Pound Sterling Price News and Forecast: GBP/USD roiled just below the 1.2700 handle on Tuesday

GBP/USD churns near 1.2700

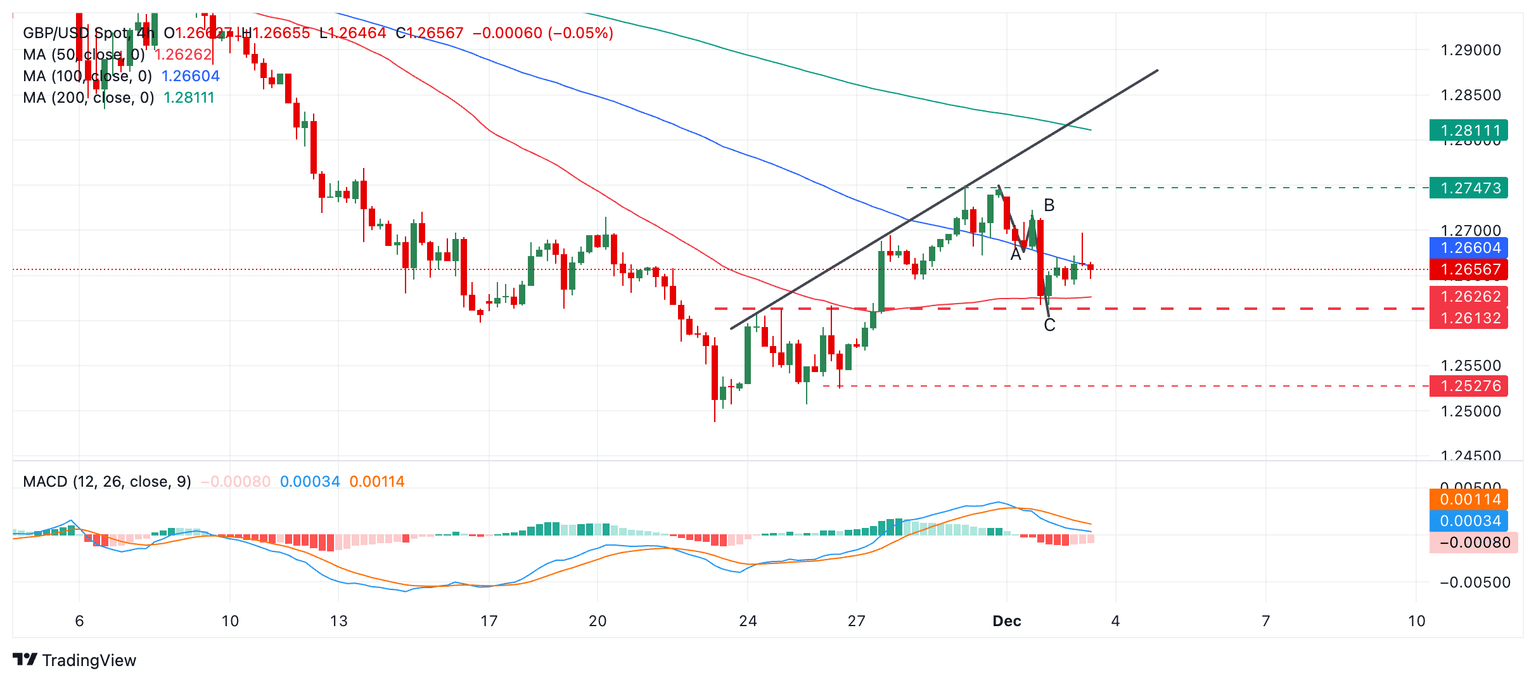

GBP/USD churned chart paper just south of the 1.2700 handle on Tuesday, roiling bids as Pound Sterling traders grapple with a significant lull in meaningful UK-centric economic data and broader markets gear up for a fresh pass of US Nonfarm Payrolls (NFP) data due at the end of the week.

Bank of England (BoE) Governor Andrew Bailey is due to make an appearance early Wednesday… sort of. The head of the UK’s central bank will delivering remarks via a pre-recorded interview during a conference hosted by the Financial Times. Nothing of note is expected from the BoE head’s appearance, but GBP traders will be keeping one ear open for any meaningful soundbites the BoE Governor may reveal. Read more...

GBP/USD Price Forecast: Stalls below 1.2700 amid dismal UK retail sales

The Pound Sterling climbed modestly against the US Dollar on Tuesday, yet it failed to decisively clear the 1.2700 figure for the third consecutive trading day. At the time of writing, the GBP/USD trades at 1.2667, up 0.15%.

The Britain Retail Consortium (BRC) revealed that retail sales plunged to their lowest reading since April, with the index diving -3.4%, missing estimates for a 0.7% increase. According to the BRC, every retail category experienced a decline, with shopping centres seeing the sharpest drop due to a significant fall in footfall. Read more...

Pound Sterling trades flat versus the US Dollar on Tuesday

The Pound Sterling (GBP) trades flat in the 1.2650s on Tuesday as sellers hit pause after the heavy sell-off of the previous day.

GBP/USD’s declined by 0.71% on Monday following tough talk from US President-elect Donald Trump in which he threatened to hit the BRICS trading bloc with 100% tariffs unless it gave up its search for an alternative to the US Dollar. Stronger-than-expected US Purchasing Manager Index (PMI) data further boosted the Buck. Read more...

Author

FXStreet Team

FXStreet

-638688888602841549.png&w=1536&q=95)