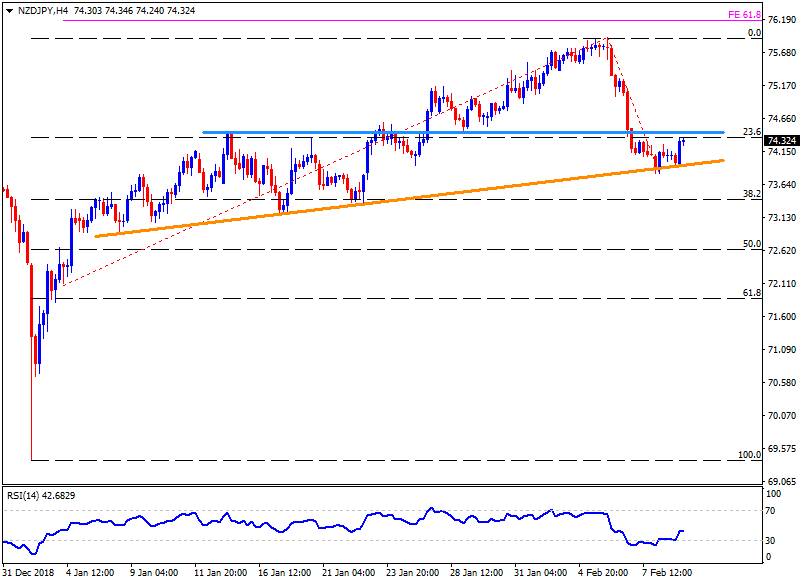

- The NZD/JPY pair again bounced off the month-long support-line during early Monday and is presently rising towards 74.45-50 resistance-area.

- During the pair’s extended up moves past-74.50, 74.70. 75.15 and 75.55 may offer intermediate halts during its rally to 75.90.

- In case prices slip under 73.90 support-line then the sellers can aim for 38.2% Fibonacci retracement of its recent surge, around 73.40.

- Assuming the Bears capacity to rule after 73.40, 72.90 and 72.40 may become their favorites.

- While gradually recovering 14-bar relative strength index (RSI) signal the pair’s rise, successful break of 74.50 seem prerequisite to justify the strength of momentum.

NZD/JPY 4-Hour chart

Overview:

Today Last Price: 74.34

Today Daily change: 23 pips

Today Daily change %: 0.31%

Today Daily Open: 74.11

Trends:

Daily SMA20: 74.54

Daily SMA50: 75.07

Daily SMA100: 75.12

Daily SMA200: 75.17

Levels:

Previous Daily High: 74.28

Previous Daily Low: 73.82

Previous Weekly High: 75.93

Previous Weekly Low: 73.82

Previous Monthly High: 75.54

Previous Monthly Low: 68.2

Daily Fibonacci 38.2%: 74

Daily Fibonacci 61.8%: 74.11

Daily Pivot Point S1: 73.86

Daily Pivot Point S2: 73.61

Daily Pivot Point S3: 73.39

Daily Pivot Point R1: 74.32

Daily Pivot Point R2: 74.53

Daily Pivot Point R3: 74.78

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.