NZD/USD Price Analysis: Rises to near psychological barrier of 0.6100 ahead of 50-day EMA

- NZD/USD moves in an upward trajectory despite the tepid momentum.

- A break above the psychological barrier of 0.6100 level could lead the pair to revisit the weekly high at 0.6152.

- The key support region appears at the major level of 0.6050 aligned with the weekly low at 0.6049.

NZD/USD extends its winning streak for the second successive day as the US Dollar demonstrates weakness due to subdued US Treasury yields. The NZD/USD pair edges higher to near 0.6090 during the European hours on Thursday.

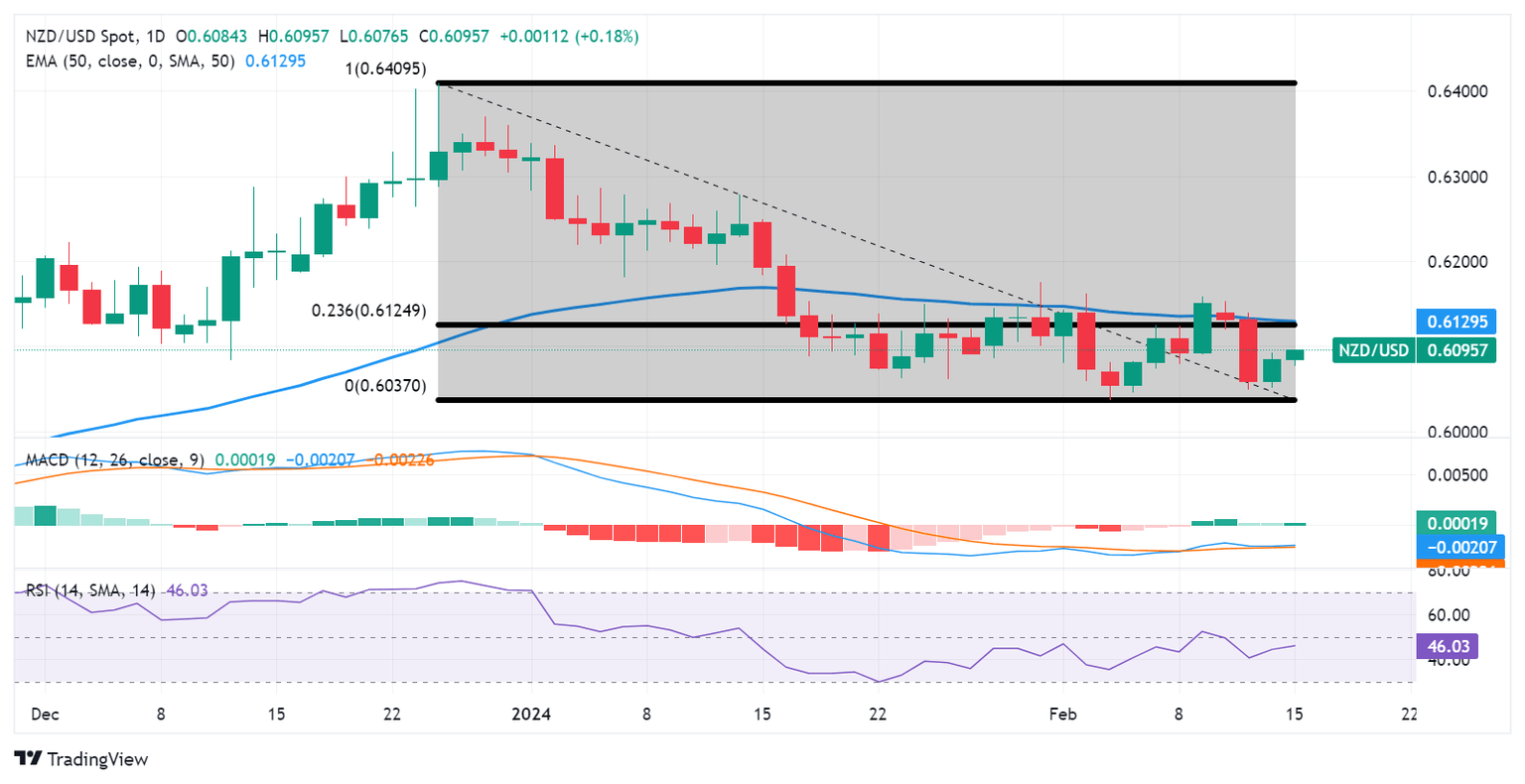

The immediate resistance appears at the psychological level of 0.6100. A breakthrough above this psychological level could inspire the NZD/USD pair to approach the resistance zone around the 23.6% Fibonacci retracement level of 0.6124 aligned with the 50-day Exponential Moving Average (EMA) at 0.6129.

If the NZD/USD pair surpasses this 50-day EMA, it could make it to the major barrier at 0.6150 in line with the weekly high at 0.6152.

The technical analysis for the NZD/USD pair indicates a tepid momentum in the market. The Moving Average Convergence Divergence (MACD) line is positioned below the centreline but lies above the signal line.

However, the lagging indicator 14-day Relative Strength Index (RSI) lies below the 50 level, suggesting a weaker sentiment for the NZD/USD pair.

On the downside, the NZD/USD pair could find key support at the major level of 0.6050 in conjunction with the weekly low at 0.6049. A break below the latter could put the downward pressure on the pair to navigate the region around February’s low at 0.6038 followed by the psychological support of 0.6000 level.

NZD/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.