GBP/USD Forecast: Pound set to shine before sterling takes to the pitch

Is it coming home? That is the question on most Brits' minds ahead of England's football semifinal against Denmark later in the day. The match may distract some forex traders away from GBP/USD. UK consumer spending may also get a boost – economists expect Brits to down some 50,000 pints of beer per minute around the game.

Yet not only Manchester City midfielder Raheem Sterling is set to shine but also pound sterling – at least against the dollar. The greenback advanced on Tuesday despite a substantial drop in the ISM Services Purchasing Managers' Index. Signs of a cooldown in the world's largest economy – and the consequent fall in Treasury yields – failed to stop the dollar. Can this last? On Wednesday, the tables may turn against the dollar. Read more...

GBP/USD outlook: Near-term focus shifts lower after recovery stalled

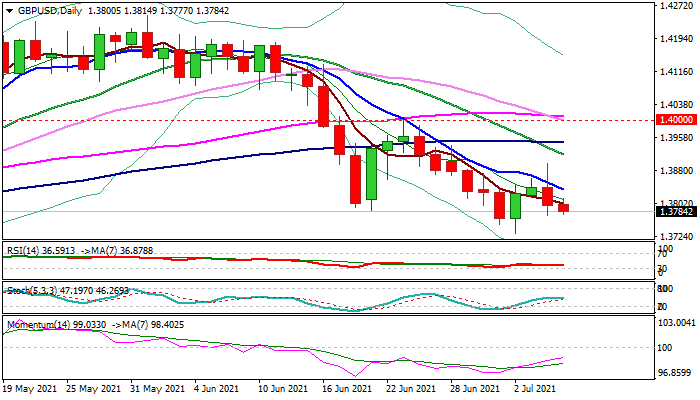

Cable stands at the back foot, weighed by Tuesday’s bearish daily candle with long upper shadow, formed after strong upside rejection on a false break of descending 10DMA and subsequent weakness. The action generated an initial signal of a bearish continuation pattern on a daily chart, which looks for more evidence to be confirmed.

Fresh bears need a daily close below 1.3770 pivots (Tuesday’s low/Fibo 76.4% of 1.3731/1.3897 recovery leg) to signal an end of the corrective phase. Read more...

GBP/USD refreshes session tops, around 1.3815-20 region

The GBP/USD pair quickly reversed an early European session dip and climbed back above the 1.3800 mark, back closer to daily tops in the last hour.

The pair attracted some dip-buying near the 1.3775 region on Wednesday and for now, seems to have stalled the previous day's sharp retracement slide from the vicinity of the 1.3900 mark. The UK Prime Minister Boris Johnson set out plans for the final step of lifting lockdown in the UK, which, in turn, was seen as a key factor that extended some support to the British pound. Apart from this, a subdued US dollar price action provided a modest lift to the GBP/USD pair. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold price hits an all-time high to near $2,440

Gold price (XAU/USD) climbs to a new record high near $2,441 during the Asian trading hours on Monday. The bullish move of the precious metal is bolstered by the renewed hopes for interest rate cuts from the US Federal Reserve (Fed).

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.