GBP/USD Price Analysis: More downside looks inevitable on Double Top breakdown near 1.1850

- GBP/USD has taken a sigh of relief after a nosedive move near 1.1825, more downside looks inevitable.

- Fed Powell’s extremely hawkish remarks on interest rate guidance have spooked market sentiment.

- A breakdown of crucial support after a Double Top formation has confirmed a bearish reversal.

The GBP/USD pair has turned sideways around 1.1825 in the early Asian session after a nosedive move from the psychological resistance of 1.2000. The downside bias in the Cable looks not over yet as the currencies have to bear the volatility associated with the US Automatic Data Processing (ADP) Employment Change (Feb) after sheer volatility inspired by the commentary from Federal Reserve (Fed) chair Jerome Powell.

S&P500 futures were heavily dumped by investors as more rates from the Federal Reserve (Fed) have made the US economy prone to recession. A dismal US economic outlook sent the US Dollar Index (DXY) to a fresh three-month high at 105.65. The return delivered on 10-year US Treasury bonds is around 3.97%.

The remarks from Fed Powell in his testimony before Congress forced investors to underpin the risk aversion theme. Powell said the “ultimate level of interest rates is likely to be higher than previously anticipated,” after the “latest economic data have come in stronger than expected.”

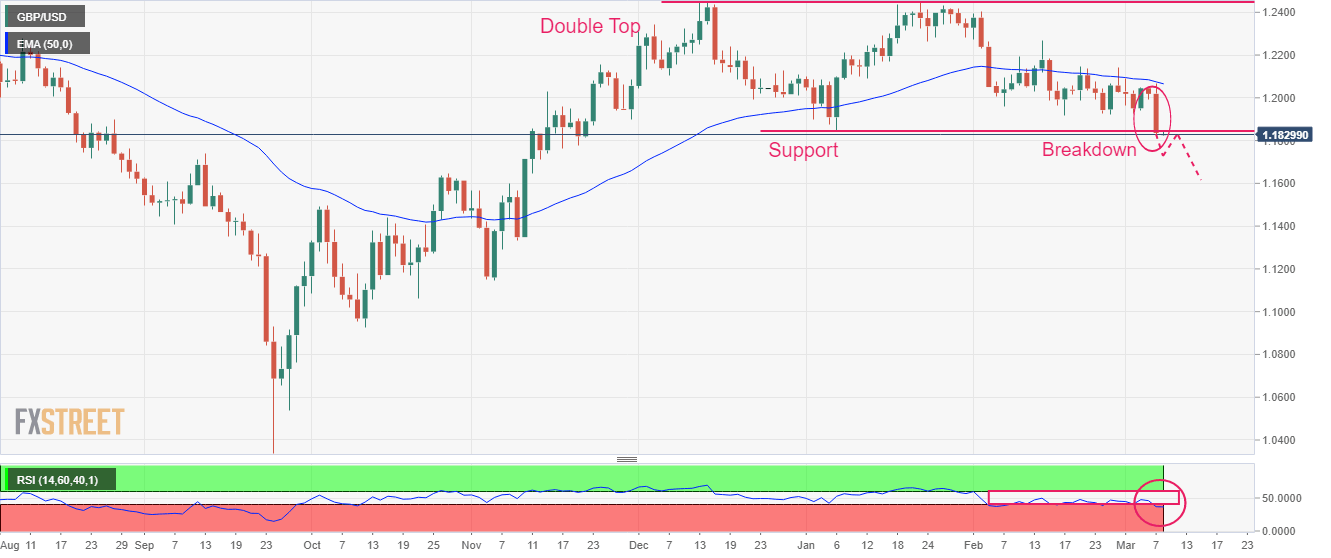

GBP/USD has delivered a breakdown of the Double Top chart pattern formed on a daily scale plotted from December 15 high at 1.2447. A slippage below the horizontal support placed from January 06 low at 1.1841 confirms a bearish reversal.

The 50-period Exponential Moving Average (EMA) at 1.2064 is acting as a major barricade for the Pound Sterling.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below 40.00 for the first time in the past one month. More downside looks inevitable as the RSI (14) is not showing any sign of divergence and oversold.

Should the Cable break below the round-level support of 1.1800, US Dollar bulls will drag the asset further toward November 17 low at 1.17633 followed by November 14 low around 1.1700.

On the flip side, a move above February 24 high at 1.2040 will drive the asset toward February 23 high around 1.2080. A breach of the latter will expose the asset to February 21 high around 1.2140.

GBP/USD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.