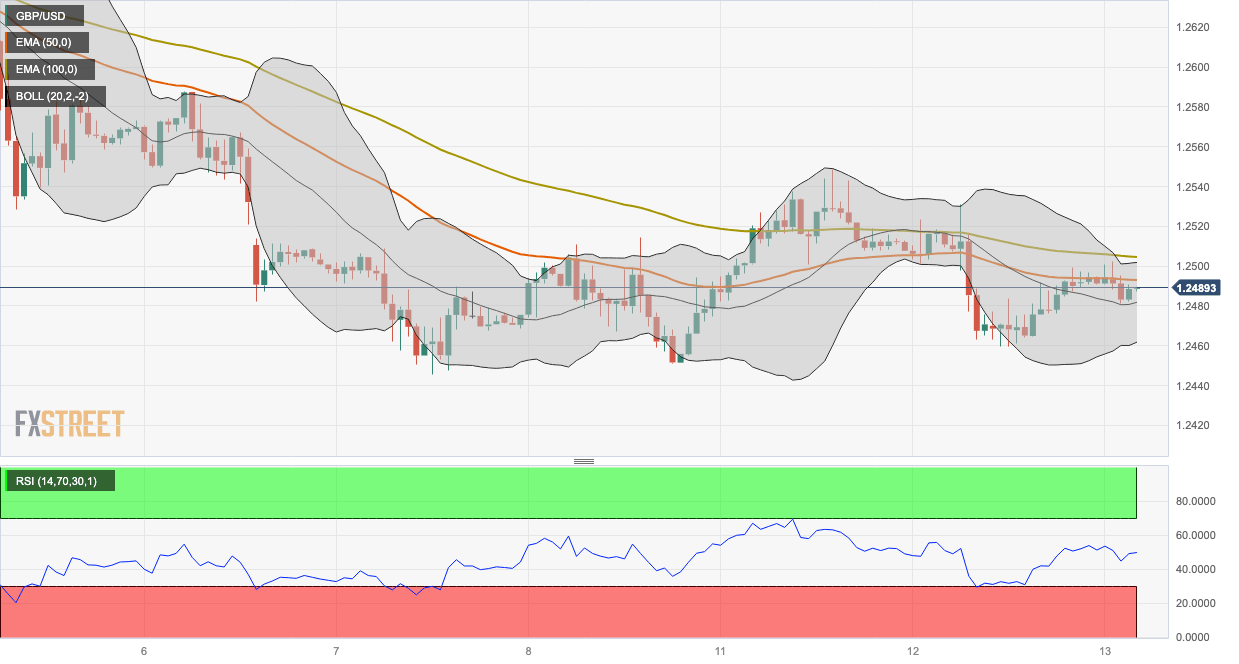

Pound Sterling Price News and Forecast: GBP/USD oscillates in the 1.2480-1.2502 region

GBP/USD Price Analysis: Oscillates in a range below the 1.2500 mark, eyes on UK GDP, US CPI

The GBP/USD pair consolidates in a familiar range below the 1.2500 barrier during the Asian session on Wednesday. The major pair currently trades near 1.2488, losing 0.01% on the day. Market players prefer to wait on the sidelines ahead of the UK Gross Domestic Product (GDP) data for July and the highly anticipated US Consumer Price Index (CPI) data. These figures could trigger the volatility in the pair.

The Bank of England (BoE) policymaker Catherine Mann remarked on Monday that it was too early for the central bank to pause interest rates and that it was better for the central bank to err on the side of rising rates too high rather than suspending them too soon. The hawkish comments by BoE governors may restrict the British Pound's fall and serve as a tailwind for GBP/USD. Read more...

GBP/USD consolidates in a familiar range around 1.2500 ahead of UK macro data, US CPI

The GBP/USD pair edges higher during the Asian session on Wednesday, albeit lacks follow-through and remains confined in a familiar range held over the past week or so. Spot prices currently trade around the 1.2500 psychological mark and remain well within the striking distance of a three-month low touched last Thursday.

The US Dollar (USD) languishes near the weekly low and turns out to be a key factor acting as a tailwind for the GBP/USD pair, though expectations that the Bank of England (BoE) is nearing the end of its rate-hiking cycle cap the upside. BoE Governor Andrew Bailey told lawmakers last week that the central bank is much nearer to ending its run of rate increases. Furthermore, the UK employment details released on Tuesday pointed to a cooling labour market and do not justify another rate hike after the widely anticipated lift-off in September. Read more...

Author

FXStreet Team

FXStreet