Nasdaq (NDX NQ1 QQQ) key technical levels as Fed tapers but avoids tantrum

- Fed talks taper and rate rises, but markets throw no tantrum.

- Nasdaq settles for a loss of 0.34% when worse was feared.

- Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Tesla (TSLA) all close in the green.

So can the goldilocks economy and corresponding bull market run continue? Well, the Fed appears to have done its best on Wednesday. Placating equity markets is not on the agenda of Fed policy, but they do keep a close eye on the main indices. Back in the financial crisis, the Fed was more direct in its equity market intervention, repeatedly saying it wanted the market to know it was there to help. Now all this pandemic printing had led to inflation running away with itself and causing a headache for investors.

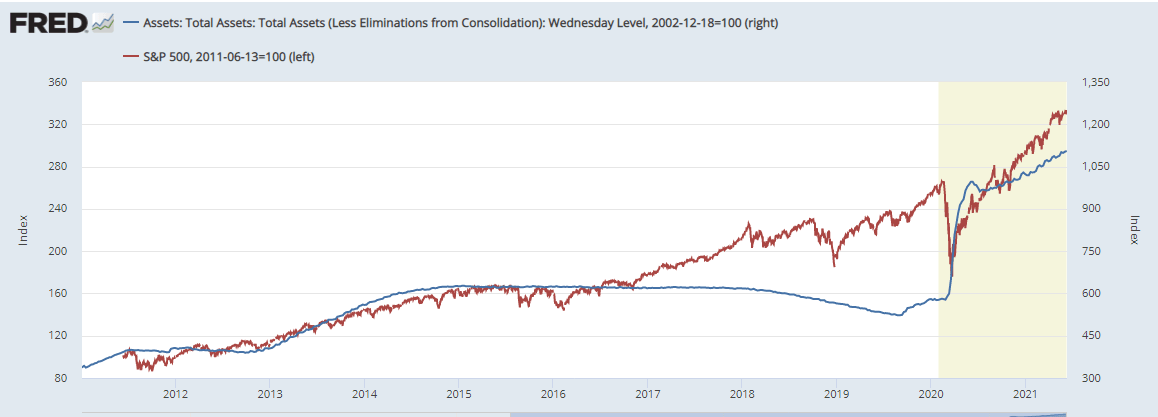

The Fed changed tactics on Wednesday by bringing forward its interest rate predictions to early 2023 and talking about tapering its bond purchase program. Ordinarily, this may have led to a serious equity market sell-off, but investors are actually relieved that the Fed has noticed the inflation warning signals and is prepared to act. Previously, participants were worried the Fed was asleep at the wheel, so that worry has been dispelled. Markets are less fearful, and we know the effect fear has on markets. But the fact remains that the Fed balance sheet has been closely correlated to the performance of the equity market on the way up, so will the correlation hold as the Fed reduces its balance sheet? The chart below shows the S&P 500 versus the Fed balance sheet going back to 2012.

Nasdaq forecast

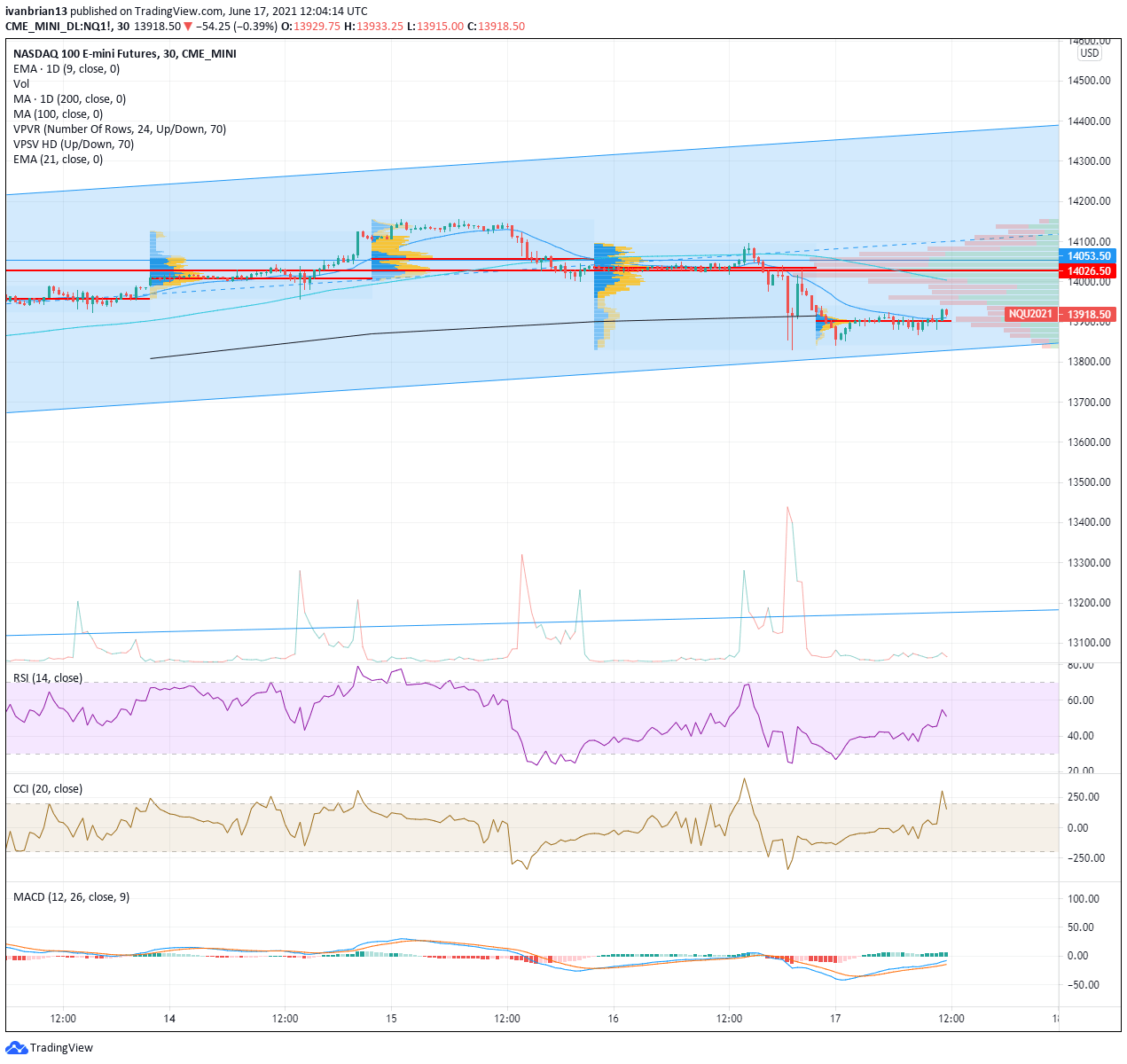

The 30-minute chart below of the front-month Nasdaq futures contract shows the strong trend channel that has been holding the Nasdaq back with Wednesday's price action trending toward the lower end of the channel. Wednesday's volume profile was toward the end of the range, giving a slight cause for concern. The point of control is 14,026, and above 14,145 there is little volume-based resistance. This means a move should accelerate to the top of the channel at 14,400. Just a slight aside – futures expiry is tomorrow, so June rolls to September.

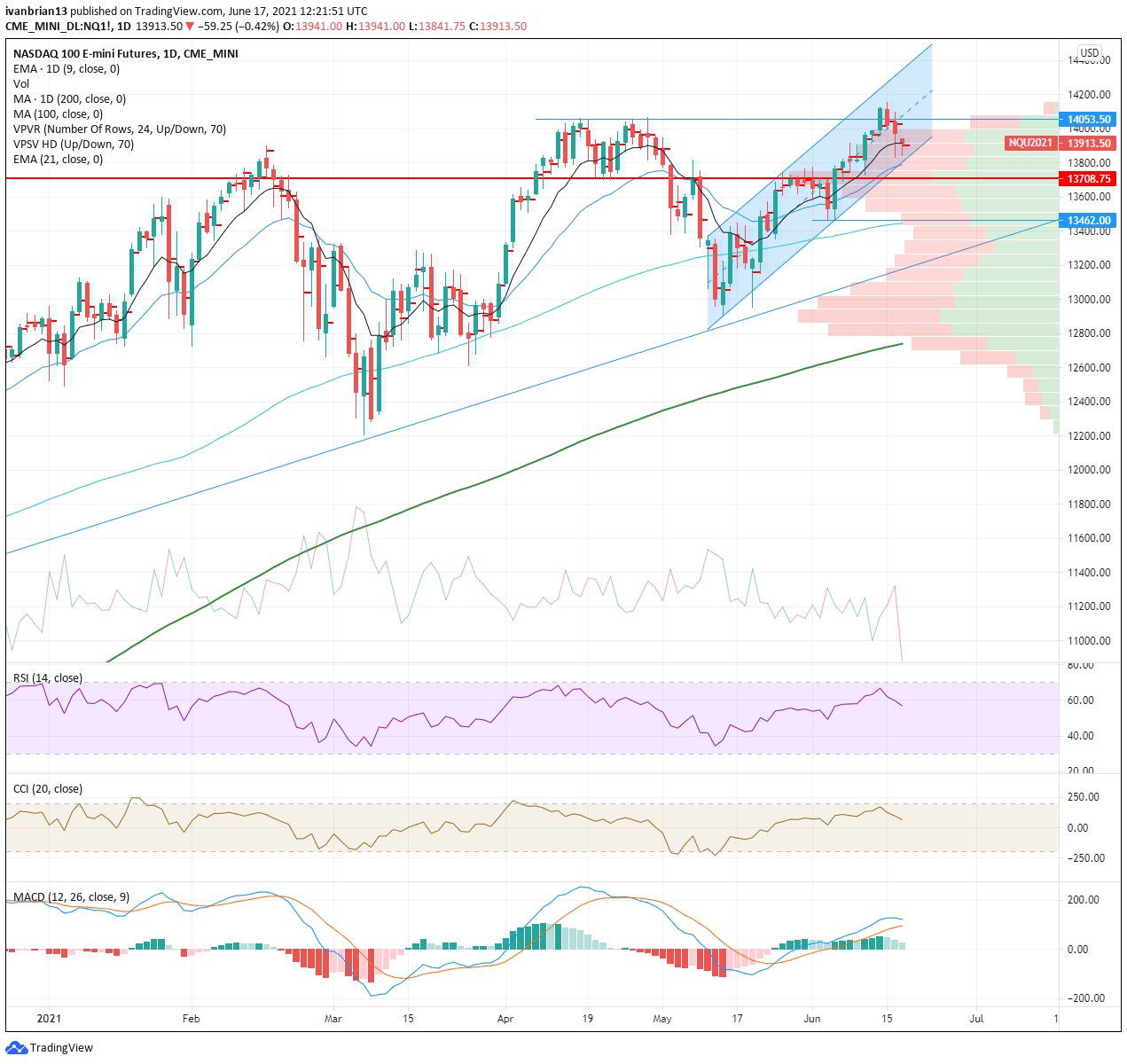

The daily view looks a little more worrying as the Nasdaq has just about broken the 9-day moving average. Bulls really need the 21-day to hold, which is currently at 13,788 and corresponds nicely with the lower end of the trend channel. This area offers strong support with the point of control for 2021 just below at 13,708. A break here and the early June low of 13,462 will be targeted. This is the short-term bullish pivot as it will end the series of higher lows.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.