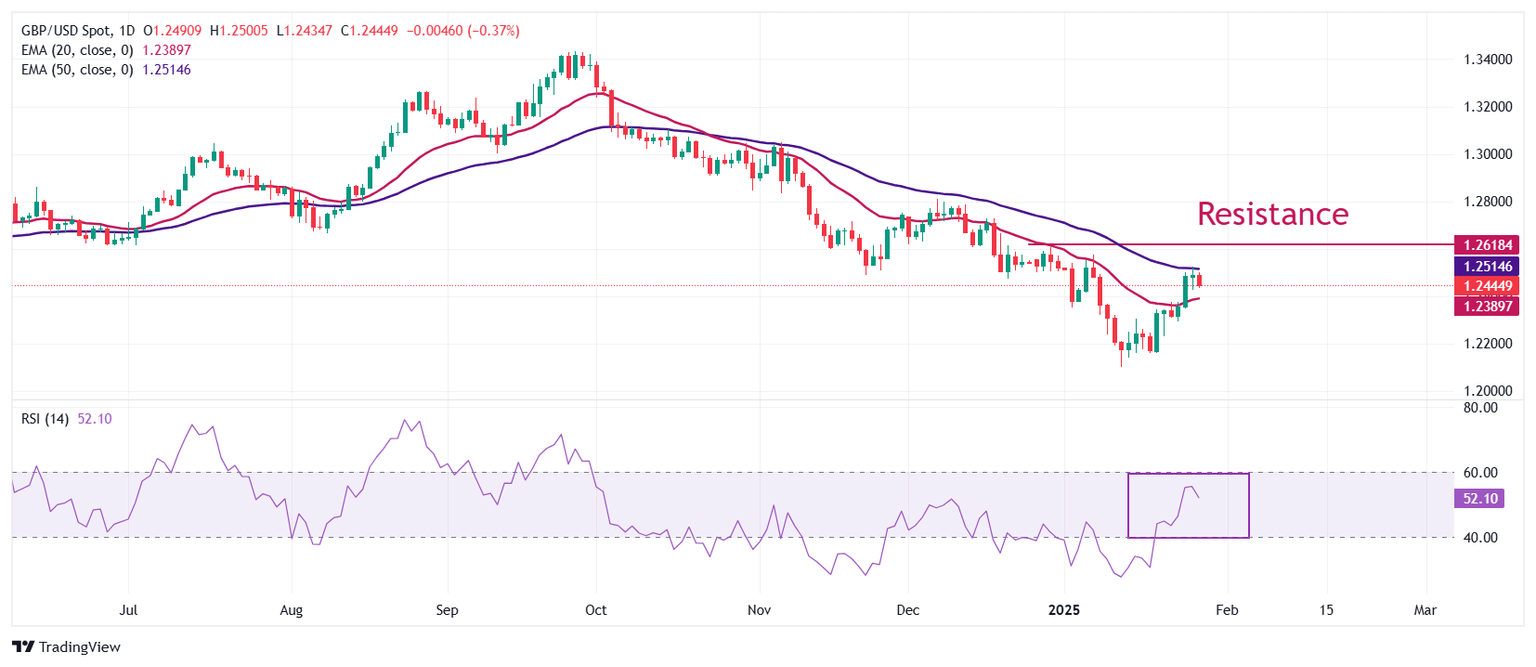

Pound Sterling Price News and Forecast: GBP/USD steadies due to risk aversion ahead of the Fed policy decision

GBP/USD holds ground near 1.2450 ahead of Fed policy decision

GBP/USD remains steady after registering losses in the previous session, trading around 1.2440 during the Asian hours on Wednesday. The pair’s downside could be attributed to the increased risk aversion due to tariff threats made by US President Donald Trump.

President Trump announced plans on Monday evening to impose tariffs on imports of computer chips, pharmaceuticals, steel, aluminum, and copper. The goal is to shift production to the United States (US) and bolster domestic manufacturing. Read more...

GBP/USD drops as Trump’s tariff threat boosts US Dollar

The Pound Sterling extended its losses against the Greenback on Tuesday as US President Donald Trump threatened to impose tariffs on computer chips and other industries. Risk aversion extended for the second straight day, and the GBP/USD retreated from weekly highs of 1.2523, trading at 1.2432, down 0.50%

On Monday, the Greenback recovered some ground, and most G8 FX currencies tumbled as Trump crossed the wires. He said he would impose duties on chips, pharmaceuticals, steel, aluminum, and copper if not produced in the United States (US). Therefore, the trade war is on, and traders keep the US Dollar bid. Read more...

Pound Sterling trades cautiously despite UK Starmer anticipates turnaround in economy

The Pound Sterling (GBP) faces pressure against its major peers in Tuesday's North American session. The British currency trades cautiously despite United Kingdom (UK) Prime Minister Keir Starmer's positive commentary on the economic outlook in an interview with Bloomberg on Tuesday. Starmer said that the number one priority of the Labour government is "growth" and the economy is starting to "turn around." On the outlook of trade relations with the United States (US), Starmer commented: “We’ve got a huge amount of trade between our two countries already and the base is there for even better trading relations. We need to build on that.”

Starmer's positive comments have fuelled some strength in the Pound Sterling, which was trading cautiously amid worries that the economy could face risks of stagflation amid weakening labor demand and a stubborn inflation outlook. Read more...

Author

FXStreet Team

FXStreet