GBP/USD Forecast: Boris' bodies' remarks make the pound powerless ahead of Powell

- GBP/USD has been under pressure as US yields make their way up.

- The UK PM's political troubles and speculation ahead of the Fed dominate trading.

- Tuesday's four-hour chart is showing bears are improving their positions.

"Let the bodies pile high" is better than having another lockdown – these insensitive comments attributed to UK Prime Minister Boris Johnson refuse to die down. Downing Street's denials were rebuffed by additional sources and they put the PM in a pickle.

Having to deal with scandals may hobble the government's efforts to push the economy forward despite the impressive vaccination campaign. That is weighing on the pound.

Johnson's issues fill the gap for traders, who are anxious ahead of the Federal Reserve's decision on Wednesday. The world's most powerful central bank could be forced to acknowledge that America's economic boom may force it to taper its bond-buying scheme as soon as this year. That is the prerequisite for raising rates.

See Federal Reserve Preview: Will Powell power up the dollar? Three things to watch out for

Speculation is causing some tensions and somewhat keeping currencies in range, but other events could still move markets. The US Conference Board's Consumer Confidence gauge is set to show an improving sentiment, yet Monday's disappointing Durable Goods Orders statistics for March may show that economists' enthusiasm could be exaggerated.

Brexit is also an issue that could come to haunt the pound. Despite new EU offers on the Northern Irish protocol, progress has yet to be made. While covid overwhelms almost everything, leftovers from the Brexit deal still lurk in the shadows.

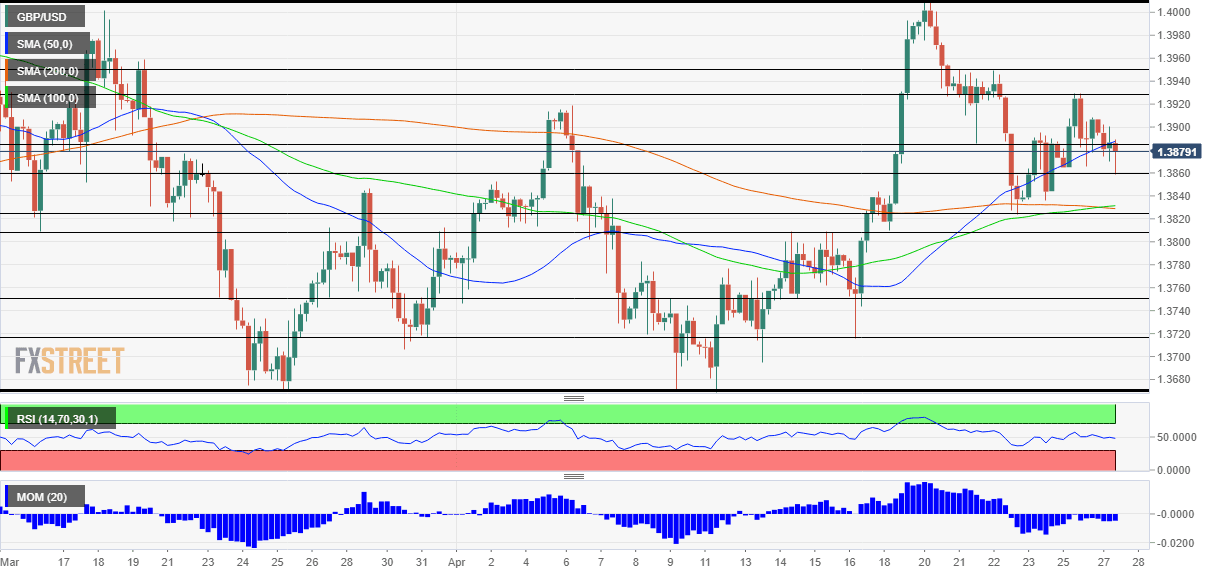

GBP/USD Technical Analysis

Pound/dollar is suffering from downside momentum on the four-hour chart and has recently slipped below the 50 Simple Moving Average – a bearish sign.

Initial support awaits at the daily low of 1.3680, followed by 1.3820 and 1.3810. Further down, 1.3740 is the next level to watch.

Resistance is at 1.3925, the weekly peak, followed by 1.3950 and the all-important double-top of 1.4010.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.