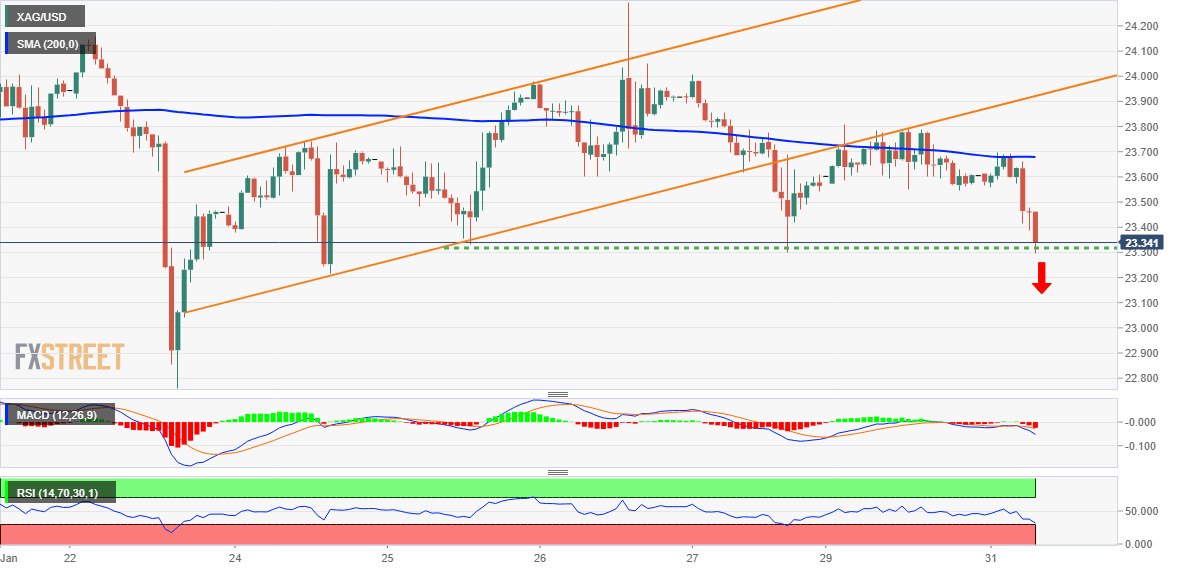

Silver Price Analysis: XAG/USD flirts with $23.30-20 support. seems vulnerable

- Silver meets with a fresh supply on Tuesday and seems vulnerable to sliding further.

- Last week’s breakdown below the $23.80-$23.75 confluence favours bearish traders.

- A sustained move back above the $24.00 mark is needed to negate the negative bias.

Silver comes under heavy selling pressure on Tuesday and slides back to the $23.30-$23.20 support zone during the early part of the European session. The technical setup, meanwhile, favours bearish traders and supports prospects for a further near-term depreciating move.

The XAG/USD last week confirmed a breakdown below the $23.70-$23.80 confluence support, comprising the 200-hour SMA and the lower end of a short-term ascending channel. The overnight failure near the said support breakpoint, now turned resistance, adds credence to the negative outlook. Moreover, oscillators on the daily chart have just started gaining negative traction.

Some follow-through selling below the $23.30-$23.20 area will reaffirm the bearish outlook and make the XAG/USD vulnerable to weaken further below the $23.00 mark. The next relevant support is pegged near the $22.75 area, below which the downward trajectory could get extended and drag the white metal towards the $22.20-$22.15 intermediate support en route to the $22.00 level.

Meanwhile, Relative Strength Index (RSI) on the 1-hour chart has moved on the verge of breaking into oversold territory. This makes it prudent to wait for some intraday consolidation or a modest rebound before positioning for additional losses. That said, any attempted recovery might now confront stiff resistance near the $23.60-$23.70 region, or the 100-hour SMA.

Any subsequent move up could attract fresh sellers and remain capped near the ascending trend-channel support breakpoint, currently around the $24.00 mark. The latter should act as a pivotal point, which if cleared decisively is likely to trigger a short-covering rally. The XAG/USD might then aim to retest the multi-month to, around the $24.50-$24.55 area touched in January.

Silver 1-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.