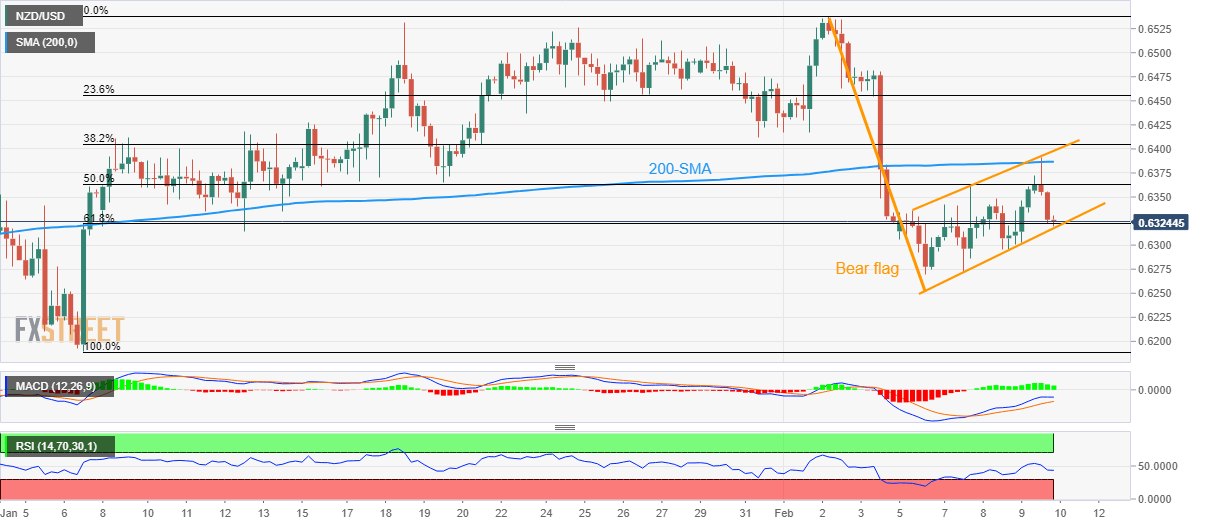

NZD/USD Price Analysis: Bear flag highlights 0.6315 as the key support

- NZD/USD extends late Thursday’s pullback from weekly high inside bearish chart pattern.

- RSI, MACD conditions suggest buyers are running out of steam while pullback from 200-SMA strengthens downside bias.

- Late January’s swing low adds to the upside filters before welcoming Kiwi buyers.

NZD/USD teases sellers inside a bearish formation as it drops to 0.6320 during the early hours of Friday morning in New Zealand. In doing so, the Kiwi pair extends the late Thursday pullback from the one-week high.

In addition to the weekly bear flag chart pattern, the quote’s inability to cross the 200-SMA also teases the sellers. Furthermore, the receding strength of the bullish MACD signals and the sluggish rise in the RSI adds strength to the downside bias.

However, a clear downside break of the stated flag’s lower line, close to 0.6315 by the press time, becomes necessary to trigger a theoretical fall towards the mid-November 2022 low surrounding 0.6065.

That said, monthly lows marked so far during 2023, around 0.6270 and 0.6190, could offer intermediate halts during the anticipated slump between 0.6315 and 0.6065.

Alternatively, the 50% Fibonacci retracement level of the NZD/USD pair’s January-February upside, near 0.6365, could act as an immediate resistance to watch during the recovery.

Following that, the 200-SMA and the stated flag’s top line, respectively near 0.6385 and the 0.6400 threshold, will be crucial to watch as they hold the keys to the NZD/USD bull’s entry.

NZD/USD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.