GBP/USD Forecast: UK elections outweigh Nonfarm Payrolls impact and favor the bulls

Hartlepool – a place where many GBP/USD traders are unable to locate on the map – is breaking the typical pre-Nonfarm Payrolls silence. Prime Minister Boris Johnson's Conservatives have won a by-election for the Northern seat, defeating the opposition Labour Party in its heartland. Such a victory provides some political calm.

Counting in a long list of other local and regional elections is moving slowly, but speculation about Scotland's elections is set to increase. The pro-independence Scottish National Party (SNP) is close to winning an absolute majority, paving the road for another clash with London over a new referendum. Read more...

GBP/USD analysis: Moves due to bad news reporting

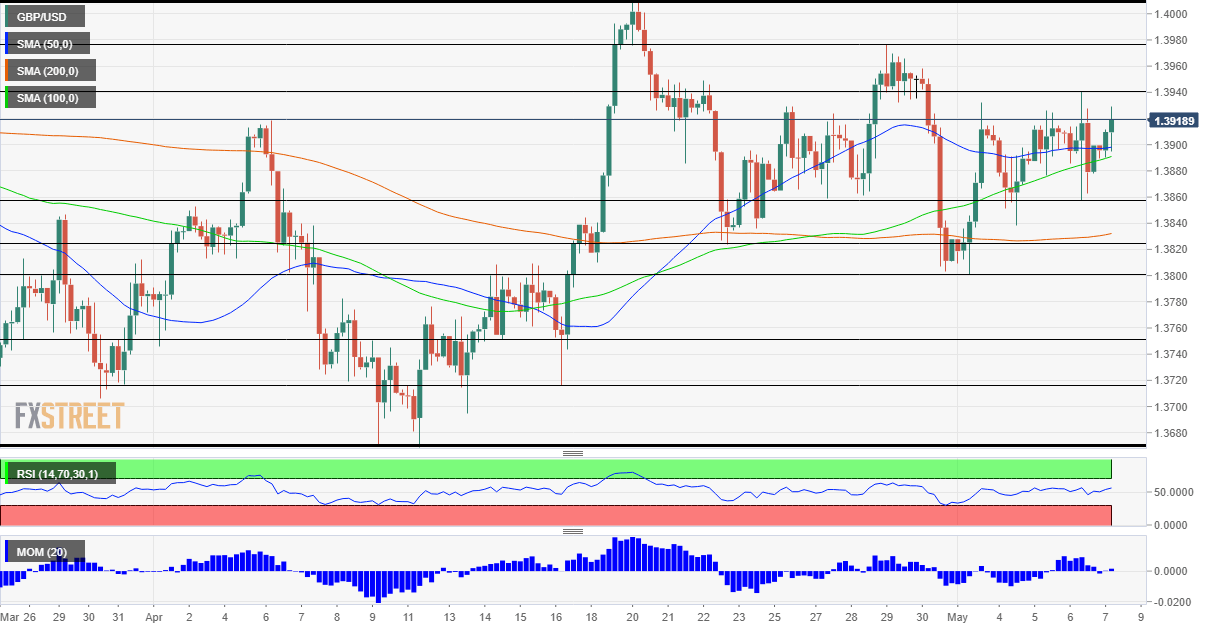

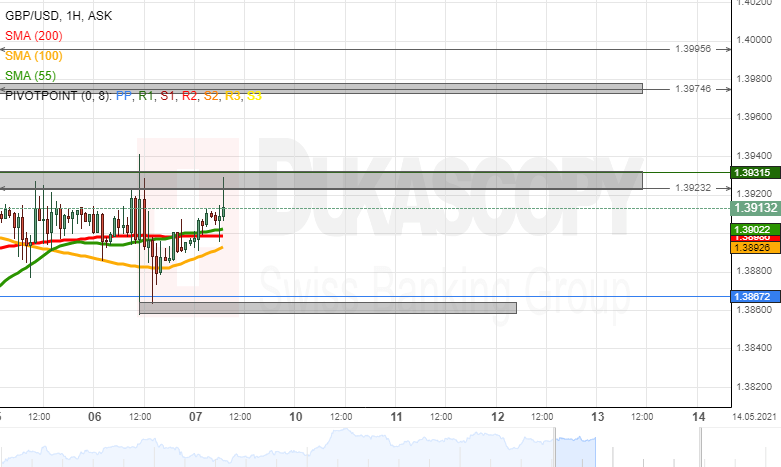

The GBP/USD currency exchange rate made a short-term surge above the 1.3920/1.3930 zone. The rate bounced off the 1.3940 level and retreated to the 1.3860 level, which provided support. The volatility is attributed to the announcement of the Bank of England that it would stick to its monetary policy. Initially, a 30 pip move down occurred, which was followed by a 80 pip recovery.

These moves were created by news agencies reporting that the central bank would slow its government bond-buying. However, the official statement clearly stated that the program would remain unchanged. Moreover, some reputable news outlets even started publishing analysis of the future scenarios in case of central banks following the example of the BoE reducing easing. Read more...

GBP/USD Analysis: Bulls struggle to seize control despite hawkish BoE, focus shifts to NFP

The GBP/USD pair witnessed some intraday volatility on Thursday after the Bank of England announced its monetary policy decision. As was widely anticipated, the BoE left the benchmark interest rate and Asset Purchase Facility unchanged at 0.10% and £895 billion, respectively. However, the lack of clarity on future tapering plans exerted some downward pressure on the British pound. The early downtick, however, turned out to be short-lived and was quickly bought into near the 1.3855 area in the wake of more upbeat economic forecasts. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.