NZD/USD rebounds amid upbeat market mood, eyes weekly losses

- As Wall Street opens positive, NZD/USD rises 0.57% to 0.5907, partially offsetting fears of a global economic slowdown.

- US Dollar softens after hitting a six-month high, providing a tailwind for NZD/USD amid a lack of fresh US economic data.

- Traders await key economic indicators next week, including US inflation data and New Zealand Retail Card Spending, for directional cues.

The New Zealand Dollar (NZD) stages a rebound against the US Dollar (USD), but it remains set to finish the week with losses. Fears of a global economic slowdown led by Europe and China dented investors’ mood during the European session, but Wall Street opened in the green. This bolstered the NZD/USD, which is trading at 0.5907, a gain of 0.57%.

New Zealand Dollar gains against a softening US Dollar, but concerns over global economic slowdown and upcoming data keep traders cautious

The Greenback (USD) continues to soften after data propelled the buck to a six-month high, according to the US Dollar Index, at 105.057. Nevertheless, the lack of economic data in the US agenda and falling US Treasury bond yields weighed on the USD, a tailwind for the NZD/USD pair.

During the week, US data was positive for the buck, showing the economy’s resilience. Business activity in the services segment picked up, while the jobs market remains tight, as Initial Jobless claims show. However, the NZD/USD was propelled by Federal Reserve officials taking a more cautious stance, particularly Regional Fed Presidents Collins, Williams, and Bostic. Contrarily, the Chicago Fed President, Austan Goolsbee, adopted a more neutral stance, while Lorie Logan from the Dallas Fed said the US central bank needs to be data-dependant but added that more rate hikes are required to curb inflation.

In the meantime, the Kiwi has been influenced by market sentiment and negative data from China. As business activity in the latter struggled, despite Chinese authorities stimulating the economy, the financial markets had not bought that story, as the Chinese stock market was headed for weekly losses.

Aside from this, the NZD/USD would gather direction from next week’s data. The US agenda will feature inflation data, Retail Sales, unemployment claims, Industrial Production, and Consumer Sentiment from the University of Michigan. On the New Zealand front, Retail Card Spending.

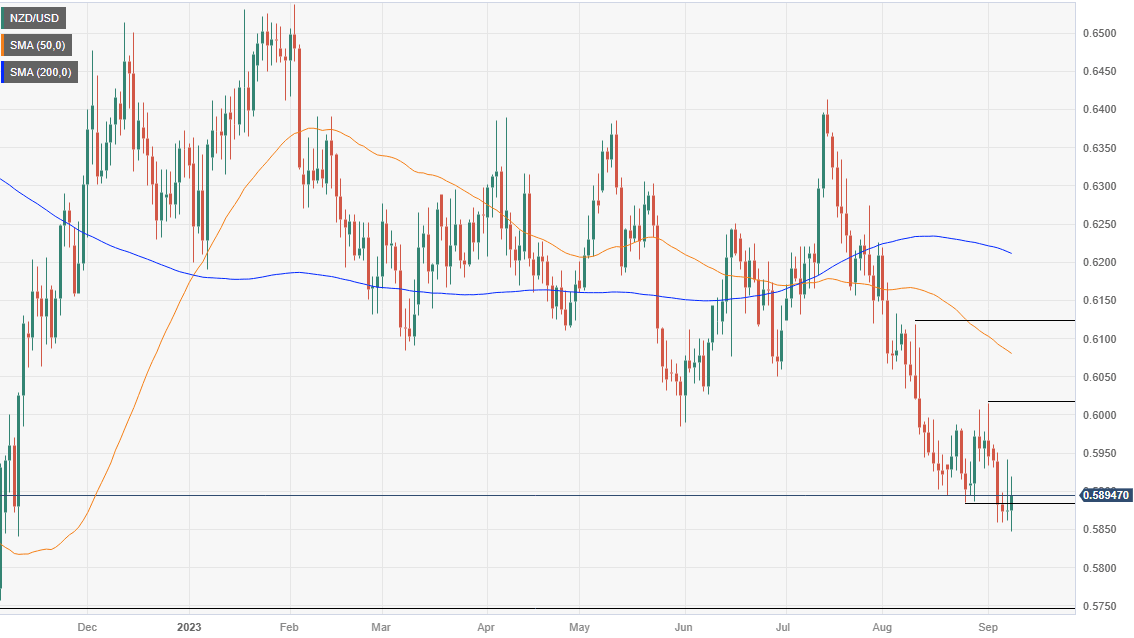

NZD/USD Price Analysis: Technical outlook

The pair’s rally above the September 6 high of 0.5904 could be seen as an upward correction, but the overall trend remains downward. To shift the bias, buyers must reclaim the September 1 swing high of 0.6015, which would put the 50-day Moving Average (DMA) at 0.6080 in play. If the NZD/USD prints a daily close below 0.5904, sellers could drive the Kiwi/US Dollar pair toward the week’s lows at 0.5859 before challenging 0.5800.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.