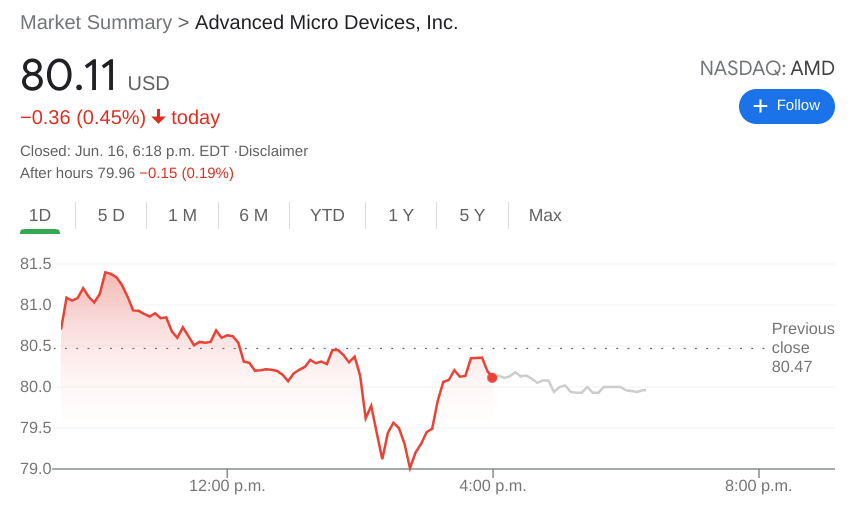

AMD news: Advanced micro devices stock falls during another roller coaster session

- NASDAQ:AMD dips by 0.45% as the Fed interest rate announcement rocks tech sectors.

- AMD unveils a new version of its Radeon GPU that features liquid cooling technology.

- A report surfaces that 25% of GPUs in the first quarter of 2021 were used for Crypto mining.

NASDAQ:AMD has seen its recent downtrend continue with another lower low on Wednesday during a whipsaw session that sent the markets tumbling midday. Shares of AMD lost 0.45% to close the trading day at $80.11, after hitting as low as $78.96 during intraday trading. AMD has struggled to gain traction as of late, and Wednesday was the third straight day this week that the stock closed at a lower low, signalling a bit of bearishness starting to creep into its chart.

Stay up to speed with hot stocks' news!

AMD did manage to unveil a new Radeon GPU model of processor on Wednesday that utilizes the company’s patented liquid cooling technology. The Radeon RX 6900 XT Liquid Edition has a higher board power and runs at higher speeds than its non-liquid cooling counterpart. The early rumor is that this version will only be available in pre-built gaming computers, which would definitely make them an exclusive feature that gamers would seek out.

AMD stock forecast

AMD wasn’t the only chip stock to fall on Wednesday, as the Fed announcement of interest rates arriving sooner than expected did not sit well with growth investors. Other industry stalwarts like Intel (NASDAQ:INTC) and Taiwan Semiconductor (NYSE:TSM) fell by 1.33% and 1.20% respectively, although industry leader NVIDIA (NASDAQ:NVDA) was up slightly by 0.12% on the day.

A new report from John Peddie Research showed that nearly 25% of high powered GPUs that were sold in the first quarter of 2021, were used for the purposes of cryptocurrency mining. While the company cites NVIDIA as the leading producer of the CMP crypto-mining cards, it revealed that AMD has not taken any steps towards creating specific crypto-mining cards to compete in the growing market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet