GBP/USD Forecast: Boris' bodies' remarks make the pound powerless ahead of Powell

"Let the bodies pile high" is better than having another lockdown – these insensitive comments attributed to UK Prime Minister Boris Johnson refuse to die down. Downing Street's denials were rebuffed by additional sources and they put the PM in a pickle.

Having to deal with scandals may hobble the government's efforts to push the economy forward despite the impressive vaccination campaign. That is weighing on the pound. Johnson's issues fill the gap for traders, who are anxious ahead of the Federal Reserve's decision on Wednesday. The world's most powerful central bank could be forced to acknowledge that America's economic boom may force it to taper its bond-buying scheme as soon as this year. That is the prerequisite for raising rates. Read more...

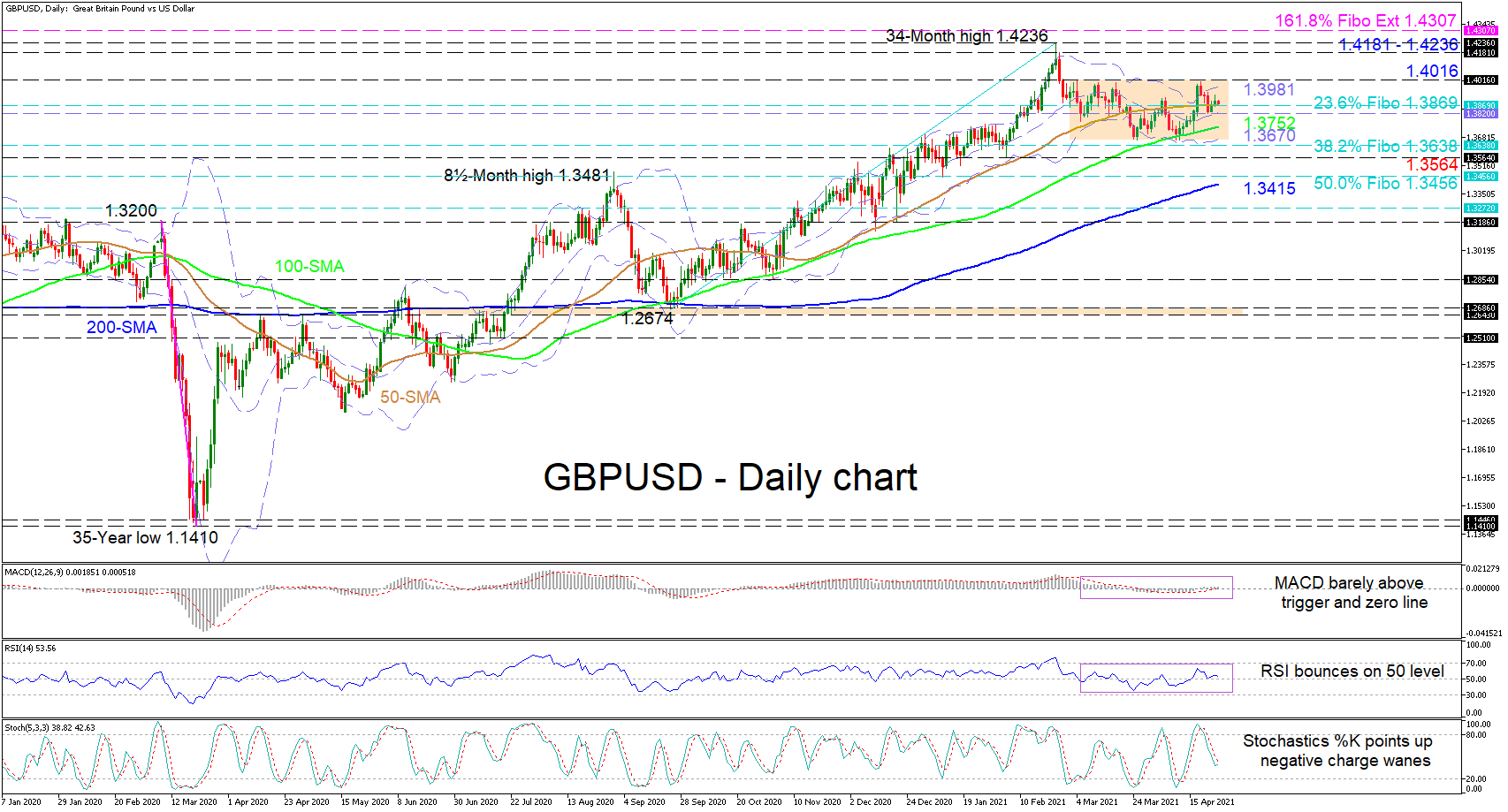

GBP/USD technical analysis: Stagnant around 50-day SMA, optimism lingers

GBPUSD is flirting with the 1.3869 level, which happens to be the 23.6% Fibonacci retracement of the up leg from 1.2674 until the 34-month high of 1.4236 after the price pullback found some footing off the 100-day simple moving average (SMA). The bullish SMAs are shielding the positive structure, while the slowed incline of the 50-day SMA is endorsing a more neutral-to-bullish tone.

The conflicting signals in sentiment in the short-term oscillators are indicating a phase of weak directional momentum. The MACD is holding marginally above its red trigger and zero lines, while the RSI is striving to remain in the bullish region. The stochastic %K line has turned upwards and is suggesting some fading in negative price impetus. Read more...

GBP/USD: Boris kills the pound with his words ahead of the Fed

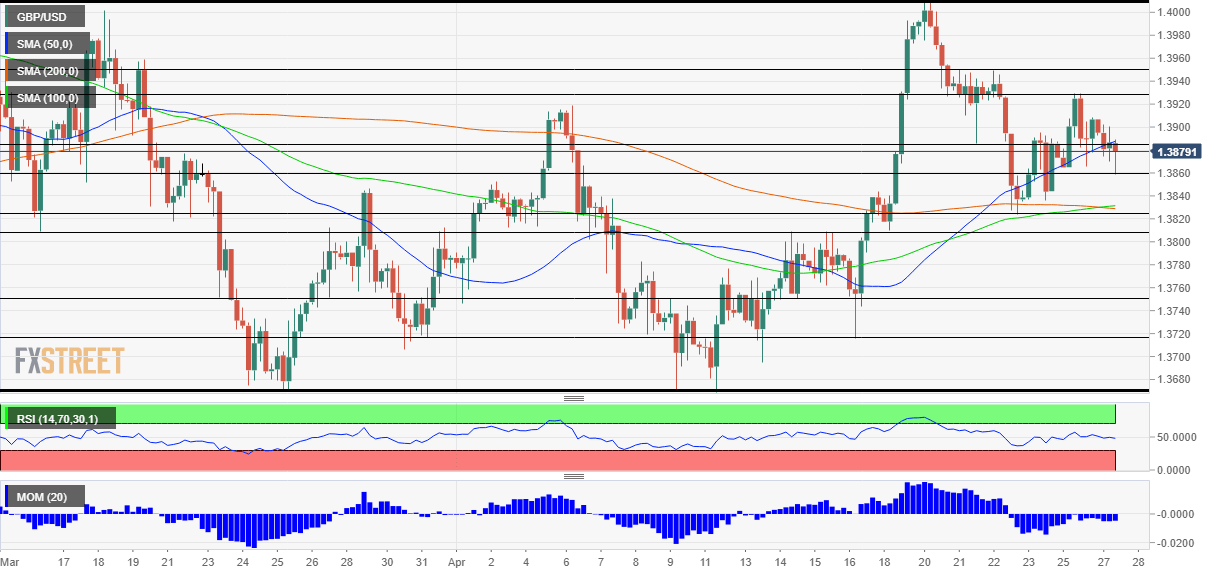

GBP/USD is under 1.39 as US yields make their way up. Boris' bodies' remarks make the pound powerless ahead of Powell while Tuesday's 4-hour chart is showing bears are improving their positions, Yohay Elam, an Analyst at FXStreet, briefs.

“‘Let the bodies pile high’ is better than having another lockdown – these insensitive comments attributed to UK Prime Minister Boris Johnson refuse to die down. Having to deal with scandals may hobble the government's efforts to push the economy forward despite the impressive vaccination campaign. That is weighing on the pound.” Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.