- Moderna shares fall again on Tuesday.

- MRNA faces multiple headwinds as shares suffer.

- Results, antiviral pills, dispute with US government are just some of the headwinds.

Moderna (MRNA) shares fell again on Tuesday, but at least the move was small by recent standards. Moderna stock closed lower by just 0.34% at $234.28. The stock has been under pressure following its earnings release earlier this month and then more news from competitors Pfizer (PFE) and Merck (MRK). Moderna probably stretched too far on the back of its covid vaccine success and now it is snapping back.

Moderna (MRNA) stock news

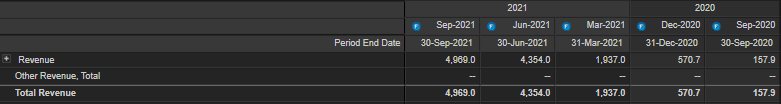

Moderna has been wildly successful as the development of its Spikevax covid vaccine has transformed the company. In September 2020, so just about a year ago, the company had revenue of $158 million. The last results to the end of September 2021 show revenue of just under $5 billion. The reason is solely down to covid vaccine development. Moderna and Pfizer are the two main suppliers.

Source: Refinitiv

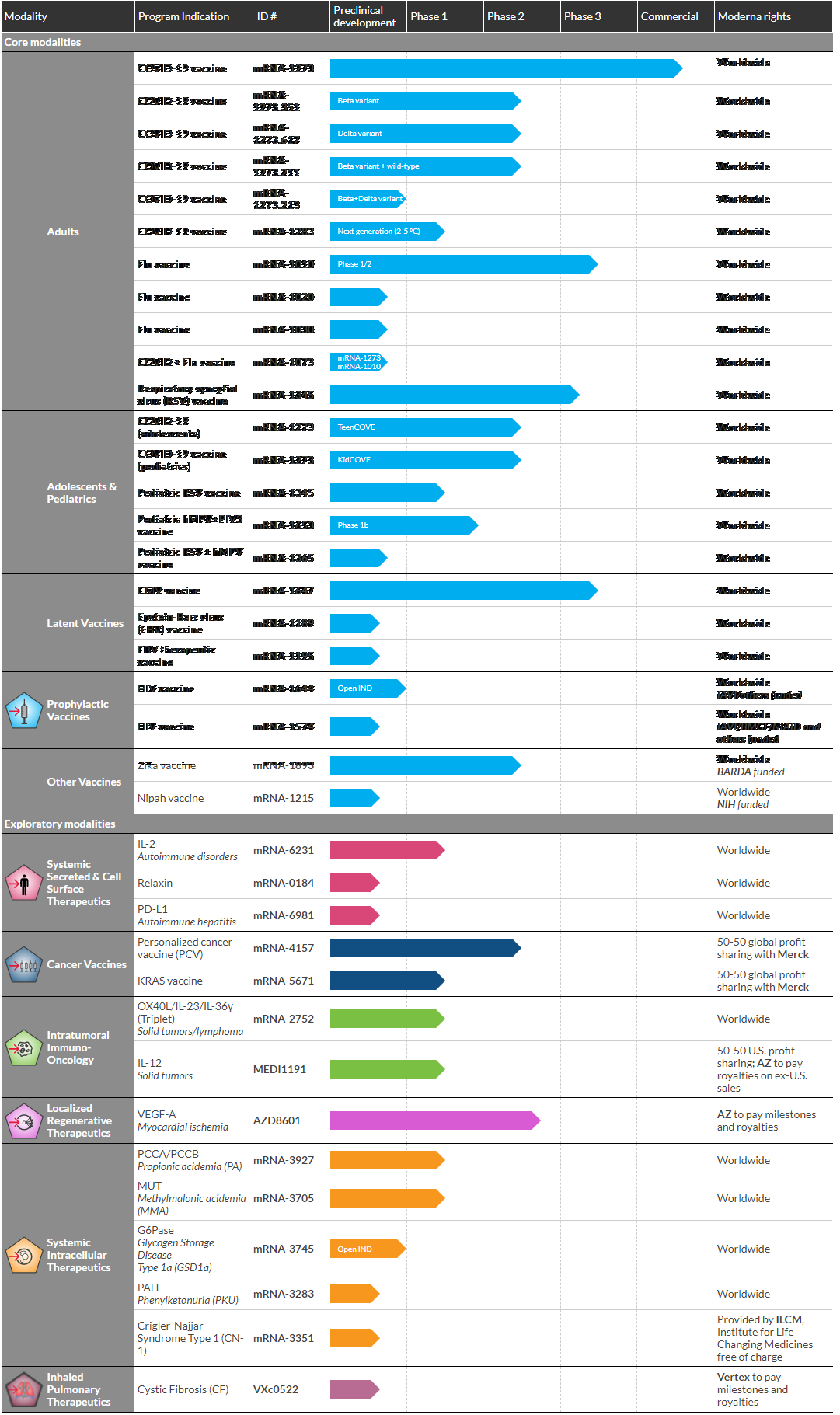

However, as mentioned Moderna is currently a one-trick pony. It does have numerous other development candidates, but none will be as profitable as a covid vaccine. This pandemic is a once-in-a-century event and of a global nature. Even other successful drugs will never have this potential market again.

Estimates for 2023 show revenue peaking at $7 billion in Q1 2022 before falling by 50% to $3.6 billion by Q2 2023. The next boost to revenue could come from a flu vaccine as this is another worldwide vaccine with billions of doses given each year. However, there is stiff competition from other pharma companies. At present Moderna's flu vaccine using MRNA technology is in phase-3 trials. Below is a list of all development pipelines from Moderna. As you can see only a few are in phase-3 trials.

Source: Moderna

With increased competition from Pfizer (PFE) and Merck's (MRK) antiviral pill for covid and the gradual winding down of covid, Moderna needs more pipeline development and fast to replace those huge profits from covid vaccines. Drug development is notoriously slow, hit and miss, and leads to volatile share performance.

Moderna is also facing headwinds from haggling over intellectual property with the US government. This creates uncertainty, and markets hate uncertainty.

Moderna (MRNA) stock forecast

We have outlined the challenging fundamental outlook for Moderna and now turn our attention to the technical aspect. What we see is a consolidation or pausing phase after the recent heavy losses. This is usually a continuation pattern. The market is now more and more accepting of these new lower prices the longer it remains down here. Big resistance from the 200-day moving average at $255 and the yearly Volume-Weighted Average Price at $265. Only above there does the bearish outlook change. Right now the target in the short term is $188.41 and then $157.70. At this $157 area there is strong volume support, so our argument would then need to be reevaluated.

MRNA 1-day chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD rises to near 1.2540, driven by higher UK GDP

GBP/USD edged higher to near 1.2540 during Asian hours on Friday, buoyed by the release of higher-than-expected UK Gross Domestic Product (GDP) data for the first quarter.

EUR/USD: The crucial resistance level will emerge at the 1.0790–1.0800 region

The EUR/USD pair trades on a softer note near 1.0775 during the early European hours on Friday. The downtick of the major pair is supported by the renewed US Dollar demand amid hawkish comments from Federal Reserve officials.

Gold price attracts some buyers despite hawkish Fedspeak

Gold price edges higher for the second consecutive day on Friday. Weak employment data bolstered the speculation that the weakening economy would force the Fed to cut rates.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Rate cut optimism fuelled by higher US jobless claims

With Federal Reserve policy acting as the primary driver of investor sentiment in 2024, renewed optimism surrounding the possibility of rate cuts has propelled the Dow to its most significant rally since December.