Silver Price Analysis: XAG/USD tides could be turning despite NFP

- Silber bears are moving in as an hourly lower low is put in and a lower high on Friday.

- The weekly and daily charts also lean bearish and readers look for confirmation of a trend change.

Silver rose on Friday and was on track for their first weekly gain in four as the Greenback and US treasury bond yields fell after weaker US Nonfarm Payrolls numbers cast doubts over the Federal Reserve's interest rate hiking path beyond July yet again. November Fed hike odds dropped to 39% from 45% after Nonfarm Payrolls.

At the time of writing, XAG/USD is trading at $23.1038 and has travelled between a low of $22.6165 and a high of $23.1545. The following technical analysis arrived at a bearish thesis, however, for the medium and longer-term:

Silver Weekly charts

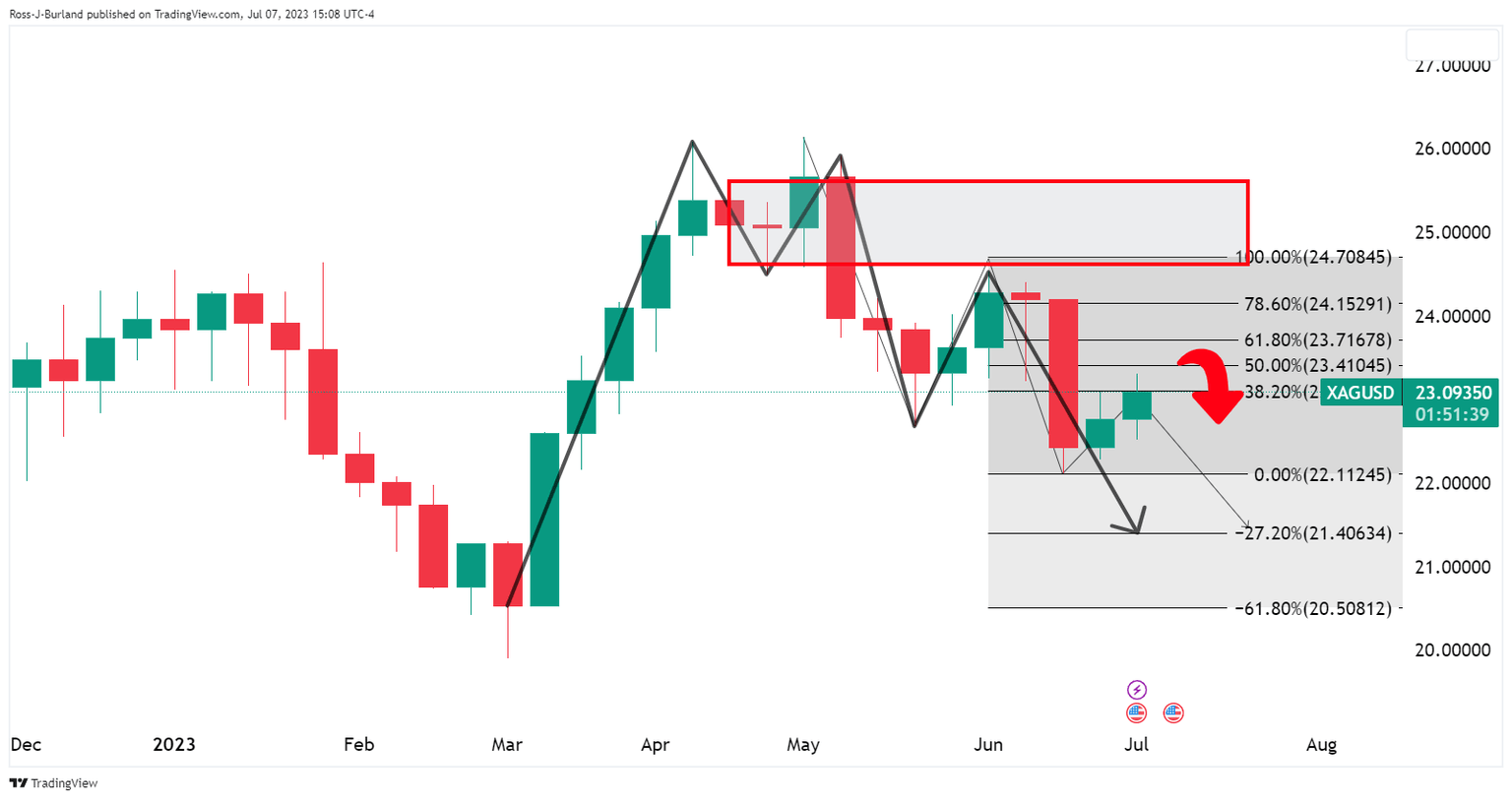

The weekly chart shows the price edging up to test the bearish commitments near the neckline of the M-formation in a 38.2% Fibonacci retracement. While the corrections not showing signs of deceleration, this can be monitored on the lower time frames for clues.

Silver Daily chart

The daily chart is showing the price is moving to a near 61.8% Fibonacci retracement and into the M-formation neckline resistance. A strong high may have been put in already.

Silver H1

On the hourly time frame, a lower low was recently put in and this could be a sign that the bulls are tiring. A lower high could result in a sell-off and a target is eyed to the swing lows as a potential demand area.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.