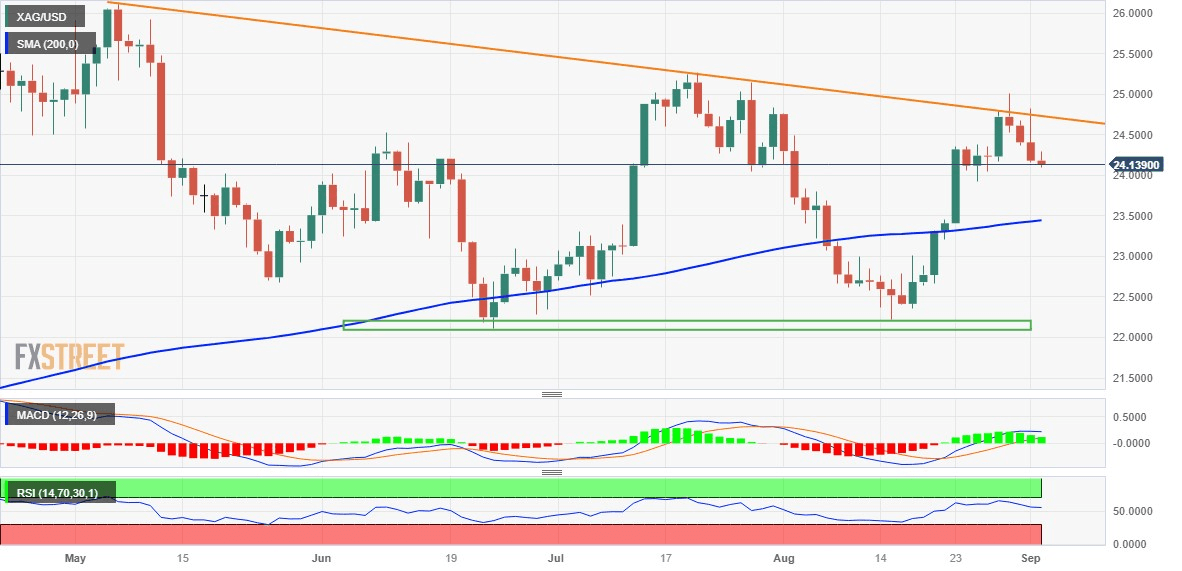

Silver Price Analysis: XAG/USD hits one-week low, manages to hold above $24.00 mark

- Silver edges lower for the fourth successive day and touches a one-week low on Monday.

- The mixed oscillators on hourly/daily charts warrant caution before placing directional bets.

- A sustained move beyond the $25.00 mark will be seen as a fresh trigger for bullish traders.

Silver remains on the defensive for the fourth successive day on Monday and drops to a one-week low during the early part of the European session, though manages to hold above the $24.00 round-figure mark.

The downtick could be attributed to some technical selling after last week's repeated failures to break through a descending trend line extending from over a one-year high, around the $26.10-$26.15 region touched in May. That said, mixed oscillators on hourly/daily charts warrant some caution before placing bearish bets around the XAG/USD and positioning for any further decline.

Hence, any subsequent fall is more likely to find some support near the 200-period Simple Moving Average (SMA) on the 4-hour chart, currently pegged around the $23.80 region. Some follow-through selling, however, should pave the way for a fall towards the $23.55 region, which is closely followed by the 200-day SMA, near the $23.40 region. The latter should act as a pivotal point for the XAG/USD.

A convincing break below will be seen as a fresh trigger for bearish traders and expose the $23.00 round figure. The downward trajectory could get extended further and drag the XAG/USD towards strong horizontal support near the $22.20-$22.10 region.

On the flip side, the $24.30-$24.35 area now seems to act as an immediate hurdle ahead of the aforementioned descending trend-line resistance, currently around the $24.75 region. This is followed by the $25.00 psychological mark and July monthly swing high, around the $25.25 region. A sustained strength beyond should allow the XAG/USD to make a fresh attempt to conquer the $26.00 mark.

Silver daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.