Nio Stock News and Forecast: Why is NIO stock trading higher?

- NIO stock ends Wednesday higher to put in a three-day win streak.

- NIO added another 1.2% on Wednesday to hit $22.17.

- The Chinese EV stock remains a big loser year to date, down 30%.

Nio stock (NIO) edged higher on Friday despite some other retail interest stocks starting to reverse recent momentum gains. NIO has now gained for three straight sessions, although most gains are modest. By comparison, other retail interest stocks have exhibited their customary volatility with the likes of AMC and GME spiking before a collapse on Wednesday. NIO looks calm by comparison but remains well down on the year so far as high growth stocks and especially Chinese high-growth stocks fell out of investor favor.

Nio Stock News: Entering the phone business

NIO has been the subject of rumours for some time that it is preparing to enter the phone-making industry, and now a report from China's CNEVPost says this may be in the cards. NIO CEO William Li spoke on a talk show that this may be a possibility.

"We will look at this direction positively and are aware that getting the phone produced is easy, but building a good phone is challenging," Li said.

This is interesting but not significant from an earnings perspective any time soon in our view. In the same interview, the CEO also said Apple (AAPL) is the main competitor to look out for if they enter the car space. Recent news flow surrounding the Apple car project has not been positive, and it looks for now like the company is focusing on its core phone and tablet businesses.

Overnight news from Asia does not make for positive reading with Chinese shares under pressure across the board. China's manufacturing data for March was not good as the country battles with a covid surge. Numerous cities have been locked down or partially locked down. NIO is down 1% in Hong Kong.

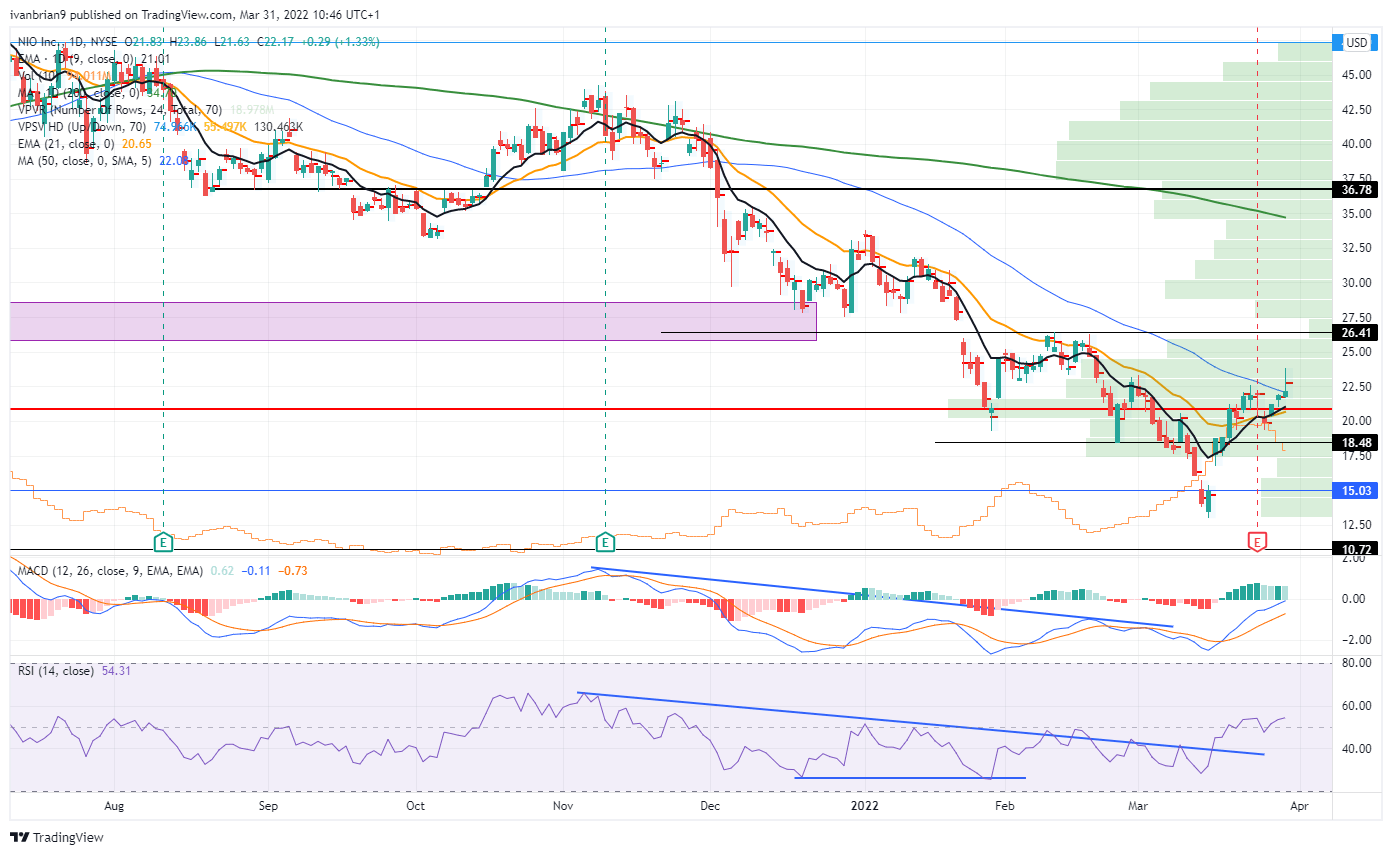

Nio Stock Forecast: Inverted hammer at mid-swing

The move on Wednesday, while positive, does leave a bitter aftertaste. We have an inverted hammer candle. A long spike with the body much lower in the daily range. This is a reversal signal. NIO spiked higher but could not sustain the move and closed much lower than the intraday high. This is consistent with what is happening with other retail stocks. AMC and GME fell sharply on Wednesday.

NIO stock chart, daily

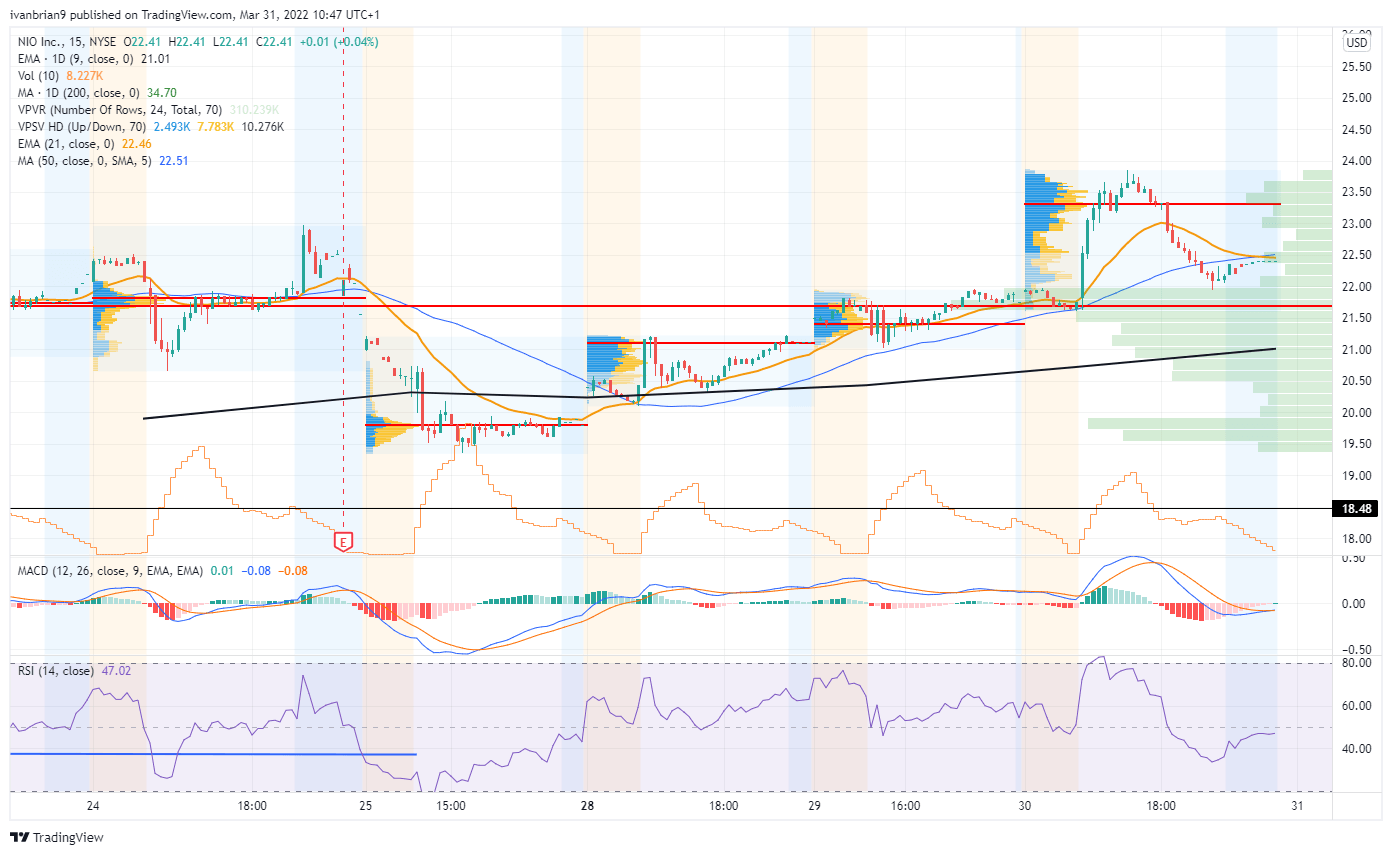

The 15-minute chart below shows this in more detail. $22 is short-term support from the volume profile, and breaking below $21 sees a volume gap to $19.50.

NIO stock chart, 15-minute

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.