RBA: Further monetary policy tightening is expected to be required to bring inflation down.

The Reserve Bank of Australia minutes are out as follows:

Key notes

Minutes of the March 7 policy meeting out on Tuesday showed the Reserve Bank of Australia's (RBA) Board only discussed raising the cash rate by 25 basis points to 3.6%, compared with weighing between 25 bps and 50 bps hikes in February.

Monetary policy was already in restrictive territory and the economic outlook was uncertain.

Members "agreed to reconsider the case for a pause at the following meeting, recognising that pausing would allow additional time to reassess the outlook for the economy," according to the minutes.

- Further monetary policy tightening is expected to be required to bring inflation down.

The Board reiterated that further tightening of the monetary would likely be required given inflation was still too high, the labor market tight and business surveys showed solid activity.

The RBA noted that recent data releases on Gross Domestic Product, jobs, wages and inflation, had come in softer than expected, but the shortfalls to expectations were not large.

The Board said they would be watching upcoming releases on employment, inflation, retail trade and business surveys, as well as the developments in the global economy at the April meeting.

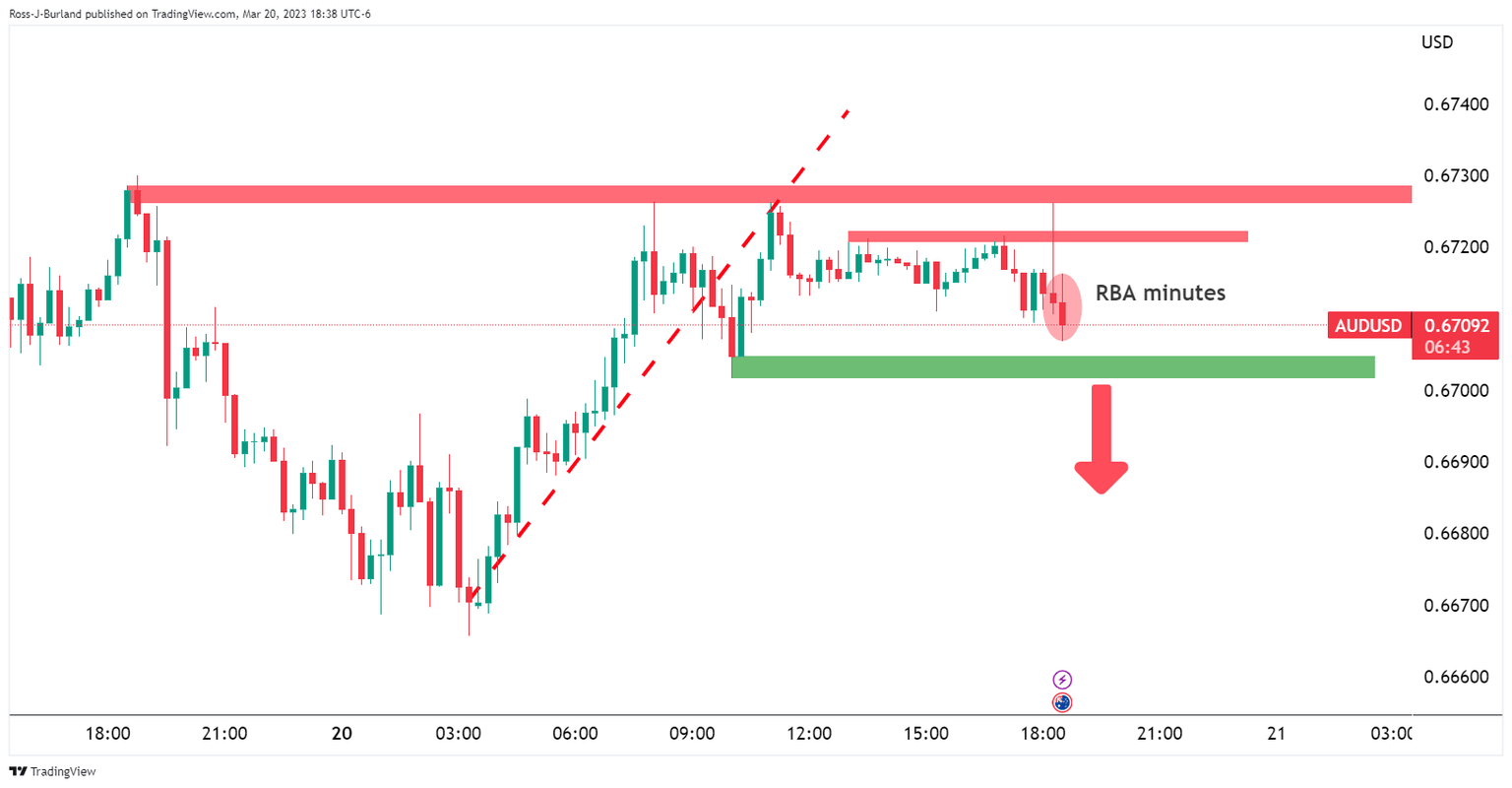

AUD/USD update

Governor Philip Lowe earlier this month said the central bank was closer to pausing its rate increases as policy was now in restrictive territory, and suggested a halt could come as soon as April depending on the data.

Why it matters to traders?

The Reserve Bank of Australia (RBA) publishes the minutes of its monetary policy meeting two weeks after the interest rate decision is announced. It provides a detailed record of the discussions held between the RBA’s board members on monetary policy and economic conditions that influenced their decision on adjusting interest rates and/or bond buys, significantly impacting the AUD. The minutes also reveal considerations on international economic developments and the exchange rate value.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.