Rivian Automotive Stock News and Forecast: RIVN faces first major setback, stock down 17%

- Rivian Motors stock still awaits its first down day post IPO.

- RIVN surges as LCID stock pops 24%.

- Lucid Motors announces more strong preorder data.

UPDATE: Rivian stock got rocked at the open on Wednesday, falling more than 17%. The stock is now trading around $141.50. The EV truck maker has doubled in value since its IPO just a week ago and recently touched an all-time high of $179.47.

Rivian (RIVN) stock IPO investors are making off like bandits as the stock has now more than doubled from its IPO price of $78. RIVN shares closed on Monday at $172.01. While Lucid Motors (LCID) went public via SPAC, its PIPE investors are also making similar gains as the PIPE was done at $15. Now the stock is trading at $55.52. The electric vehicle (EV) sector is the place to be with Tesla (TSLA) being dragged along on the coat tails of Lucid on Tuesday.

Legacy automakers are being left in the rearview mirror as traditional valuations go out the window. Lucid Motors is now worth more than Ford (F), while Rivian is worth more than Ford, Volkswagen (VWAGY) and General Motors (GM). Rivian is the third most valuable automaker in the world. It has orders for 55,000 cars and 100,000 vans, which it hopes to fill by 2023 and 2025, respectively. Ford sells 5 million cars a year. VW sells 10 million per year. No wonder GM CEO Mary Barra said GM is undervalued. Either they are all very undervalued, or EV stocks are extremely overvalued. I know where my guess is.

However, at FXStreet we are not blind to the power of momentum. While we would not advise a long-term investment in most EV stocks due to high valuations, we recognize that short-term momentum is powerful and eliminates the concern about valuations as it deals in a much shorter time span. EV stocks are in the perfect space right now. Going green is in vogue, we have just had the COP 26 climate forum, and money is looking for a home. Retail accounts just look for volatility and momentum, and they are currently finding it in the EV sector.

Rivian (RIVN) stock news

With such a strong move in a stock, you would usually expect some underlying fundamental catalyst but not in this case. It is simply just more and more momentum entering the stock and inflating the bubble a bit more. Now you may think the term "bubble" is insulting, but it is not meant to be. There is no other way to describe such a valuation. However, that should not stop you from trading it if you want to. Momentum means trend following and can be done to great effect if you use strong risk management.

It is likely when we do get the first down day in Rivian stock that another few will follow as momentum begins to slow. For now it looks likely to continue. If anything, the speed of the move is accelerating. With Lucid Motors also on the up and up, keep an eye on the sector for signs of slowing momentum across one or more stocks. That will be the signal to get more defensive.

Rivian (RIVN) stock forecast

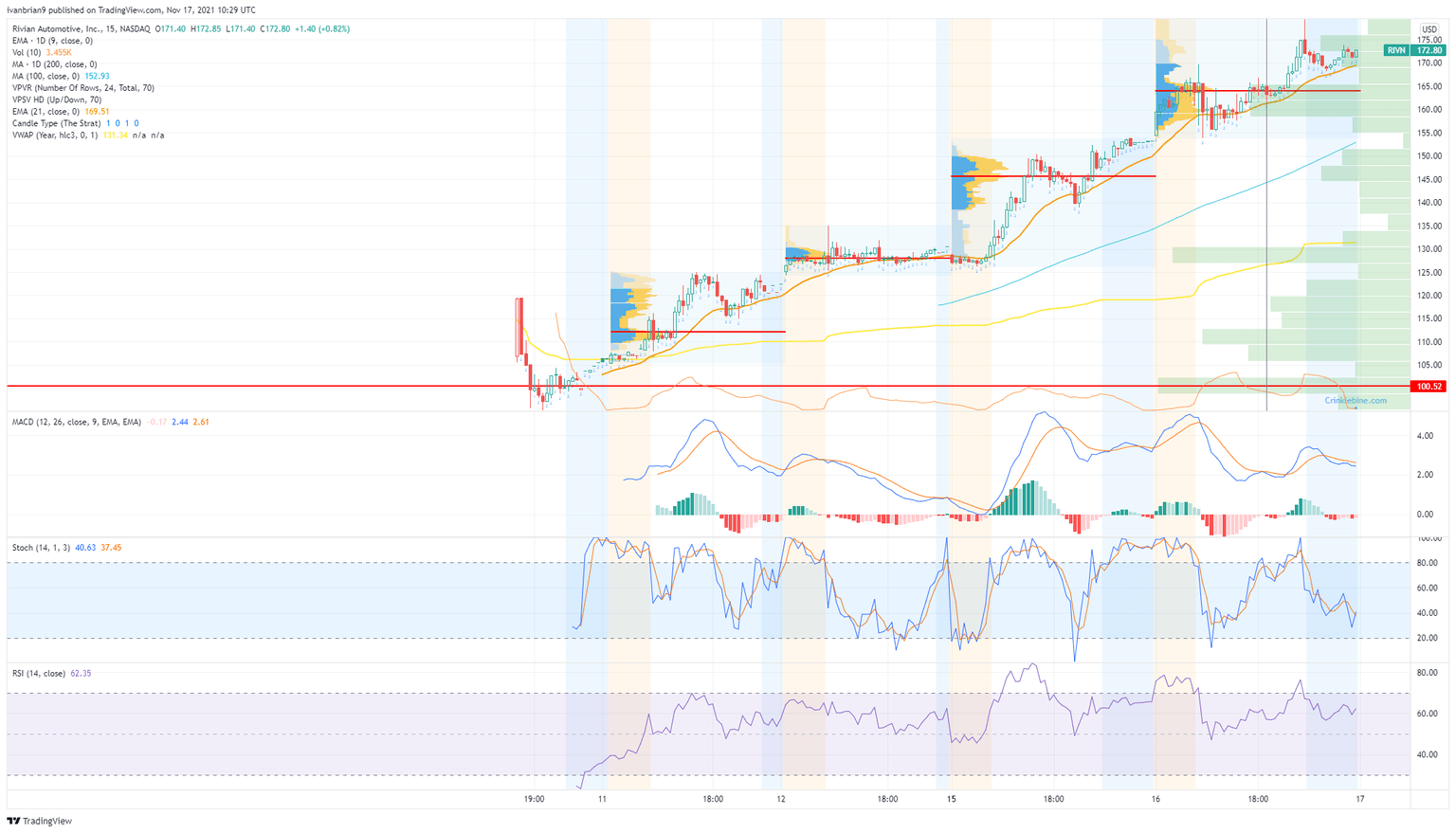

We can see clearly using the volume profile that the strong volume-based support is at $130 and again at $100. $100.52 is the point of control – the price with the highest amount of volume. No resistance is in sight.

RIVN 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.