GBP/USD outlook: Signals of an end of extended directionless mode still require a confirmation

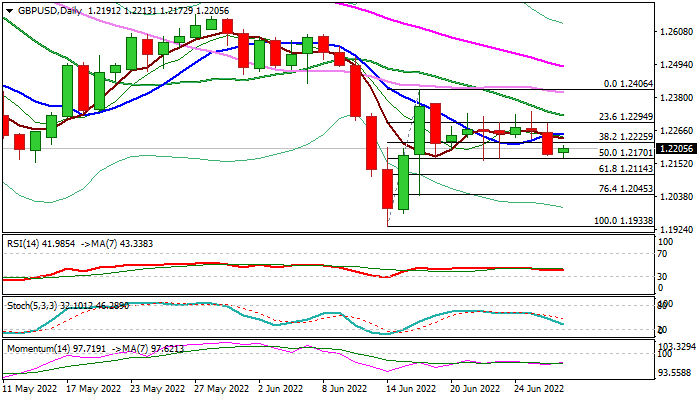

Cable is holding within a narrow consolidation in European trading on Wednesday, following Tuesday’s 0.64% drop, which generated an initial signal of an end of a multi-day directionless mode. Fresh weakness touched strong supports at 1.2170 zone (50% retracement of 1.1933/1.2406/lows of June 22/23), but so far lacking strength for a clear break, which would confirm bearish signal and shift near-term focus lower.

Daily technical picture is bearish with strong negative momentum and MA’s in bearish setup, keeping near-term bias with bears, as sterling is weighed by month-end dollar buying. However, risk of extended range-trading is expected to persist as long as the price action stays above 1.2170 zone pivots, but the downside will remain vulnerable while daily Kijun-sen (1.2300) caps. Read more ...

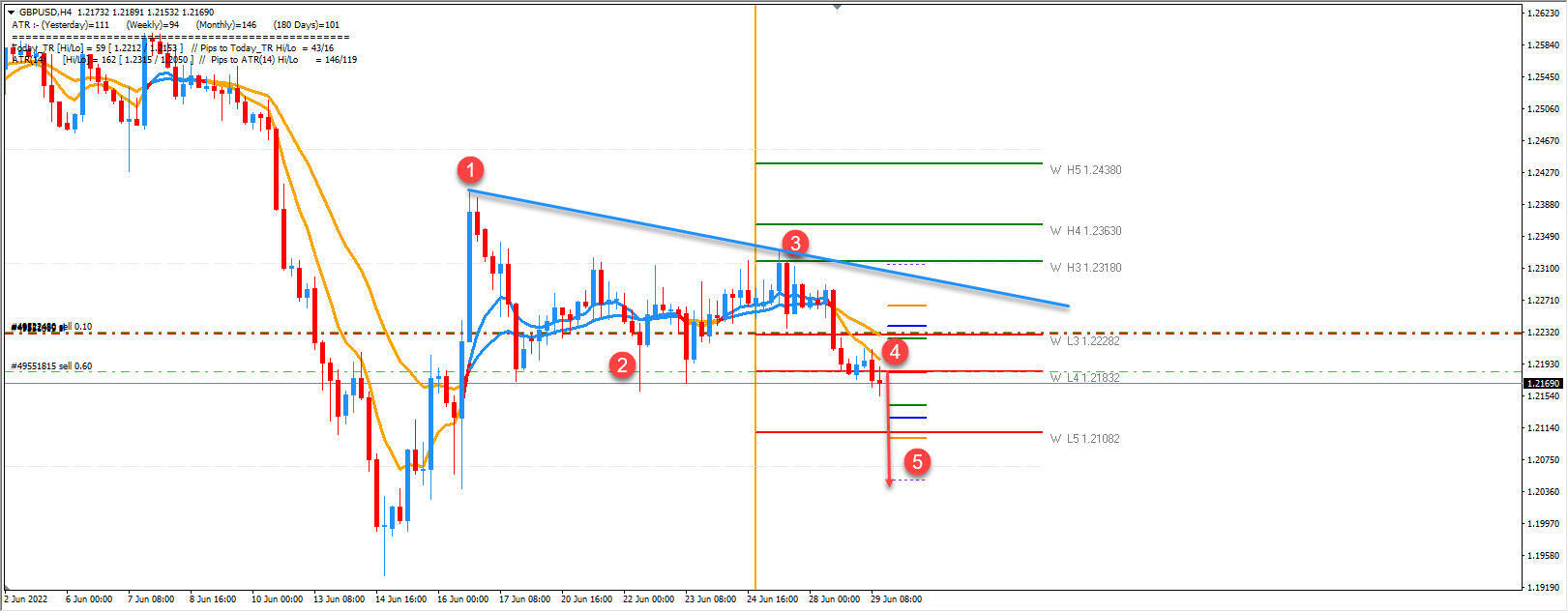

GBP/USD scaled-in short trade added

The GBP/USD is in a short trend. Megatrend moving averages are bearish and we can also spot daily bearish candles along with H4 bearish rejections. The ongoing problem in the UK with Scotland can also weigh on the price. Currently 1.2160 is strong support and intraday break of that level should move the price lower. W L5 is 1.2108 and the ATR projection is 1.2050. However, if the market doesn’t hold below 1.2183 we might see 1.2230 again and that would endanger the bearish trend on the GBP/USD. I am selling the rallies and two short positions are there for a continuational move down. Read more ...

GBP/USD struggles near two-week low, just above mid-1.2100s ahead of central bank speakers

The GBP/USD pair prolonged this week's retracement slide from the 1.2330-1.2335 region and edged lower for the third successive day on Wednesday. The downward trajectory dragged spot prices to a nearly two-week low, closer to mid-1.2100s during the first part of the European session, though lacked follow-through selling.

The market sentiment remains fragile amid concerns that a more aggressive move by major central banks to curb soaring inflation would pose challenges to global economic growth. This assisted the US dollar to capitalize on the previous day's strong move up and gain some follow-through traction, which, in turn, exerted some downward pressure on the GBP/USD pair. Read more ...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.