NZD/USD Price Analysis: Falls to 0.6150 ahead of US core PCE data, RBNZ policy

- NZD/USD drops to 0.6150 as the US Dollar gauges temporary support.

- Investors await the US core PCE price index and the RBNZ monetary policy for further guidance.

- The RBNZ is expected to keep interest rates at 5.50%.

The NZD/USD pair remains on the backfoot near 0.6150 in Tuesday’s European session. The Kiwi asset faces a sell-off as investors see the Reserve Bank of New Zealand (RBNZ) keeping its Official Cash Rate (OCR) unchanged at 5.50%.

Last week, RBNZ Governor Adrian Orr warned about economic risks associated with the over-tightening of monetary policy. While he acknowledged that the RBNZ needs to do more work to tame price pressures.

Meanwhile, the US Dollar recovers intraday losses as investors turn cautious ahead of the United States core Personal Consumption Expenditure (PCE) price index data for January, which will be published on Thursday. The inflation data will guide market expectations for rate cuts by the Federal Reserve (Fed).

Meanwhile, Fed policymakers have been in favor of keeping interest rates unchanged in the range of %-% until they get convinced that inflation will decline to the 2% target.

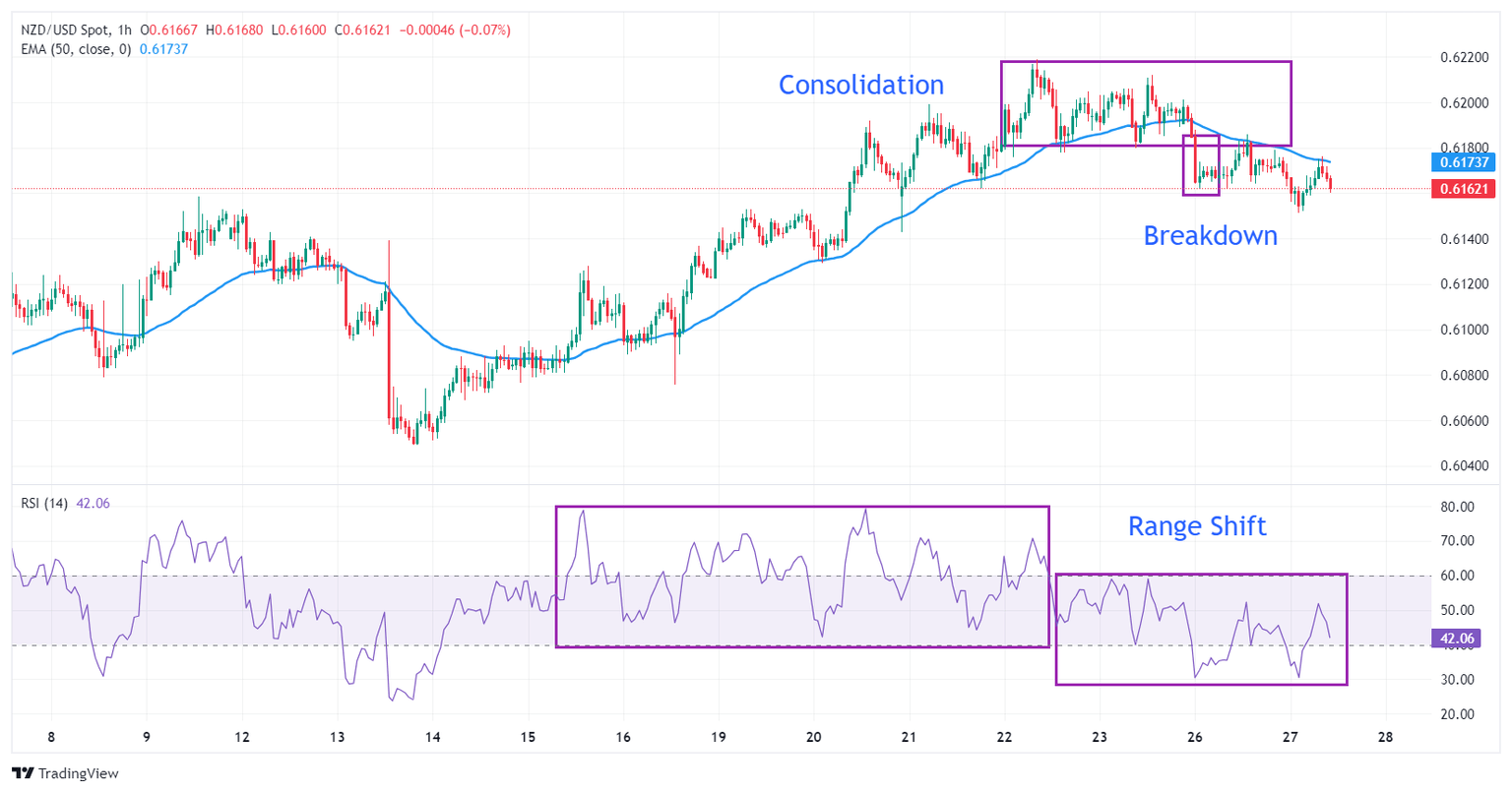

NZD/USD falls sharply after testing the breakdown of the consolidation formed in a range of 0.6180-0.6220 on an hourly scale. A breakdown of the consolidation indicates that institutional investors sell inventory to retail participants.

The near-term outlook has turned bearish as it has dropped below the 50-period Exponential Moving Average (EMA), which trades around 0.6174.

The range shift move by the 14-period Relative Strength Index (RSI) from the bullish range of 40.00-80.00 to 20.00-60.00 indicates that investors will use pullback moves to make fresh shorts.

Going forward, a downside move below February 20 low near 0.6129 would expose the asset to the round-level support of 0.6100, followed by February 13 low near 0.6050.

On the flip side, an upside move would emerge if the asset will break above the round-level resistance of 0.6200, which will drive the asset towards February 22 high at 0.6220, followed by January 11 high at 0.6260.

NZD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.