Pound Sterling Price News and Forecast: GBP/USD approaching critical support

GBP/USD analysis: Reaches below 1.3750

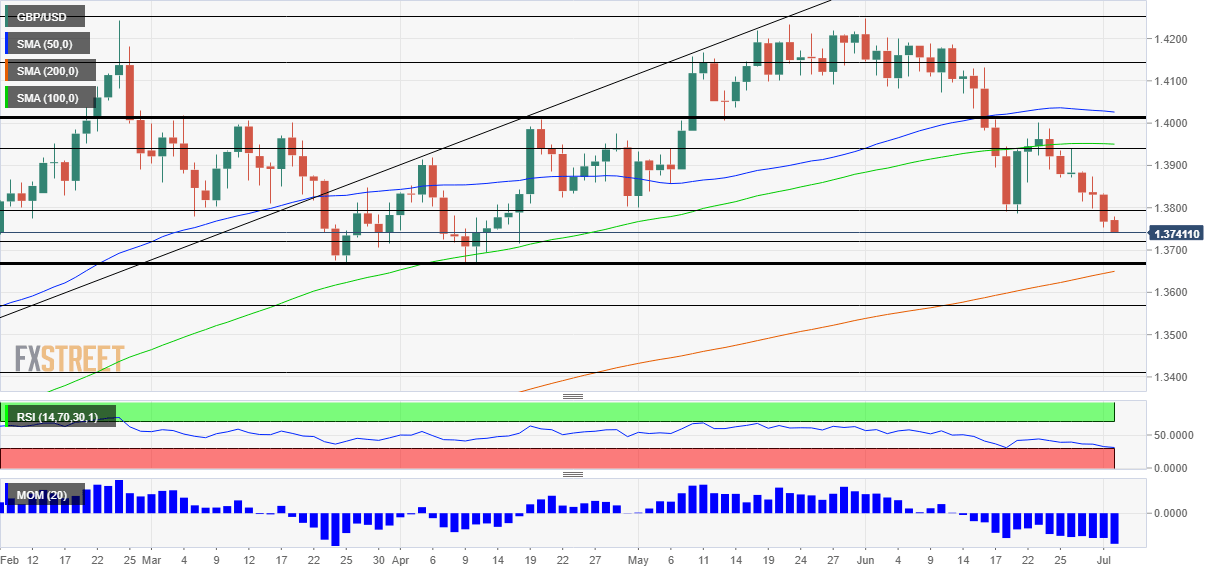

The 1.3820 level provided enough resistance for the GBP/USD to pass below the lower trend line of the channel down pattern, which guided the rate since June 23. During Friday's trading hours, the rate fluctuated sideways near the 1.3750 mark. In theory, the pair should decline, as it has no technical support as low as the 1.3677 level, where the weekly S2 simple pivot point was located at. However, support could be provided by round exchange rate levels like the 1.3740, 1.3720 and most importantly the 1.3700 mark. Read more...

GBP/USD Weekly Forecast: Approaching critical support, Fed minutes and Delta could down cable

GBP/USD has been on the back foot mostly due to dollar strength. Fed meeting minutes, UK GDP and virus headlines are set to rock cable. Early July´s daily chart is showing bears have limited room to run. The FX Poll is pointing to short term falls and recovery afterward. Where will the dollar rally halt? A mix of factors has been boosting the greenback – which seems unstoppable, especially as the pound has had its share of issues. Minutes from the Fed – the main dollar driver – and the Delta covid variant remain in the limelight. Read more...

GBP/USD recovers further on Friday as the US dollar retreats

Greenback holds onto daily losses during Friday’s American session. US employment data triggers correction of the dollar. GBP/USD up on Friday, but down for the week. The GBP/USD is hovering near 1.3800 after a sharp recovery from 1.3730, the lowest level since mid-April. The pair bottomed immediately after the release of the US employment report and then bounced to the upside as the greenback reversed, falling across the board. Read more...

Author

FXStreet Team

FXStreet