NZD/USD struggles in the face of a stronger US dollar despite hot RBNZ inflation expectations

- NZD/USD bears are lurking in an attempt to take on the daily trendline support.

- A Doji candle followed by a daily engulfing could signal more to come from the bears in the days ahead.

- RBNZ inflation extensions are at a 31-year high, but US CPI trumps at a 40 year high already.

At 0.6658, NZD/USD is 0.17% lower on the day as the greenback continues to dominate the top spot on the forex leader board. On an hourly basis, the US dollar is leading while the commodity currencies are the laggards.

In recent trade, the Reserve bank of New Zealand released its Two-Year Inflation Expectations:

- RBNZ: OCR expectations continue to rise in the short and medium-term

- Q1: 3.27% (prev 2.96%).

- OCR expectations continue to rise in the short and medium-term.

- One year ahead CPI Inflation expectations rose to a 31-year high of 4.40%.

- Unemployment expectations reach all-time lows.

- House price expectations responses show uncertainty in the housing market.

''CPI inflation pressures are set to remain strong in the near term, and that should be reflected in rent and food prices out next wee,'' analysts at ANZ Bank reported earlier 'But the housing market is slowing, as REINZ housing data should confirm. This should take some heat out of the CPI in time.''

Meanwhile, this has failed to move the needle and the markets are instead consolidating the volatility from overnight when the US Consumer Price Index arrived hot, causing two-way price action in the New York day. the data was accompanied by very hawkish comments from James Bullard, a voting member at the Federal Reserve.

His rhetoric unleashed a wave of bets on aggressive rate hikes. Bullard told Bloomberg he'd like to see 100 basis points of hikes by July and that inter-meeting rate hikes could be considered. This has led some Fd watchers to talk of a rate rise before the March meeting. Rates futures have shifted to price a better-than-even chance of a 50 bp hike next month and more than 160 bps of tightening by the end of the year.

Thursday data showed US Consumer Price Index was up 7.5% year-on-year in January, a fourth straight month above 6% and slightly higher than economists' forecasts for a 7.3% rise. Consequently, US Treasury yields leapt and the dollar jumped to a five-week high of 116.34 yen. The kiwi was bod for part of the day on a flight to commodities but turned on a dime when Bullard came on the scene and has been under pressure ever since. New Zealand dollars each dropped about 0.3% in morning trade.

NZD/USD techncial analysis

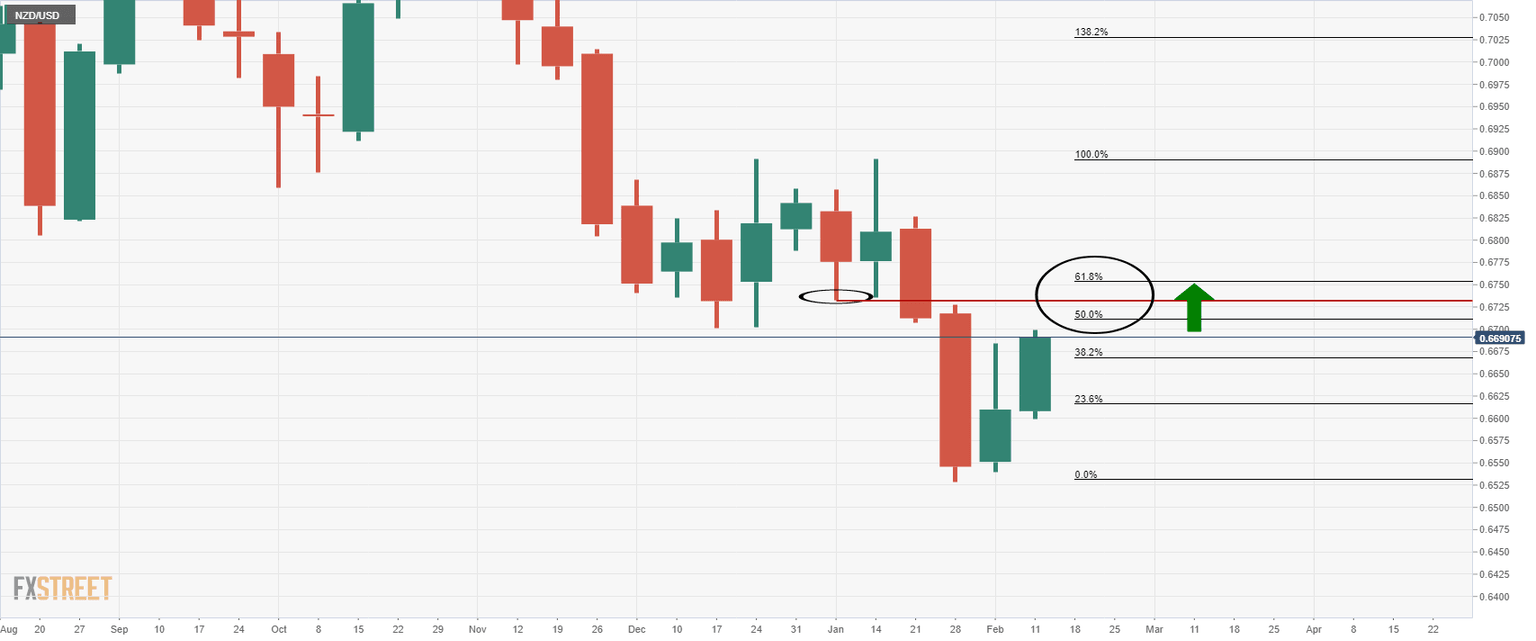

As per the prior analysis, whereby it was noted: ''NZD/USD bulls are taking charge in a significant correction,'' that was moving ''in on old lows near 0.67 the figure and towards the neckline of the M-formation near 0.6733,'' the price reached the target on Thursday. This resided between the 50% mean reversion and the 61.8% ratio as follows:

NZD/USD prior and live analysis

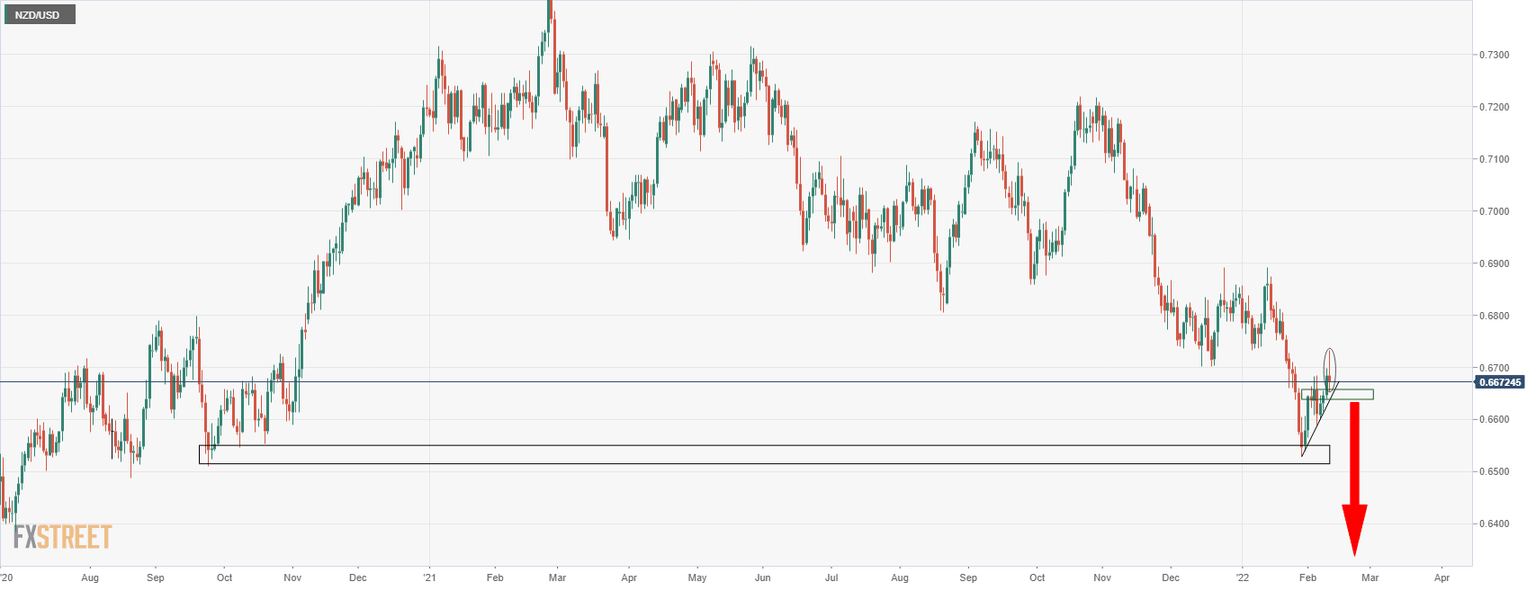

NZD/USD daily chart

The Doji candle, if followed by a bearish close on Friday, could set the case for a downside continuation for next week's business:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.