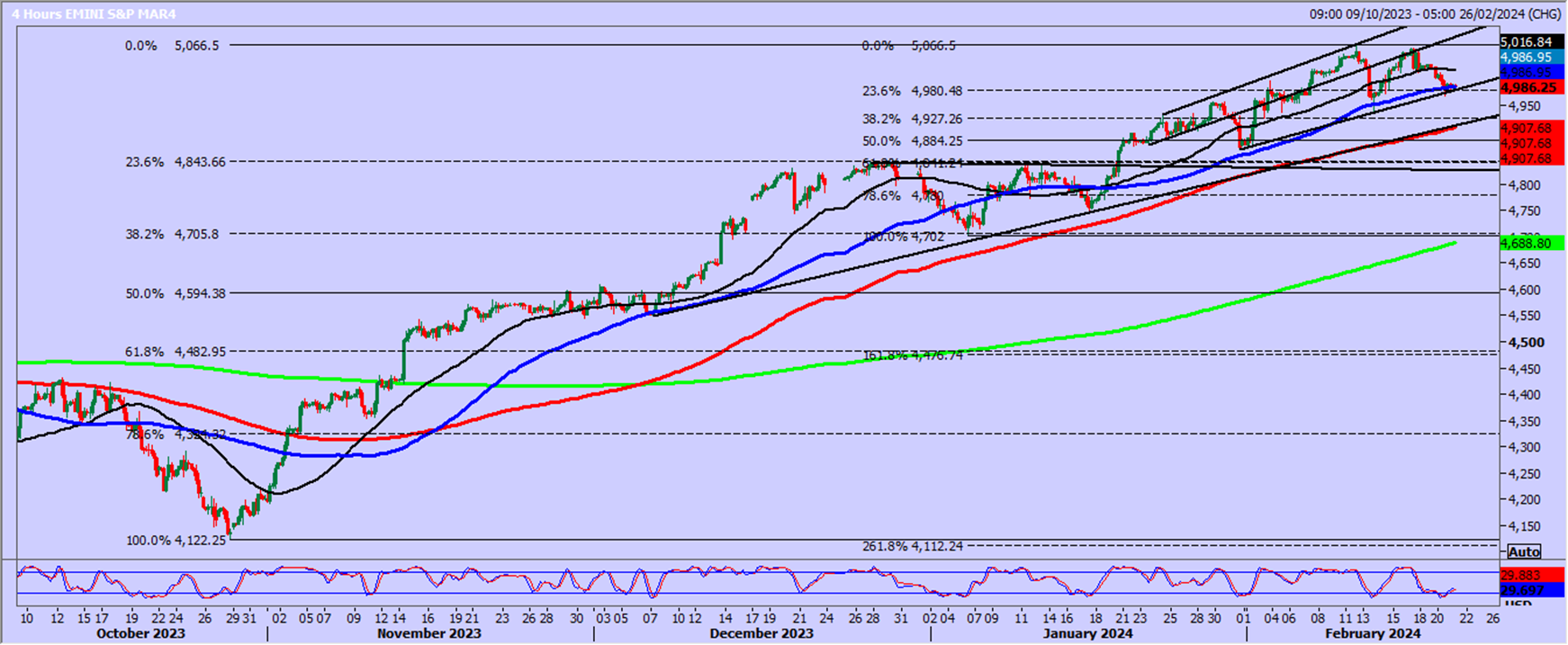

Emini S&P March futures reversed from 5059, just 7 points from the all time high at 5066, set on Monday last week.

Obviously a break above here is a buy signal & initially targets 5090/94.

However we do have a potential double top pattern after the rejection on Friday. It's only small & would require a break below last week's low at 4936 for confirmation of a short term sell signal but if you are looking for an excuse to short the index this is the best one for a while. Shorts need stops above 5070, so the downside risk is small & if we do break below 4935 we can target 4850/40 so there is a profit taking 3:1 risk vs reward.

In the short term, for scalpers we have some support at 4985/75 (with a low for the day at 4968 yesterday) but a break below 4965 today risks a slide to 4930/25, perhaps as far as 4900/4895.

Nasdaq March futures reached 18026, just shy of the all time high at 18100/120.

A break above 18130 can target 18300/330.

However, Friday's bearish engulfing candle on the daily chart, just below the all time high is a warning for bulls. Friday's peak was not close enough to Monday's all time high to call it a double top but the price action suggests a period of consolidation, if not a short term (minor) correction to the downside.

We broke good support at 17700/650 but must hold below below 17500 if we are to see further losses targeting 17460/420, (which held the downside yesterday) perhaps as far as a buying opportunity at 17230/180. Longs here need stops below 17100.

Emini Dow Jones March futures beat resistance at 38600/650 to hit my next target of 38880/900 with a high for the day exactly here.

We can only scalp at this stage in the 2 week sideways consolidation as there are no swing opportunities until we see a breakout of the range. With minor support at 38600/550 (which did hold the downside yesterday) & 38350/300, longs need 50 point stops on these scalping levels & look for a 200 to 300 tick profit.

Any recovery meets the all time high at 38980-39012. Above here we look for 39160/220. A break above 39270 targets 39450/500.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.