Pound Sterling Price News and Forecast: GBP/USD seesaws around multi-day low

GBP/USD steadies above 1.1800 at 3.5-month low amid Brexit, Fed chatters

GBP/USD struggles to defend the 1.1800 threshold at the lowest levels since late November 2022 even as the market turns dicey during early Wednesday. That said, the mixed plays surrounding Brexit and the Bank of England (BoE) seem to push the Cable pair towards making rounds to 1.1830-20 of late.

“The Bank of England has admitted that Brexit is making the City easier to regulate despite issuing warnings against the Government’s plan to axe swathes of red tape,” said The Telegraph. On the other hand, The Guardian highlights the push the British business leaders use over the UK government to fasten the Brexit practice, which in turn highlights the hopes of an end to the multi-month-old policy deadlock. “Business leaders say frayed relations with the EU are costing the British economy, as suppliers in the bloc grow more cautious about doing business with post-Brexit Britain,” said The Guardian. Read more...

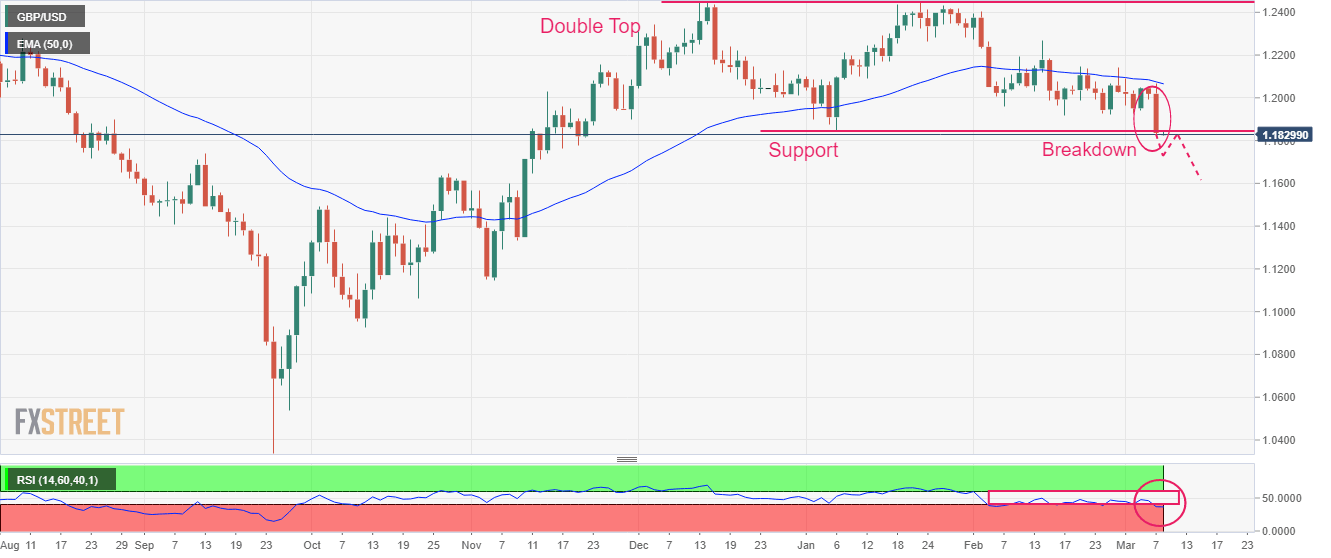

GBP/USD Price Analysis: More downside looks inevitable on Double Top breakdown near 1.1850

The GBP/USD pair has turned sideways around 1.1825 in the early Asian session after a nosedive move from the psychological resistance of 1.2000. The downside bias in the Cable looks not over yet as the currencies have to bear the volatility associated with the US Automatic Data Processing (ADP) Employment Change (Feb) after sheer volatility inspired by the commentary from Federal Reserve (Fed) chair Jerome Powell.

S&P500 futures were heavily dumped by investors as more rates from the Federal Reserve (Fed) have made the US economy prone to recession. A dismal US economic outlook sent the US Dollar Index (DXY) to a fresh three-month high at 105.65. The return delivered on 10-year US Treasury bonds is around 3.97%. Read more...

Author

FXStreet Team

FXStreet