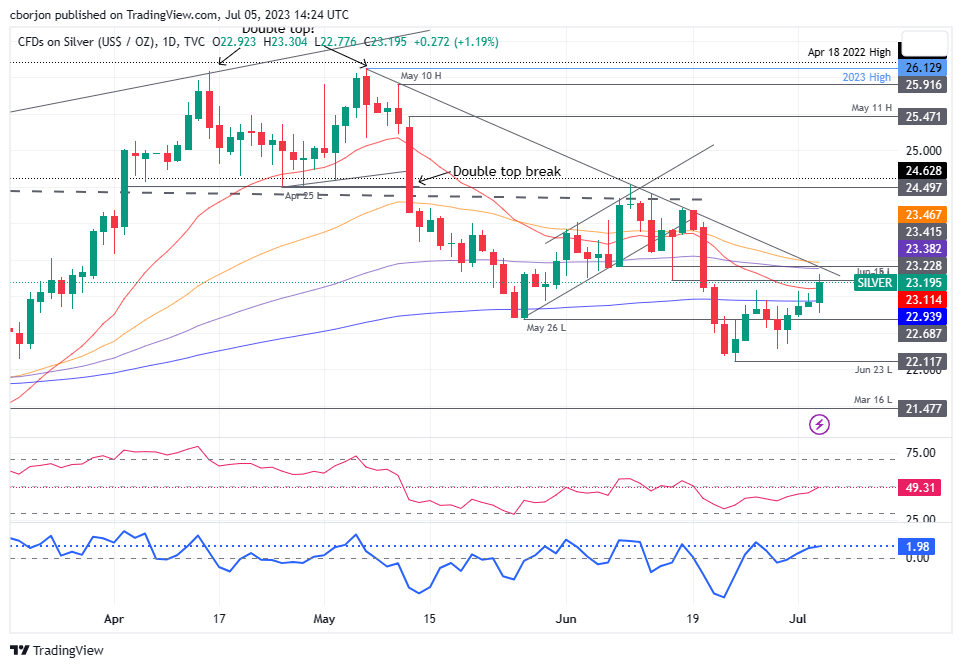

XAG/USD Price Analysis: Technical outlook

The XAG/USD extended its recovery, though it remains below technical resistance levels, which, once cleared, could pave the way for further upside. The first resistance is the 20-day Exponential Moving Average (EMA) at $23.10, followed by the confluence of a downslope resistance trendline and the 50-day EMA at around $23.46. Break above will expose the June 16 daily high at $24.20. Conversely, a drop below $23.00 would keep sellers in charge and exacerbate a fall to the June 23 swing low of $22.11.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.