Apple Stock Forecast: AAPL not worried by Fed talk as it rallies to $131.45 resistance

- Nasdaq closes lower after the Fed, but AAPL shares close in the green.

- Other big tech names also close higher, so is a turnaround coming?

- AAPL shares target a break of $131.45 resistance.

The Fed did a good job yesterday of placating equity markets. The so-called dot plot of each member's interest rate predictions was cast aside as the Fed opened the door to two rate hikes in 2023. Only as recently as March, the Fed had pencilled in no rate hikes. Clearly then moving in the right direction and markets seemed pleasantly surprised at the idea of rising rates sooner rather than later. This is an interesting observation and potentially bullish.

Apple certainly took the positives and closed up just under 0.5%. Not exactly stellar, but nonetheless it is telling as the Nasdaq closed lower on the day. Any stock that closes up on a down day needs examining, and when it is the stock market beast that is Apple then even more so.

AAPL stock forecast

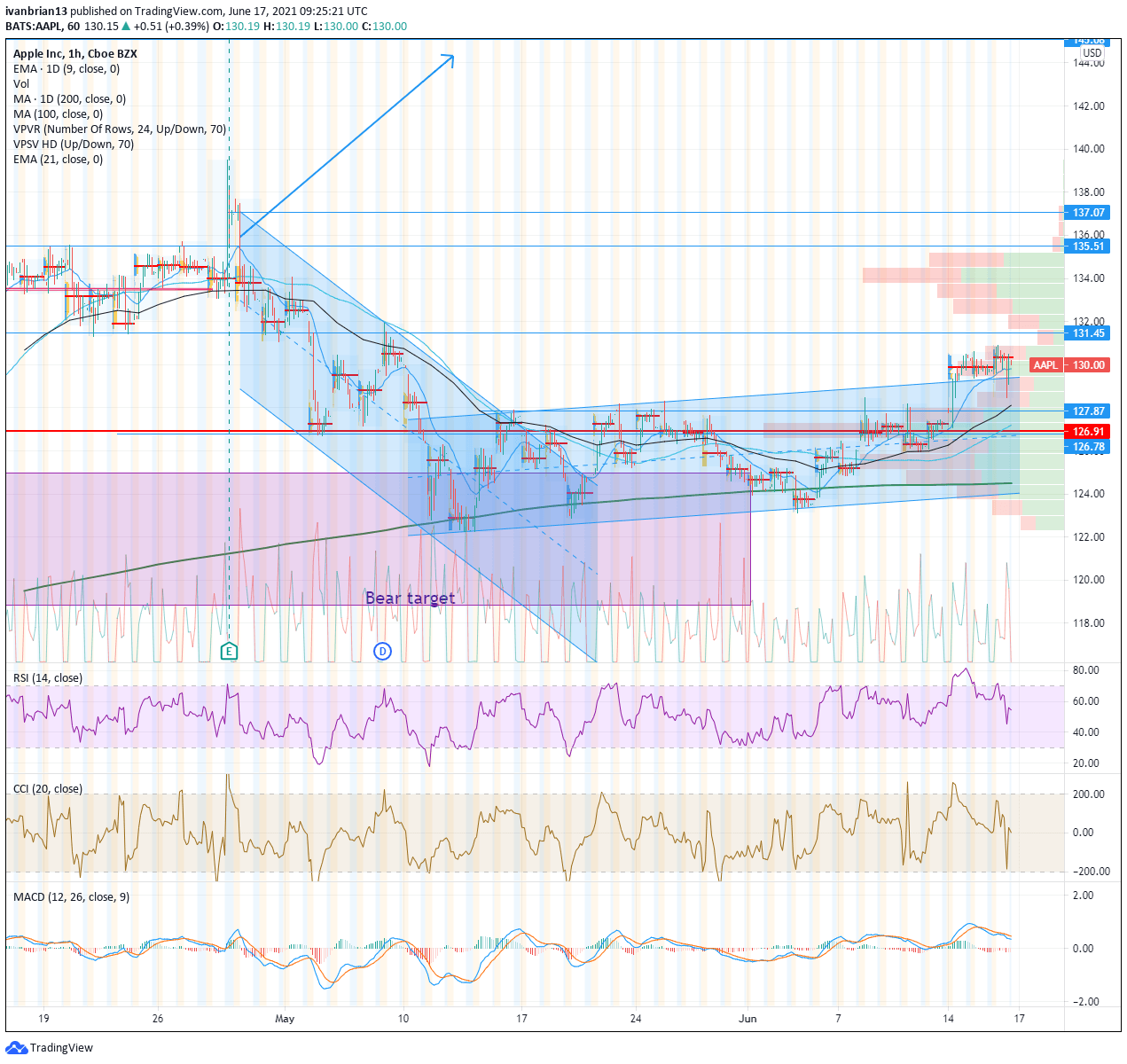

The hourly chart for AAPL stock shows the breakout of the recent upward trending channel and how this has then worked nicely as support this week. The spike (If you can call a $3 move a spike! AMC traders call it a tick!) out of this channel has now consolidated on the hourly chart and looks set for a move higher. $131.45 is the first resistance to take out. Very short-term support is at $128.

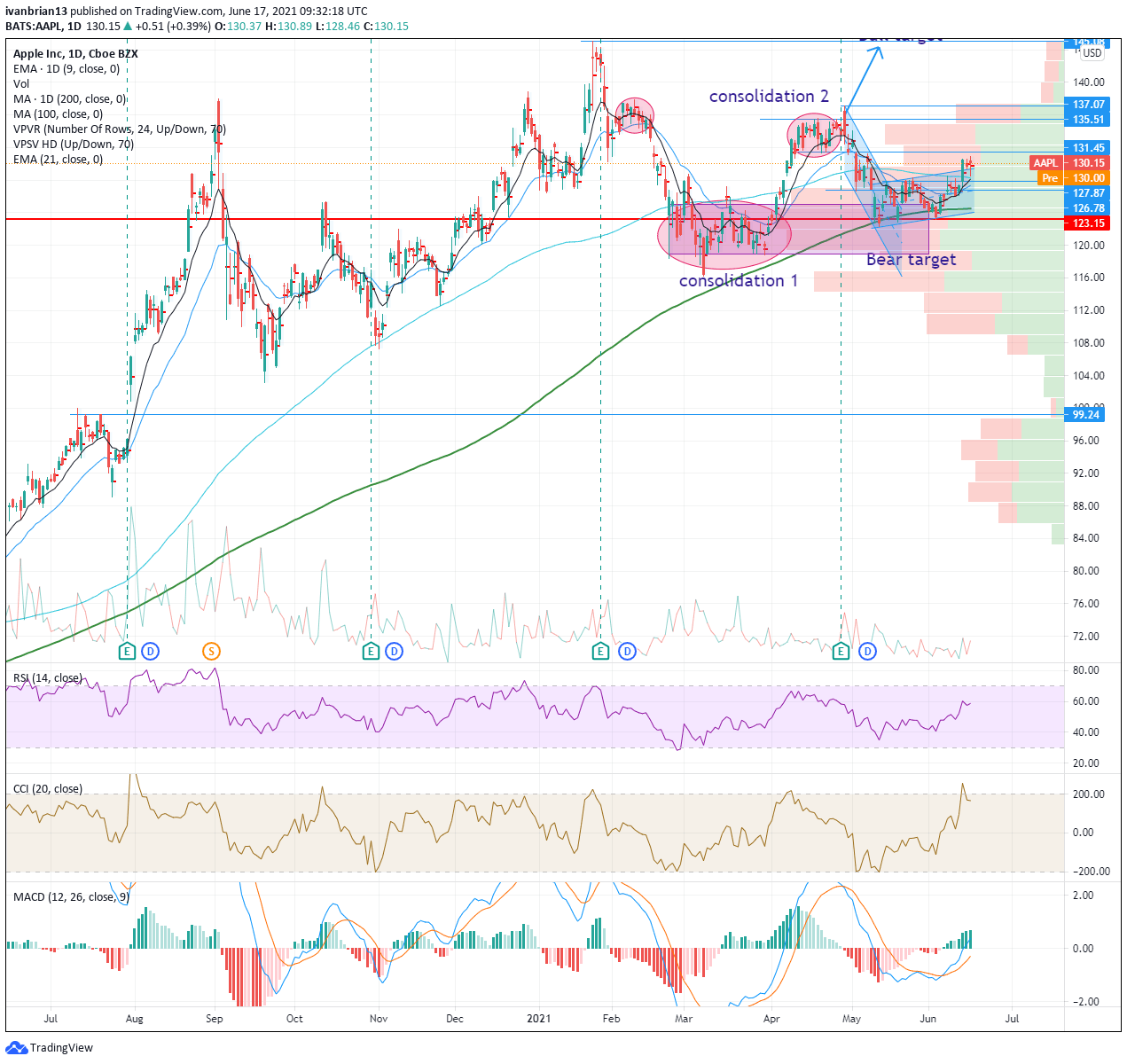

Now, it is best to step back and have a look at the bigger picture. The chart below shows the last year of the AAPL share price history. The point of control is $123.15. This is the strongest price with the highest amount of volume over the last year and so is a strong support level and equilibrium. As we can see, this is a large consolidation zone from March and April 2021. Apple stock broke out of this zone and traded higher, searching out record highs. Solid results, actually pretty spectacular results, with a 40% earnings beat were not enough to keep the momentum going, and Apple shares retreated to test this strong support zone again. This has worked, and Apple has pushed higher once more. Breaking $131.45 is the first target and then $135.51 to take out the higher consolidation zone.

Apple has found strong support and failed to reenter the consolidation 1 zone, a bullish sign. Now Apple is searching out new resistance and gradually moving higher. The 200-day moving average held a further bullish sign. Now AAPL shares are trading above the 9 and 21-day moving averages, so the shorter-term trend is also bullish. Therefore, the risk reward is skewed to the upside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.