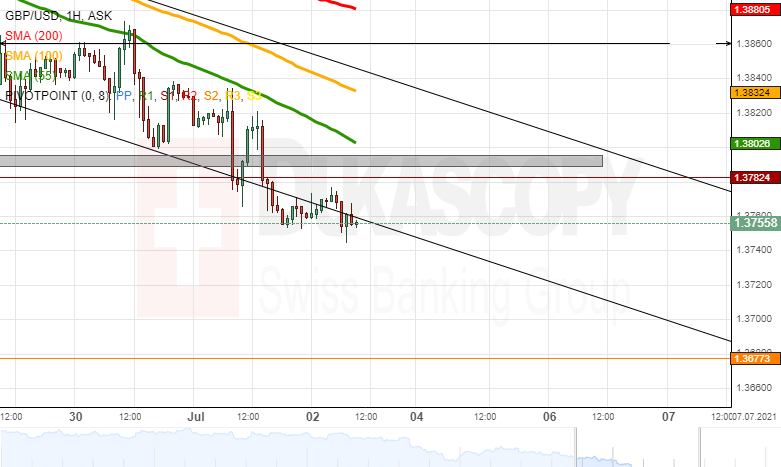

GBP/USD analysis: Reaches below 1.3750

GBP/USD

The 1.3820 level provided enough resistance for the GBP/USD to pass below the lower trend line of the channel down pattern, which guided the rate since June 23. During Friday's trading hours, the rate fluctuated sideways near the 1.3750 mark.

In theory, the pair should decline, as it has no technical support as low as the 1.3677 level, where the weekly S2 simple pivot point was located at. However, support could be provided by round exchange rate levels like the 1.3740, 1.3720 and most importantly the 1.3700 mark.

Meanwhile, a potential recovery of the GBP against the USD could find resistance in the weekly S1 at 1.3782, the previous June low level near 1.3790 and the 55-hour simple moving average, which was approaching from above. If these levels fail to provide resistance, the pair might further reach for the 100-hour SMA and the 1.3820 level.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.