Pound Sterling Price News and Forecast GBP/USD: BOE may save sterling after massive Fed-induced 300-pip blow

GBP/USD Weekly Forecast: BOE may save sterling after massive Fed-induced 300-pip blow

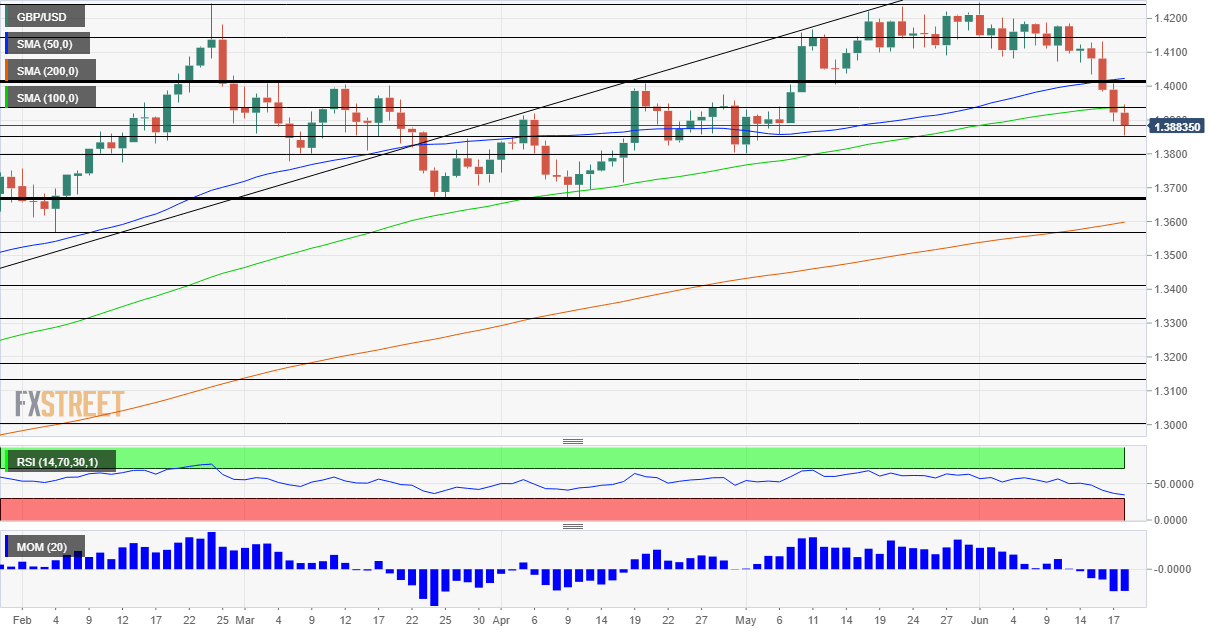

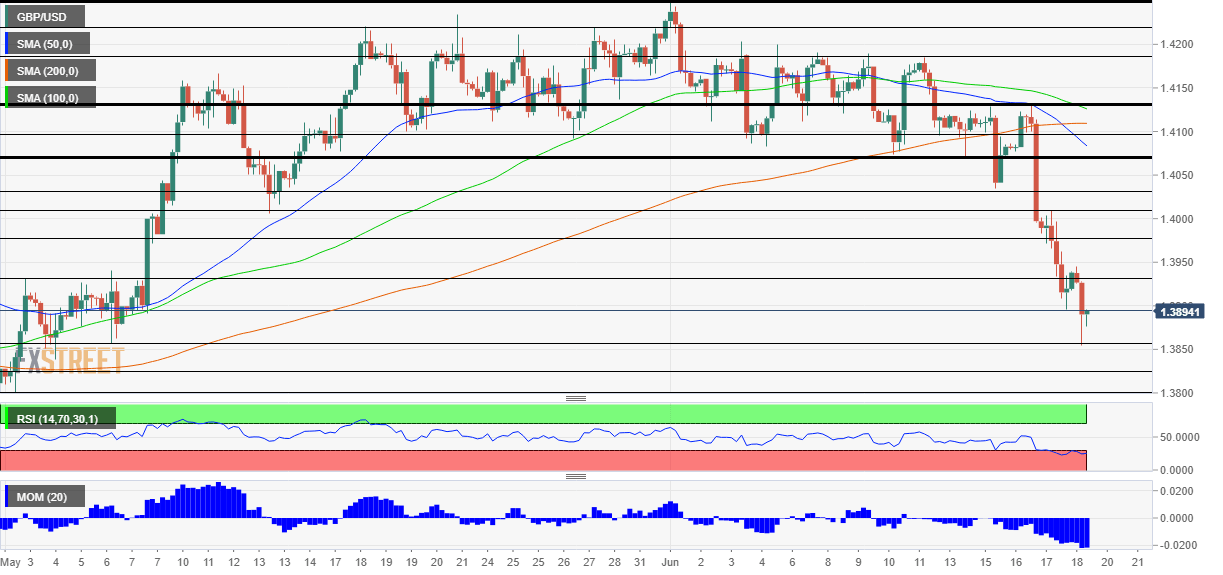

GBP/USD has tumbled down in response to a Fed decision, UK reopening delay. The BOE's decision and a bulk of US figures are set to move the currency pair. Mid-June's daily chart is showing bears are taking over. The FX Poll is pointing a recovery, albeit not to pre-Fed levels. Hawkish Fed – these words have rarely been written together, and the abrupt change from the world's most powerful central bank has been boosting the dollar. For GBP/USD, the ball now shifts to the Bank of England, which has to weigh economic optimism and the spread of the Delta covid variant. Read more...

GBP/USD Forecast: Recovery from the Fed? Only a dead-cat bounce for Delta-depressed pound

GBP/USD has been struggling to recover from the Fed-fueled dollar storm. Weak UK retail sales and covid's rapid spread have been weighing on sterling. Friday's four-hour chart is showing that cable is moderately oversold. When will "Freddom Day" come? That is a question many Brits are asking themselves after the government postponed the lifting of the last restrictions to July 19 – but reportedly considers bringing it forward to July 5. However, such hopes will likely be dashed. Read more...

GBP/USD dives to fresh multi-week lows amid sustained USD buying

GBP/USD remained under some heavy selling pressure amid a broad-based USD strength. The Fed’s hawkish turn, the risk-off mood continued boosting the safe-haven greenback. COVID-19/Brexit jitters weighed on the British pound and contributed to the selling bias. The USD buying picked up pace during the early North American session and dragged the GBP/USD pair to fresh multi-week lows, around the 1.3845 region in the last hour. Read more...

Author

FXStreet Team

FXStreet