GBP/USD stays firm amid BoE, Fed commentary and US data

The Pound Sterling is virtually unchanged against the US Dollar in the mid-North American session, amid a scarce economic docket in the United Kingdom (UK) if not interrupted by

Bank of England (BoE) member Megan Greene. A slew of Federal Reserve officials keep pounding the mantra of patience when easing rates. The GBP/USD trades at 1.2456, almost flat.

Read More...

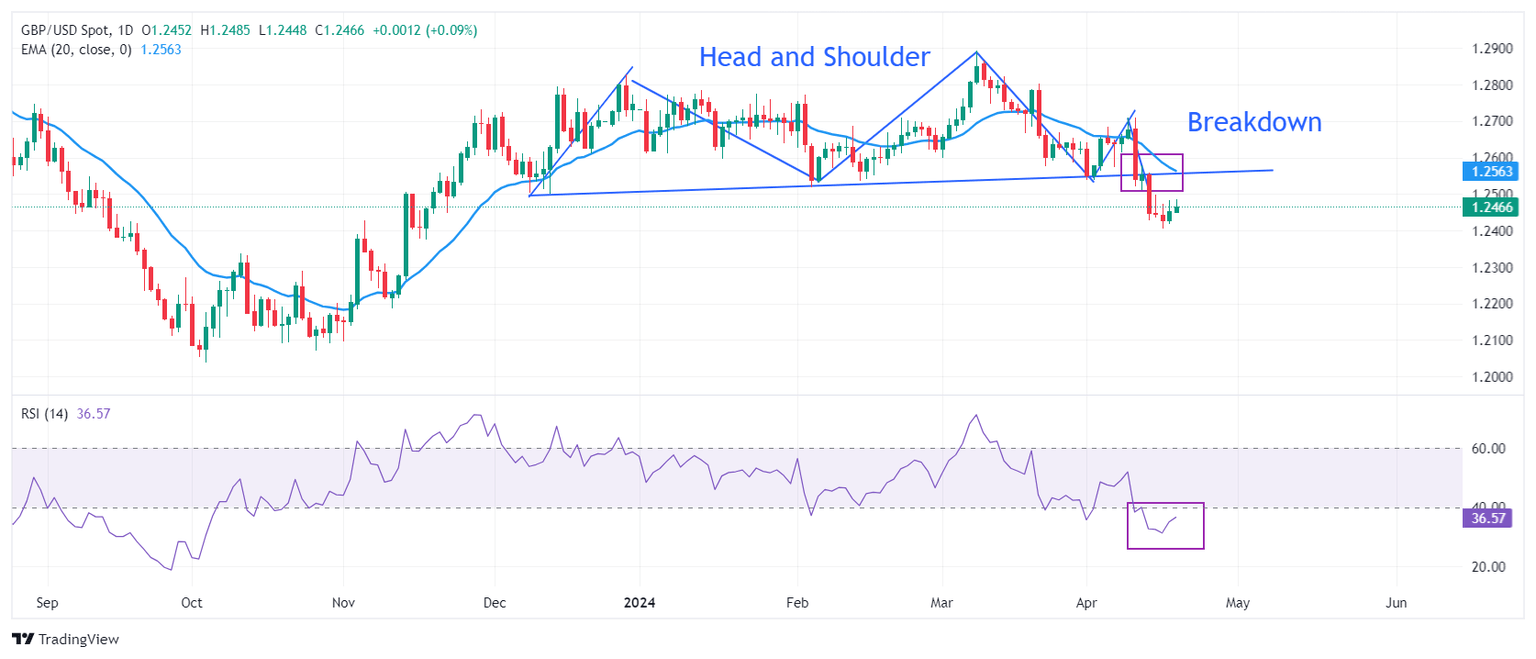

Pound Sterling weakens against US Dollar amid dismal market mood

The Pound Sterling (GBP) retreats from 1.2480 in Thursday’s early New York session. The GBP/USD pair falls back as the US Dollar recovers amid expectations that the Federal Reserve (Fed) will keep interest rates higher for a longer period.

Read More...

GBP/USD remains capped below 1.2470, eyes on US data

The GBP/USD pair trades on a softer note around 1.2450 during the early Asian trading hours on Thursday. The softer UK inflation data prompted the expectation that the

Bank of England (BoE) will start lowering interest rates in the coming months, which weighs on the Pound Sterling (GBP) against the Greenback. Investors will take more cues from the US weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, the CB Leading Index, and Existing Home Sales, due on Thursday.

Read More...