NZD/USD Price Analysis: Extends above 0.6060 as US borrowing cap increase approval weighs on US Dollar

- NZD/USD has stretched its recovery above 0.6060 amid a sheer sell-off in the USD Index.

- An increase in $31.4 trillion US borrowing limit is expected to attract downgrades from credit rating firms for US long-term sovereignty.

- NZD/USD has shown a responsive buying move after dropping below 0.6040 but is likely to face stiff barricades around 0.6110.

The NZD/USD pair has extended its recovery above 0.6060 in the Asian session. The Kiwi asset is expected to stretch its rebound move further as the approval for the US debt-ceiling raise has weighed heavily on the US Dollar Index (DXY).

Gains in the S&P500 futures have trimmed sharply after the approval of the raise in the US debt-ceiling. An increase in the $31.4 trillion US borrowing limit is expected to attract downgrades from credit rating firms for US long-term sovereignty. This will weigh heavily on the US Dollar Index and US equities ahead.

On a broader note, the New Zealand Dollar remained under pressure despite the Reserve Bank of New Zealand (RBNZ) hiked interest rates by 25 basis points (bps) last week to 5.50%. RBNZ Assistant Governor Karen Silk warned that the central bank must be watchful of over-tightening policy and that it can hold now and sees what develops.

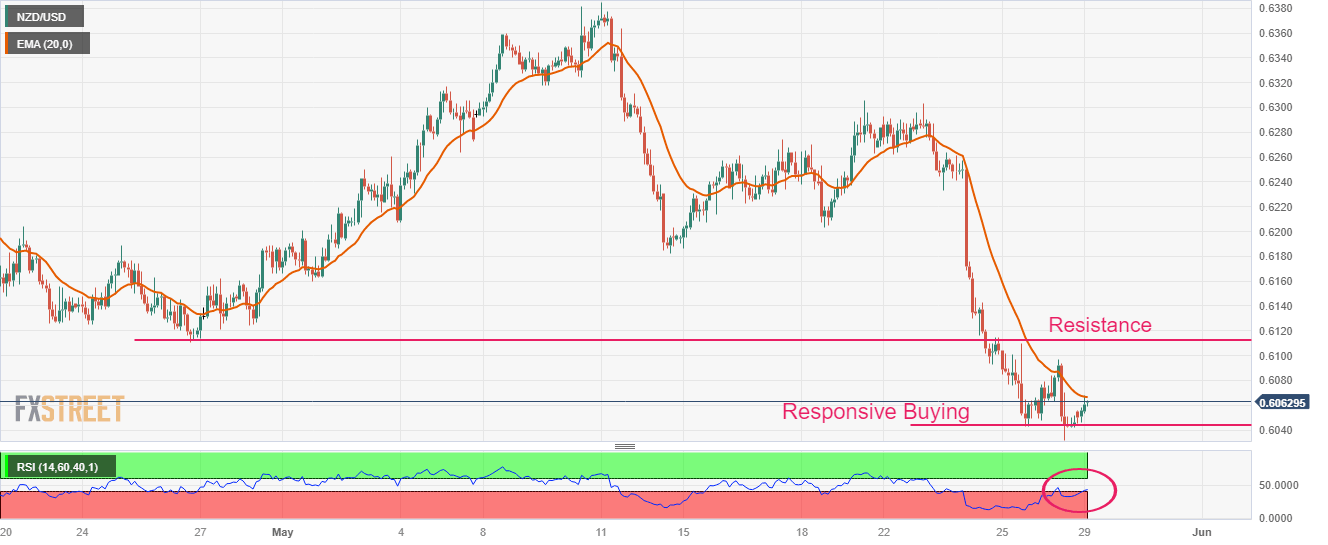

NZD/USD has shown a responsive buying move after dropping below 0.6040 on a two-hour scale. The recovery move by the Kiwi asset has to pass through plenty of filters to build a bullish impression. The recovery move in the Kiwi asset is expected to face stiff barricades around the horizontal resistance plotted from April 26 low at 0.6110.

The 20-period Exponential Moving Average (EMA) at 0.6067 is still acting as a barricade for the New Zealand Dollar bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has attempted a range shift into the 40.00-60.00 territory from the bearish range of 20.00-40.00, which indicates a loss in the downside momentum.

Further extension in recovery above April 26 low at 0.6110 will push the Kiwi asset toward April 27 high at 0.6162 followed by May 12 low at 0.6182.

On the contrary, a downside move below May 26 low at 0.6032 will expose the asset to a fresh six-month low toward the psychological support of 0.6000. A slippage below the latter will further drag the asset toward 11 November 2022 low at 0.5984.

NZD/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.