Pound sterling price news and forecast: GBP/USD could aim to reclaim 1.3500 mark

GBP/USD Outlook: Seems poised to reclaim 1.3500, dips could be seen as buying opportunity

The GBP/USD pair prolonged this week's solid bounce from the vicinity of the YTD low and gained strong follow-through traction for the third successive day on Thursday. Investors turned optimistic amid reports that the current vaccines may be more effective in fighting the new variant than first thought. Adding to this, a UK study suggested that Omicron infections are less likely to lead to hospitalization and helped offset worries about surging COVID-19 cases in Britain. This, in turn, was seen as a key factor that acted as a tailwind for the British pound and provided a strong lift to the major amid subdued US dollar demand. Read more...

Pound jumps as Omicron risk dismissed

The pound’s newfound strength is a result of stronger risk appetite. When Omicron first appeared on the scene several weeks ago, there were dire predictions about the damage another wave of Covid would cause to the global economy. Omicron has spread very quickly across Europe and the US, but investors remain optimistic that although Omicron is much more contagious than Delta, the symptoms are milder, according to some medical reports. With risk sentiment on the rise this week, we are seeing a movement away from the safe-haven US dollar, and the pound has gained ground. Read More...

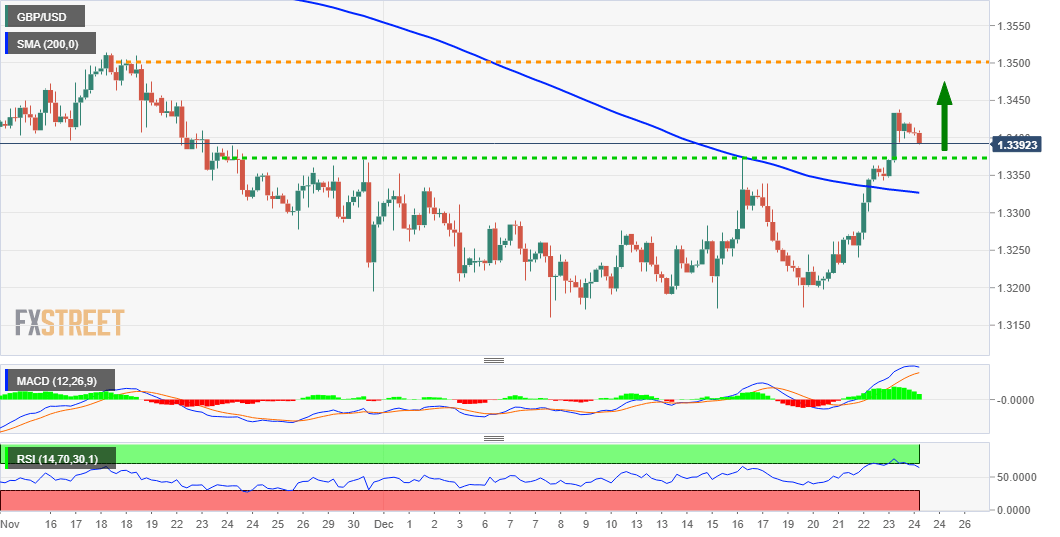

GBP/USD Price Analysis: Bulls have the upper end, could aim to reclaim 1.3500 mark

The GBP/USD pair attracted some dip-buying near the 1.3390-85 region on Friday and turned positive for the fourth successive day. The pair held on to its modest intraday gains through the mid-European session and was last seen trading near the daily top, around the 1.3415-20 region. The GBP/USD pair could then accelerate the appreciating move and aim to reclaim the key 1.3500 psychological mark. The momentum could get extended and push spot prices beyond an intermediate hurdle near 1.3515, towards testing the next relevant barrier near the 1.3560-65 region. Read More...

Author

FXStreet Team

FXStreet