NZD/USD Price Analysis: Volatility squeezes broadly amid a light economic calendar

- NZD/USD has turned sideways broadly amid an absence of a potential trigger.

- The US Dollar Index has resumed its downside journey after a less-confident pullback move to near 104.00.

- NZD/USD is auctioning in a Symmetrical Triangle that indicates a contraction in volatility.

The NZD/USD pair is demonstrating topsy-turvy moves in the early New York session. The Kiwi asset is auctioning in a tight range as investors are divided about the Federal Reserve (Fed)’s interest rate policy for June.

While the United States' solid labor market conditions are propelling the continuation of the rate-hiking spell by the Fed, deteriorating economic activities are telling a different story. The US Dollar Index (DXY) has resumed its downside journey after a less-confident pullback move to near 104.00.

The risk-on market mood has improved the appeal of the risk-perceived assets.

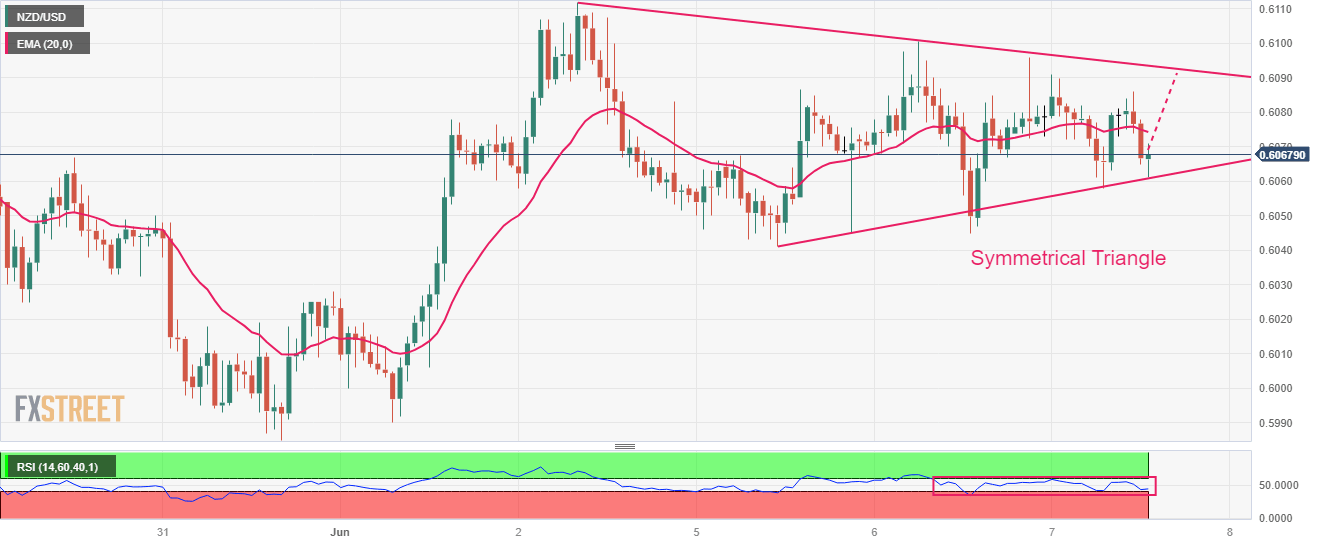

NZD/USD is auctioning in a Symmetrical Triangle chart pattern that indicates a contraction in volatility, which is followed by wider ticks and heavy volume after an explosion. The upward-sloping trendline of the aforementioned chart pattern is plotted from June 05 low at 0.6041 while the downward-sloping trendline is placed from June 02 high at 0.6112.

The 20-period Exponential Moving Average (EMA) at 0.6075 seems sticky to the asset, indicating a sideways performance.

Also, the Relative Strength Index (RSI) (14) has been confined into the 40.00-60.00 range, which signals that investors are awaiting a fresh trigger for a decisive move.

A confident break above May 25 high at 0.6110 will drive the Kiwi asset toward May 01 low at 0.6160 followed by the round-level resistance at 0.6200.

Alternatively, a downside move below the intraday low at 0.6015 will expose the asset for a fresh six-month low toward 11 November 2022 low at 0.5984. A slippage below the latter would expose the asset toward 02 November 2022 high at 0.5941.

NZD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.